Profire

De-globalization and misguided ESG narratives that served short-term political utility have created conditions for oil to rise to new, inflation-adjusted highs. The only remedy to reconcile rising demand is a massive investment in production to meet the needs of economic growth – and also to meet the need for investments in more realistic ESG goals. Profire (PFIE) is small cap value stock positioned at the center of the combustible tension between rising oil prices and the lack of investment in production.

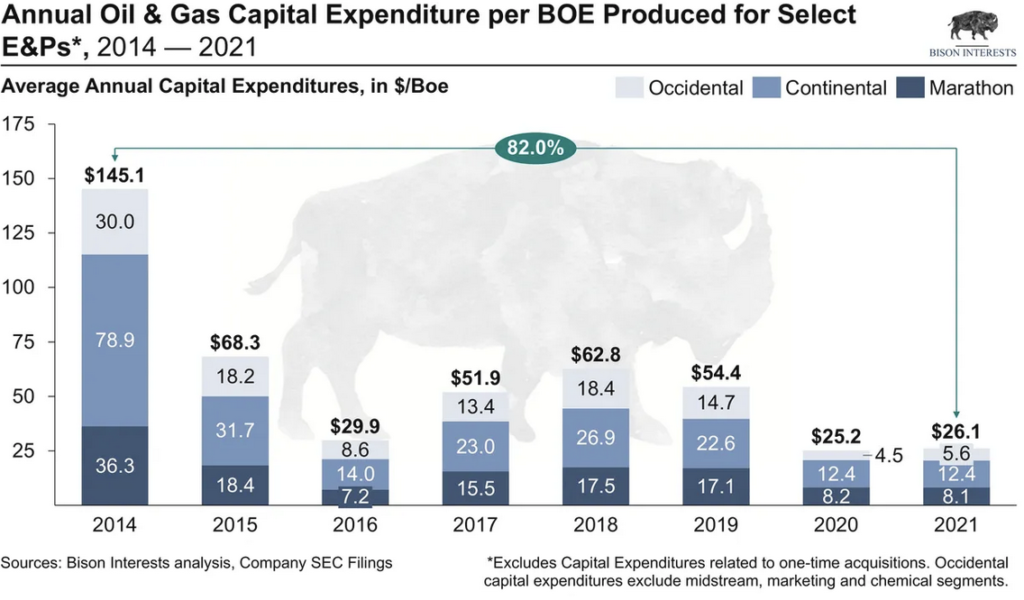

By one measure, U.S. oilfield services & equipment investment has declined 82% since peaking in 2014. How much investment is needed the oil field services sector? According to JP Morgan’s Dubravko Lakos, the energy industry needs to invest $1.2 trillion in oil and gas production this decade.

Profire is a dominant player in products and technologies related to burner-management systems (BMS) and chemical solutions in North America. Profire is levered to upstream exploration and production (E&P) activity. Well completions, and to a lesser extent replacement demand and retrofit of existing wells, is the key metric to watch. According to U.S. Energy Information Administration (EIA) data (USA), the number of well completions in 2018 was almost 15,000, which fell to under 14,000 in 2019 and to 7,400 in 2020. However, well completions in 2021 increased 32% to 9,793. Rigs are important too. The Baker Hughes North American rig count is still far below the 800-1,000 level it achieved in 2018 and 2019 when WTI ranged from $70 to $80 per barrel. At 698, it’s about 35% below the average in 2018 and 2019. Yet the number of completed wells in Q1-22 remains 30% below its recent peak level in 2018.

Profire claims to have 80% market share in its sector. According to the company, its systems and solutions have been widely adopted by major E&P companies, midstream operators, pipeline operators, as well as downstream transmission and utility providers. Its customers include, Antero, ATCO, Chevron, CNRL, Concho Resources, Devon Energy, Dominion Energy, EQT, Kinder Morgan, National Grid, Ovintiv, Oxy, Range Resources, Williams, XTO, and others. Its systems have also been sold and installed in other parts of the world including many countries in South America, Europe, Africa, the Middle East, and Asia. Profire actively invests in expansion efforts in international markets and the broader combustion industries.

Financials

The company has $15 million in cash ($0.32/share), zero debt, positive cash flow and rich EBIDTA margins of nearly 12%. It’s enterprise value (EV) is ~$50 million. Q1-22 results were better than street expectations with revenue of $9.5 million and EBITDA of $1.1 million. The company’s current EV/EBITDA is much lower today than levels achieved at much lower oil prices (~$65 in 2018). For example, when the stock traded at $4.25 in Q1-18 it had an $185 million EV and 18.5x EV/EBITDA multiple on a $2.4 million EBITDA run rate. This compares to today’s EV/EBITDA multiple of 8.8x 2022 and 5.7x 2023 estimates of more than ~$8 million EBIDTA.

With oil trading at $115, investors in the sector must assume upstream E&P activity will explode in response to much higher prices in a new cycle much bigger than the last one that ended in 2014. Profire’s operating leverage is likely to play well in such a cycle.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

Leave a Reply