Update on ProKidney

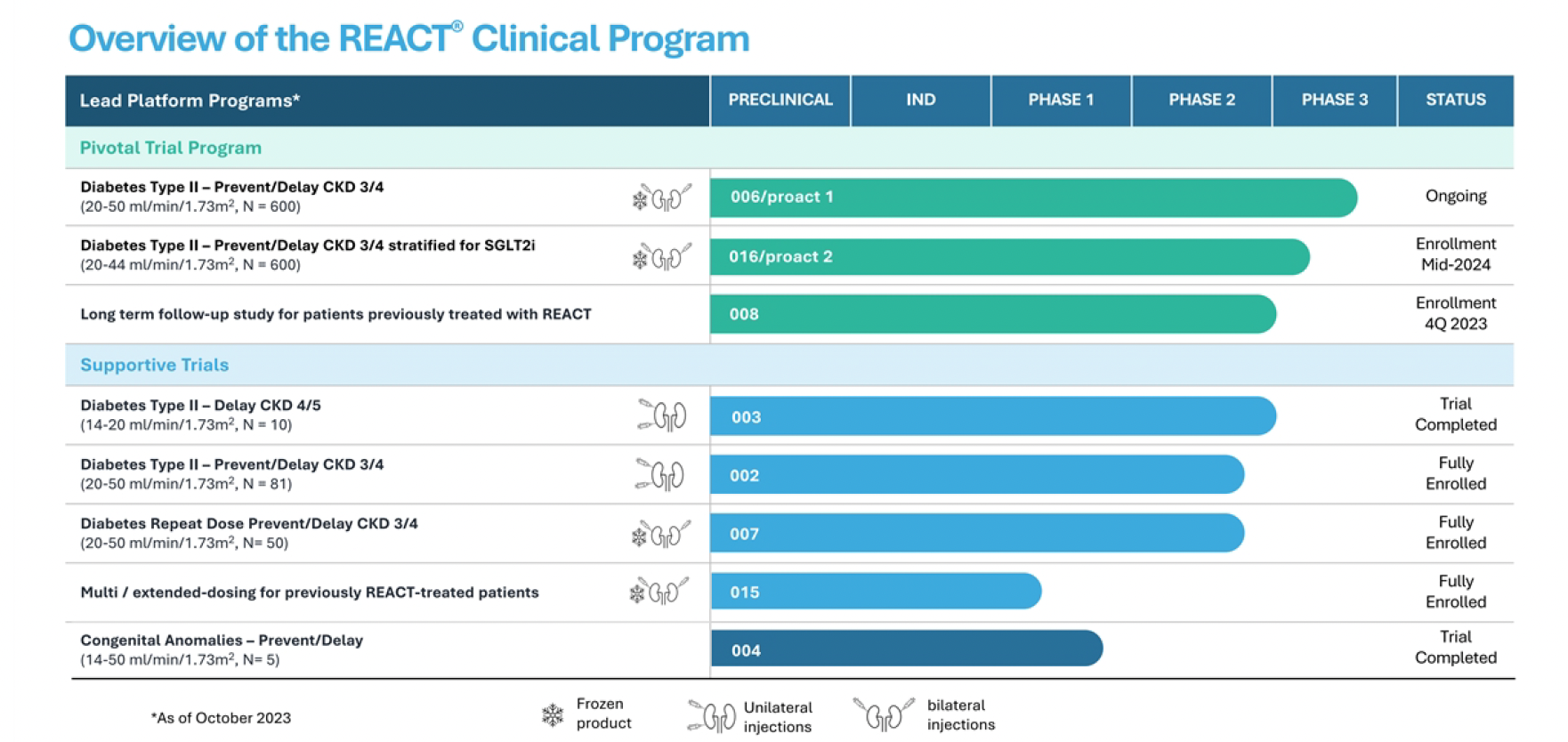

I met with Nikhil Pereira-Kamath, Chief Business Officer, another of ProKidney’s (PROK) recent hires, last week via Zoom to get a sense of where things stand. I have previously described PROK as a compelling biotech developing novel cell therapies to treat late stage CKD, and, in particular, ESRD, under a wide range of commercial scenarios – where cell therapies are unproven in CKD, and there are no other viable treatment options. The “wide range of scenarios” has delivered in terms of clouding the picture of PROK’s target profile and proof of mechanism for React (rilparencel), the company’s autologous cell therapy. Also, the company has made a number of senior management changes. In summary, PROK appears to be on track in terms of Phase 2 & pivotal Phase 3 clinical progression, with key readouts coming mid-year 2024 and 2025 that will clarify the protocol update (towards patients with highest risk of kidney failure) and include results from bilateral dosing which could improve treatment effect and which could be a financeable catalyst in the next 12 months. I expect new leadership to assert a timeline for drug approval in 2027. Given the company’s depressed valuation, down about 90% in recent months (trading at or below cash of ~$350m), the risk/reward looks compelling in the context of a portfolio of small cap biotechs. Here are the issues as I see them:

- Chamath Palihapitiya. Chamath’s violent exit as a key shareholder of the company culminated in the company repurchasing most of his shares. On November 19, 2023, ProKidney Corp entered into a share repurchase agreement with SC Pipe Holdings LLC and SC Master Holdings, LLC, pursuant to which the Company agreed to repurchase an aggregate of its 7,256,367 Class A ordinary shares for $1.309 per share. According to the latest Form 4 filing, Chamath still holds 3m shares held by a trust for the benefit of his immediate family, after this repurchase… but outside of this family trust (which LifeSci, the company’s IR firm, has confirmed cannot be touched), he no longer owns shares.

- GLP-1. The GLP-1 agonist weight loss bandwagon appears to have subsided at least in terms of the new class of drug’s potential impact on CKD any time soon. For example, DaVita’s stock has recovered dramatically, nearly doubling since the low in September 2023, presently trading near a 10-year high.

- Changes to one of the company’s clinical programs. PROK has made changes to its Phase 3 development program to exclude 3a patients and focus on patients with Stage 3b and 4 diabetic CKD, who are at the highest risk of advancing to kidney failure and requiring dialysis. This includes modifying the eGFR enrollment range for the proact 1 Phase 3 clinical study to align with the results and feedback from the RMCL-002 study. This will delay enrollment until the first half of 2024. However, the eGFR enrollment range for the second Phase 3 trial, proact 2 (REGEN-016), will remain unchanged to enable the company to seek a broader commercial label.

- Delay in manufacturing. The company has temporarily paused manufacturing to address deficiencies in the documentation of quality management systems identified during a recent audit. The company aims to optimize its capabilities to meet EU and global standards for its Phase 3 program and future commercial manufacturing, with plans to resume manufacturing in the first half of 2024. No safety issues are involved in this delay, according to the company.

- What is the impact on TAM? Here I have collected the pieces that make up a DCF model and will leave the final analysis until clarifying readouts are available later in 2024 and 2025. In summary, the parts suggest a novel product with peak sales in the billions annually for a disease state with no other therapy options. First, I observed one change in messaging. Previously, the company and the Street hoped for the potential for reparative/regenerative capability to drive more robust disease modifying activity vs SOC. Today, the company is messaging around stabilization and delay of onset of ESRD. 10-K 2023: “Clinical studies suggest that REACT can impact kidney function positively by stabilizing eGFR, or attenuating the rate of eGFR decline, in patients with CKD caused by type 2 diabetes.” vs S-1 2022: “Our lead product candidate, which we refer to as REACT, is designed to stabilize or improve kidney function in a CKD patient’s diseased kidneys.” Again, I believe this is a messaging issue, and the team will rely on clinical results to show improvement if any are demonstrated. Any such improvement would be a surprising additional benefit. TAM data: Based on available U.S. data from the 2018 National Health and Nutritional Examination Survey, the company expects the aggregate CKD population in the US and EU to grow from approximately 70 million in 2020 to approximately 80 million in 2030 and approximately 93 million in 2040. The most common causes of CKD among adults are diabetes, hypertension, and glomerular disease, and in the pediatric population, CAKUT. In the US, it is believed that approximately 3.2 million patients per year suffer from stage 3b or 4 CKD, and 1.2 to 1.8 million of those patients could be eligible for treatment with rilparencel. More than 135,000 of these CKD patients progress to dialysis every year. Total annual costs to Medicare for patients with CKD (including ESRD) exceed $138B. Dialysis treatment costs Medicare about $100k per year with survival rate of about five years. Private payors can pay orders of magnitude more than Medicare. A report by Bank America (2022) suggested pricing of $360k for once-and-done treatment based on an extrapolation of recent non-CKD specialty drug launch pricing.

- Variables include: Potential label expansion to re-dose rilparencel for longterm dialysis prevention, clinical evidence of potential to reverse progression of kidney disease in CKD patients, timing of additional readouts, timeline for drug approval, durability as measured by a parallel control group in Phase 3, in which case there may be a need for re-dosing in 18- to 24-months.

- I have only heard the new CEO, Bruce Culleton MD, speak in the November 2023 conference when he was introduced. Since then, there are two other events listed ProKidney’s website but they contain no content.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

Leave a Reply