Piedmont Lithium

In a prior post, I laid out a general thesis for lithium and discussed Piedmont Lithium (PLL) among some other publicly-traded companies that might be appropriate for speculative investors. In this post, I will examine PLL in detail and present a fuller accounting of the potential opportunity. The company is a speculative pre-production mining company that is virtually guaranteed to dilute shareholders. The question for investors is: why endure dilution, delayed cash flows and political uncertainty?

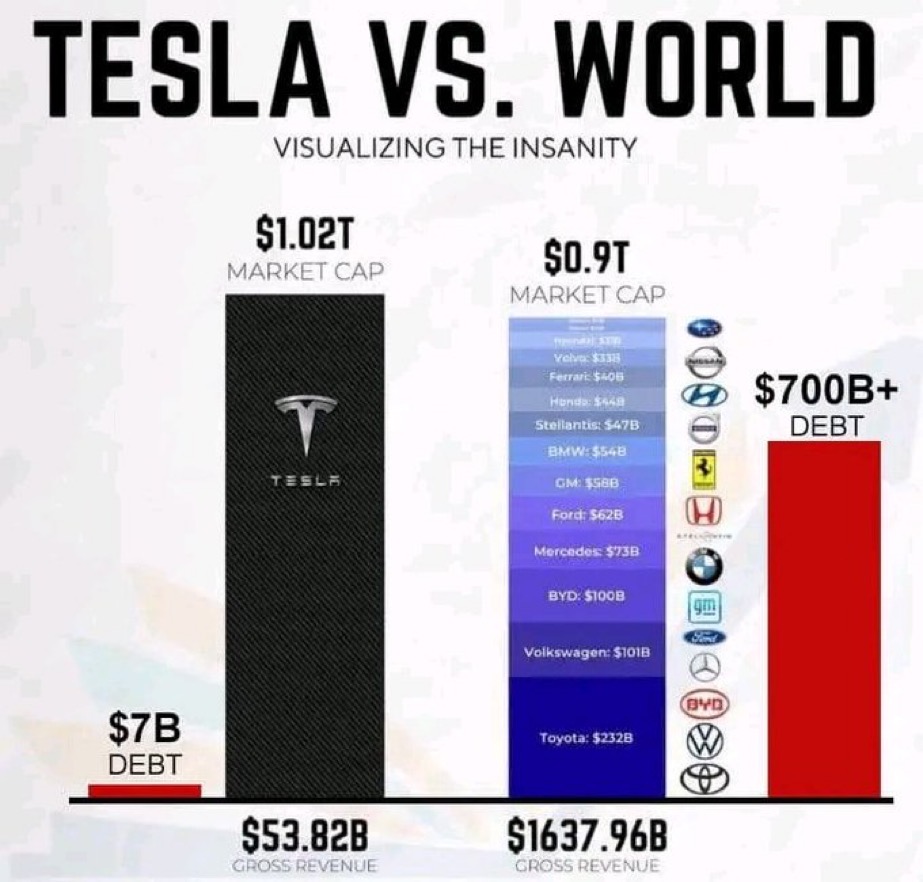

Before getting into PLL’s details, I think it’s important to look at economies of scale in the auto industry OEMs because this is the primary end market for PLL’s battery-grade lithium hydroxide (LiOH). Tesla is the first company to scale electric vehicles (EV) beyond one million annual units (run rate Q4 2021). By comparison, in Q4 2021, GM delivered in the U.S. only 26 all-electric EVs. Design, superior engineering, silicon carbide chips, early development of thousands of Tesla supercharging stations all allowed the company to become the leader in EVs.

Today, Tesla’s market cap is greater than all the other OEMs combined. Soon, certainly by the end of this decade, EV adoptions will cause volumes for internal combustion engines (ICE) to fall, creating negative economies of scale. Tesla’s margins are high (about 30%) and stable – most others are in the single digits and falling. This partly explains the size of Tesla’s market cap compared to other OEMs. The ICE inflection point will kill many traditional auto makers. And it will kill GM because the company will not have achieved scale (profitability) in EVs. Since Tesla rolled out its first car in 2008, the year GM required a bailout by the U.S. government, GM has spent more than $37 billion on advertising. Tesla has spent zero on advertising over the same period and instead put the money into R&D. The U.S. government lost $11 billion on GM’s 2008 bankruptcy/bailout. The lesson from GM’s 2008 failure is: downscaling high fixed-cost manufacturing = bankruptcy. Economies of scale are shifting to EVs and there’s no going back. (Note: in the decade leading up to GM’s bailout, the company had accumulated about $100 million in losses.)

“What villains provide for heroes is a sharper vision of what makes the hero a hero. And in this saga, GM is the best kind of villain for Musk and a tragedy for free market capitalism.” – Simons Chase 2018

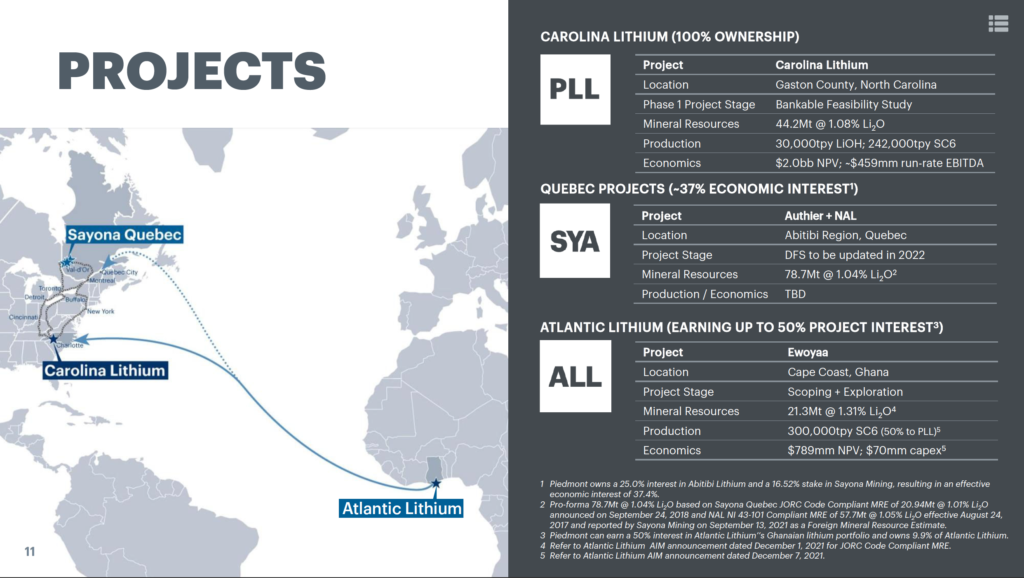

So the answer to the question about PLL’s prospect as an investment can be found in the company’s superior at-scale unit economics and NPV profile. PLL’s vision is to achieve near-term cash flows (via contractual off-take rights) from investments it has made in other lithium companies and then exploit a much bigger opportunity to become one of North America’s largest battery-grade lithium hydroxide producers – and also to become first company in the world where quarrying, concentration and chemical production occurs on one single site with superior economies of scale.

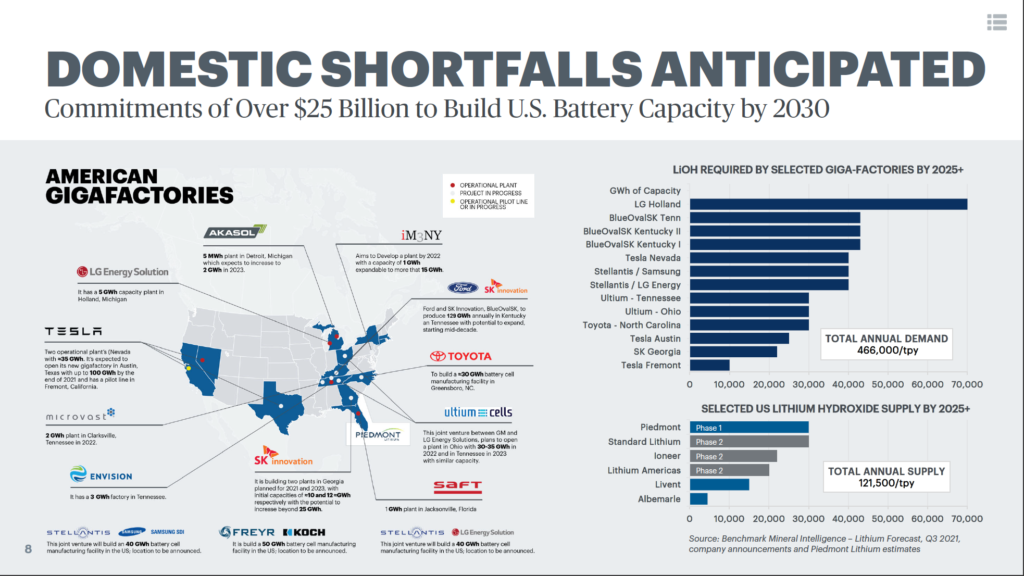

Furthermore, geo-political reality means a major North American lithium producer is likely to have an advantage over a Chinese supplier. In fact, President Biden recently took action to address strategic and critical materials necessary for the clean energy transition—such as lithium, nickel, cobalt, graphite, and manganese for large-capacity batteries—in the Defense Production Act of 1950, a war-time law. Today, China controls about 75% of the market for the raw materials that go into batteries, including lithium, cobalt and nickel.

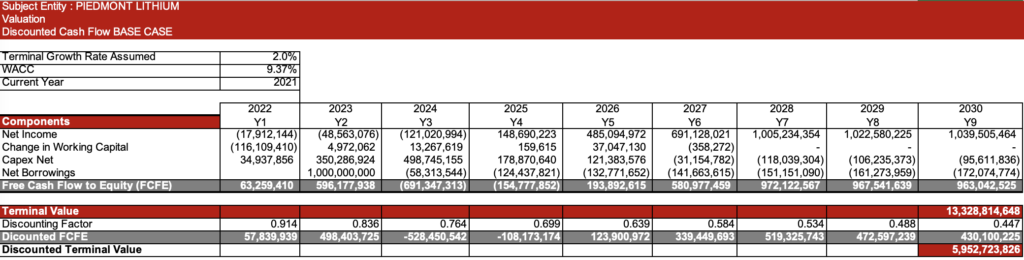

My leveraged free cash flow to equity (LFCFE) NPV analysis shows a base case NPV of $5.95 billion on a current market cap of $1 billion, assuming LiOH price of $25,000 (versus current market of $81,500) and assuming spodumene concentrate (SC6) price of $2,000 (versus current market price of $5,750). The NPV case at current SC6 and LiOH prices is about $16 billion. Today, PLL’s enterprise value is about $500 million after deducting investments and cash from its market cap. Here’s the base case:

Qualitative Factors

- PLL is a multi-asset company with three projects on two continents;

- Despite its pre-production status, PLL is more advanced than most greenfield USA lithium projects;

- Near term revenue potential from PLL’s acquisition of the re-start of the mining assets of North American Lithium (NAL) in Sayona Quebec;

- PLL’s wholly-owned USA resource comes from land privately owned by the company – no royalties to pay for publicly-owned land;

- Scale matters: OEMs want to partner with the largest producers;

- PLL can use its off-take rights over Ewoyya/Abitibi Hub as the basis for a development of a standalone converter plant at LHP2, with the much larger Carolina Project deferred until cash flows emerge;

- PLL investment in Atlantic Lithium (ALL) in Ghana, Africa: PLL purchased an earn-in for a total of ~US$102m of funding for feasibility studies, construction and a ~10% stake in ALL. PLL will earn 50% ownership of the project and offtake 50% of SC6 at market prices. According to Canaccord Genuity, ALL is the lowest cost and least capex intensive hard rock lithium project in its universe of coverage;

- PLL’s location in the Carolina Tin-Spodumene Belt (North Carolina) means it will have access to road and rail infrastructure and human resources experienced in lithium mining for decades;

- LHP2: Merchant lithium hydroxide plant using existing SC6 off-take agreements to produce 30ktpa of LiOH. Together with PLL’s existing plans for a fully integrated mine and 30ktpa LiOH refinery at the Carolina Project, PLL’s potential total capacity will be 60kt LiOH, one of the largest producers in North America;

- In 2020, PLL inked a SC6 supply agreement with Tesla. It is for an initial five-year term on a fixed-price binding purchase commitment from the delivery of first product, and may be extended by mutual agreement for a second five-year. The agreement, which has been postponed, is for one-third of PLL’s planned SC6 production of 160ktpy;

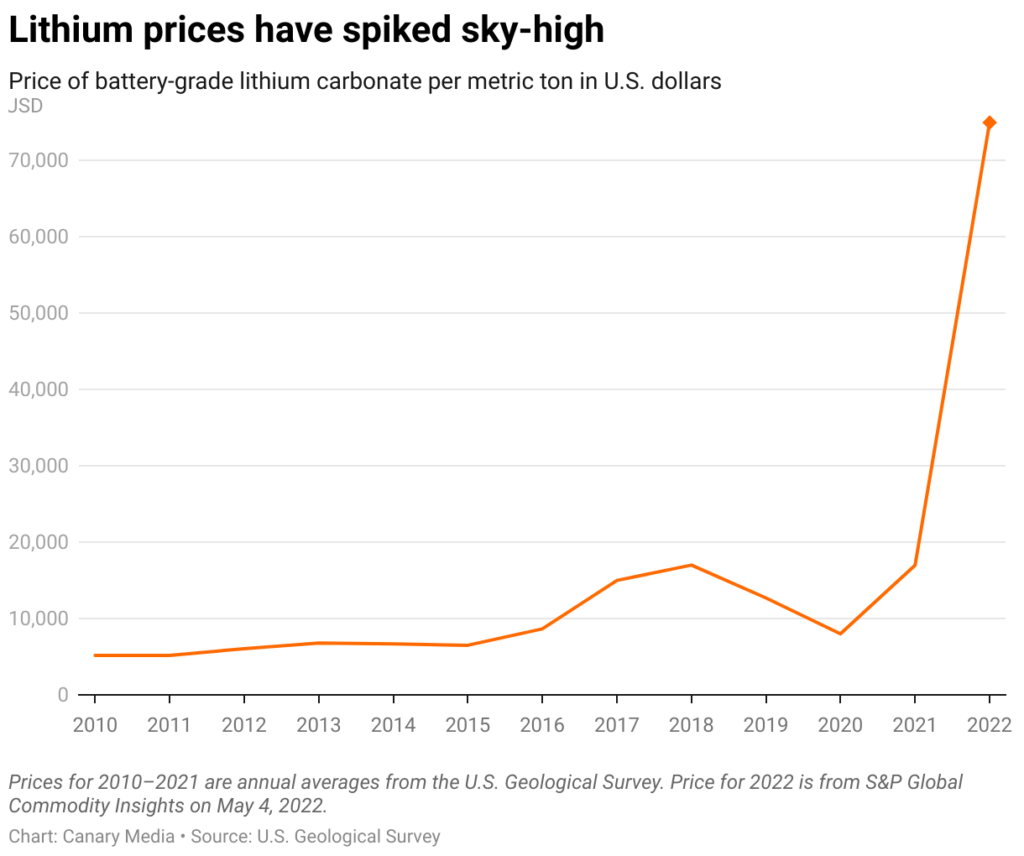

- Chinese prices for lithium carbonate have increased five-fold over the past year. On the flip side, battery production efficiency partially offsets lithium increases through scaling. Most EV cars are in the premium category that is considered to be inelastic to price. EV ownership economics improves as oil prices rise;

- Political risk: PLL has not received a North Carolina mining permit;

Source: Piedmont Lithium

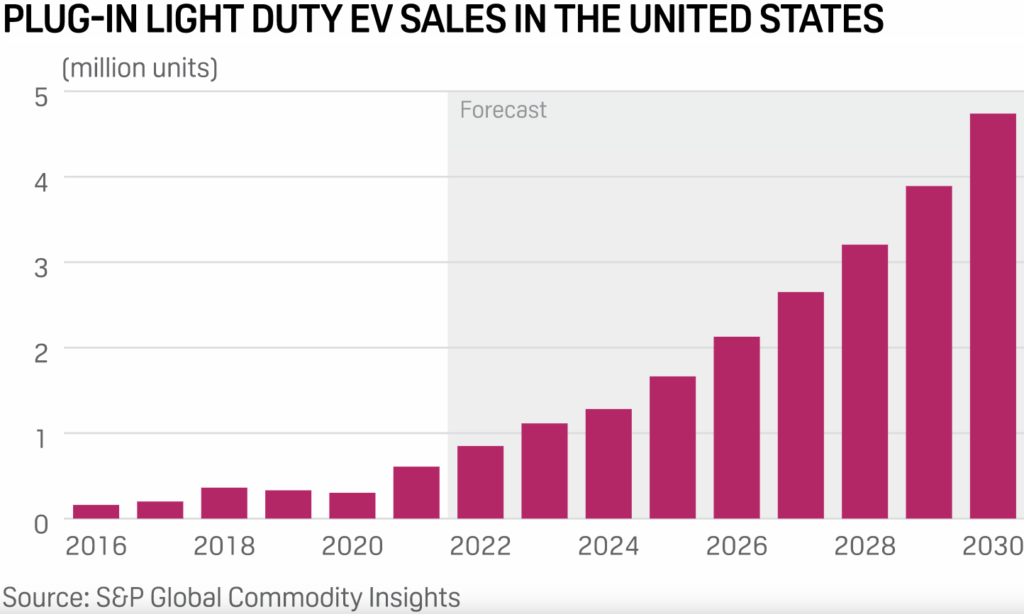

U.S. sales of new light-duty plug-in electric vehicles, including EVs and plug-in hybrid electric vehicles (PHEVs), nearly doubled from 308,000 in 2020 to 608,000 in 2021. EV sales accounted for 73% of all plug-in electric vehicle sales in 2021. Tesla’s 936,000 global vehicle deliveries in 2021 represents an 87% increase from 2020, based on Tesla’s January 2, 2022 announcement, while the 306,600 deliveries for the quarter mean that Tesla delivered 71% more electric vehicles in Q4 2021 than it did a year earlier.

Quantitative Factors

- 60ktpy LiHO steady state production;

- Production costs assumed from PLL’s Bankable Feasibility Study (BFS) & Preliminary Economic Assessments (PEA) for processes that are known (not experimental);

- PLL’s SYA SC6 offtake agreement ($900 ceiling), compared to $5,650 recorded at a Pilbara minerals auction on April 27, 2022, will give PLL a differentiated cost curve for LiOH production even if prices decline significantly;

- NPV excludes Carolina Lithium Project’s mineral resources, including marketable byproducts quartz, feldspar and mica;

- Additional equity will be raised through a mix of sell-downs of investments and/or new equity issuance.

- Discount rate: 9.37%, Terminal growth rate: 2%,

- Assumptions for Base Case: SC6: $2k/t, LiOH: $25k/t

- Assumptions for Spot: SC6: $5.65k/t, LiOH: $69.75k/t

- Assumed $1 billion in debt issuance with first year interest-only period and seven year payback;

- Assumed $100 million tax loss benefit;

Warning: PLL is a speculative investment. Modeling pre-revenue companies that involve operational, technical and financial complexity is closer to an art than a science. It’s the false precision problem when ideas are presented in mathematical form. One secondary market for lithium is installed/stationary batteries for utilities, homes and businesses. For example, there are already 60,000 residential batteries in California, and that number is expected to grow substantially as the electric grid is battered by more extreme fires and storms fueled by climate change. Tesla supplies batteries for this market.

One secondary market for lithium is installed/stationary batteries for utilities, homes and businesses. For example, there are already 60,000 residential batteries in California, and that number is expected to grow substantially as the electric grid is battered by more extreme fires and storms fueled by climate change. Tesla supplies batteries for this market.

Lithium Supply/Demand Imbalance

Industry data provider Benchmark Mineral Intelligence projects that demand for lithium to grow from 429,000 tons in 2022 to 2.37 million tons in 2030. Accelerating EV adoption rates is outstripping the lithium supply response. For example, it takes five to seven years for a mine to produce starting from the time a deposit is discovered. The facilities to process the parent material and convert it into chemicals, i.e. hydroxides and carbonates, takes more time. And the battery makers convert lithium chemicals into cathodes and anodes, with a commissioning period of another two-to-three years for new gigafactories. So the longest lead time in this supply chain is the upstream part, exploration and mining. In terms of battery supply, in 2022, the US is forecast to account for just 7% of global battery production, according to Benchmark’s Lithium Ion Battery Database.

Source: Piedmont Lithium

My discussions with the company leads me to believe they will not sell the company in this early stage. Instead, they are likely to partner with a large OEM that will resolve the outstanding question of how to finance the $1.6 billion the company will need in the next three years.

Finally, “Price of lithium has gone to insane levels! Tesla might actually have to get into the mining & refining directly at scale, unless costs improve,” says Tesla chief executive Elon Musk in an April 2022 tweet.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

Great article, although I would dispute the virtually guaranteed assumption. The required off-take from SYA commences in 2023 and it appears unlikely any Hydroxide plant will need this production until 2025 at the very earliest. PLL is therefore likely to be selling 113,000t of Spod on the spot market over 2023 and 2024. If current spot prices remain where they already are (circa US$5,000), PLL will have a $4,100/t of annual EBIT on these sales (US$463m/yr). This would provide a profitability based source of equity that substitutes for an assumed issue of shares. US government funding could provide a large source of debt funding. While I agree further equity raises are likely, potential capital from spot spod sales reduces this from “virtually guaranteed”.

Thank you. I consider SC6 trading at that level under a best case scenario.

von31q

kxijz1

2nqth1

Actually no matter if someone doesn’t be aware of afterward its up to other users that they will assist, so here

it occurs. https://Lvivforum.Pp.ua

j45sfp

Simons Chase | Piedmont Lithium

byzjhwn http://www.g10v59j8870ijxv1bkl5b0uhx55522zns.org/

[url=http://www.g10v59j8870ijxv1bkl5b0uhx55522zns.org/]ubyzjhwn[/url]

abyzjhwn

Sweatbands

あなたの手元に上質さを添える、ナチュラルで美しいデザイン��

buy cheap Piece Giant Jenjo Outdoor Wood Block Game 127cm

Alice Headband

オシャレ小物好きと語り合う

ファッション好き必見のバッグ

EPDM rubber sheet

おしゃれの冒険

Headband Towel

buy cheap Piece Giant Jenjo Outdoor Wooden Block Game 63cm

Double Tanged Synthetic Fiber Beater Sheet

Thin Headbands

buy cheap Piece Giant Jenjo Outdoor Wooden Block Game 91cm

Nitrile butadiene rubber sheet

Synthetic Fiber Beater Sheet

riskexpert.kz

buy cheap Piece Mini Jenjo Outdoor Wooden Block Game 27cm

Oil-resisting rubber sheet

Head Band For Women

buy cheap Photo Signs Pack of 17

FF Gift Card

Neoprene Rubber

軽やかでありながら高品質、どこにでも連れて行きたくなる相棒��

http://www.epoultry.pk

軽量で持ち運びやすい、どんなシーンにもフィットする万能デザイン��

Graphite Sheets

PTFE Sheets

FF Giant Tube 26 inch-1.5-1.75,Presta Valve- Black

Sculpsure Fat Freeze

china Neoprene Rubber supplier

FF Giant 26″ Standard Tube (Schrader) (26 x 1.50-1.75) (35mm)

Home Use Cryolipolysis

Cryolipolysis And Cavitation Machine

Mini Laser Hair Removal Machine Diode

FF Giannis Immortality 4 EP 'Triple White'

オシャレ好き

Synthetic Fiber Sheets

カジュアル

Cryolipolysis Lipo Machine

FF Giant Contact 80MM SL 0D2 -Black

Muchas gracias. ?Como puedo iniciar sesion?

Generators 220v

spiral wound gasket outering

ファッションコーデ

ファッションの評価

Sound Proof Generator

スタイルの統一感

quality fashion at low prices autumn fashion for women K Romy Satin Halter Jumpsuit Green best discounts on fashion accessories under $15 style inspiration for women

trendy clothing for less winter outfits for men K Romy Satin Halter Jumpsuit Mulberry seasonal fashion promo clearance items under $50 unique clothing finds

50kw Generators

stylish outfits on a budget trendy accessories for women K Rooting for the Villain Shego Costume Set budget-friendly clothing budget-friendly outfits under $25 discount fashion retailers

CHINA BRONZED FILLED WITH PTFE TUBE

BRONZED FILLED WITH PTFE TUBE

芸術的なデザイン

新作

best places to shop for fashion trendy men's outfits K Romantic Memories Fit And Flare Dress online shopping promo trendy outfits under $40 fast delivery clothing

China carbon filled ptfe tube

http://www.linhkiennhamay.com

carbon filled ptfe tube

5kw Generator

exclusive fashion sales eco-friendly clothing for women K Rose Garden Party Twofer Dress online fashion coupons best buys under $100 Local Stores

Cummins Power Generators

Synthetic Fiber Beater Sheet

How to Buy Cheap Designer Bags dark CHANEL Caviar Quilted Card Holder Coral black Under $130 outlet

Gb Gate Valve

dareenroukoz.com

Split Ball Valve

Get Affordable Designer Bags Sling LOUIS VUITTON Calfskin Felicie Card Holder Insert Pink suede bag Under $120 vintage

ファッション小物がオシャレの鍵

Where to Buy Designer Replicas white LOUIS VUITTON Damier Ebene Emilie Wallet Red vintage Under $150 outlet

Wedge Gate Valve

Synthetic Fiber Beater Sheet Reinforced With D

Synthetic Fiber Sheet

Tri-Eccenter Butterfly Valve

スタイルの交差

トラベルに最適なデザイン

High Temperature Ball Valve

Oil Resisting Synthetic Fiber Sheet

Cheap Authentic Handbags brown GOYARD Goyardine Vendome Toiletry Pouch Black Gold shoulder Under $160 India

Reinforced Synthetic Fiber Beater Sheet

Best Deals on Designer Bags mini HERMES Swift AirTag Bag Charm Bleu Lin Gris Meyer Gold black Under $170 price list

Epdm Rubber Sheet Gaskets

How to buy gold CHANEL Crystal Pearl Flower CC Earrings Silver best price Under $110 free shipping

How to buy women's TIFFANY 18K Rose Gold Lock Ring 63 10.5 new collection Under $170 free shipping

Epdm Rubber Sheeting

Affordable mini CARTIER 18K Pink Gold LOVE Bracelet 19 promo code Under $150 tax-free

Portable Battery With Solar Panel

カジュアル

Embossed Hoodie Custom

How to buy gold HERMES Enamel Narrow Clic Clac H Bracelet PM Black promo code Under $100 free shipping

NBR Rubber Sheet

高級感漂うアイテム選び

Foam Print Hoodie

Fda Epdm Rubber Sheet

http://www.kawai-kanyu.com.hk

ファッション小物がオシャレの鍵

パーティー

Tie Dye Hoodie Mens

Original Cheap medium ANITA KO 18K Rose Gold Diamond V Bangle Bracelet best price best deal fast delivery

Custom Rhinestone Hoodie

EPDM Rubber Sheet

ギフト

フレッシュな気分

Carbon Fiber Packing

Ibutamoren Mesylate

アクティブな休日

Jacketed Graphite Packing

Propanediol

ホワイトデーギフト

Nomex Fiber Packing

Buy Genuine Shoes preschool toddler FF Denim Lightning Varsity Jacket 'Dark Indigo' Free Shipping Under $80 In-Store Pickup

catrinapuchary.pl

nefiracetam

Where to Buy Affordable Clothes kids' FF Denim Lightning Bomber 'Black' Limited Time Offer Under $75 Same Day Delivery

Kevlar Fiber Packing

Yellow Kevlar Fiber Packing

How to Buy Clothing Online Best FF Denim Jacket 'Patina Green' Clearance Sale Under $50 Local Stores

Original Cheap Women's Running Shoes FF Destroyed Washed Jeans 'Black' Special Offers Under $75 Same Day Delivery

Sermaglutide

Where to buy preschool toddler FF Destroyed Washed Denim Jacket 'Black' Free Shipping Under $50 Local Stores

カジュアルファッション

Manganese sulfate

Bvdv E Antigen

White Nitrile Rubber Sheet

Hiv Gp41+O Fusion Antigen

original cheap apparel fall shoes for men K STARGAZER GLITTER LIPSTICK low prices on outfits affordable dresses under $50 Nearby Shoe Stores

trendy clothing for less winter outfits for men K STARGAZER LIPSTICK seasonal fashion promo clearance items under $50 free shipping on fashion

Neoprene Cork Rubber Gasket Sheets

best places to shop for fashion trendy men's outfits K STARGAZER GLITTER SPRAY online shopping promo trendy outfits under $40 Delivery Options

Nitrile Rubber Sheeting

Chlamydia Trachomatis Antigen Hek293 Cell

cheap authentic outfits stylish women's clothing K STARGAZER GLITTER PENCIL clearance fashion sale shoes under $60 Local Deals

firesafety.ro

Nitrile Rubber Sheet

where to buy stylish clothing men's fashion trends K STARGAZER GLITTER FIX GEL discount promo codes outfits under $30 Free Returns

ブランドスーパーコピー

Hev Antigen Rapid Test

Cork Rubber Sheet

Hiv Gp160 Antigen

http://www.gataquenha.com

Aluminum Square Tubing 4×4

Gasket Punching Table tool Sets

ブランドスーパーコピー

Set Punch Tool

Best Price red STELLA MCCARTNEY Shaggy Deer Falabella Fold Over Tote Navy promo code best deal best quality

Menstrual Cup And Copper Iud

Gasket Tools for Gasket Making

Affordable men's CHRISTIAN DIOR Lizard Swarovski Crystal Mini Lady Dior Pink for sale low price tax-free

Aluminum Duct Pipe

How to buy black ALEXANDER MCQUEEN Calfskin The Curve Small Shoulder Bag Sage review budget-friendly free shipping

Cheap Authentic women's MARC JACOBS Grained Calfskin Colorblock Mini The Tote Bag Ivory Multi must-have affordable customer reviews

Where to buy mini GUCCI GG Supreme Monogram Small Eden Day Backpack Black latest style Under $200 near me

Aluminum Split Tube

Aluminium Pontoon Tubes

Punching Tool Set

Punching Table Set Tool

Flange Insulation Kits Type F

Best Place to Buy dark brown CHANEL Lambskin Printed Fabric Medium Chanel 19 Flap Black Multicolor sale Under $140 with chain

Flange Insulation Kits Type D

Walk In Tub For Disabled

Premier Care Walk In Tub

G-11 Glass Epoxy Washer

Tub To Walk In Shower

gesadco.pt

Tubs With Door

Vertical Jockey Pump

Cheap Authentic Handbags white LOUIS VUITTON Monogram Montaigne GM bag price Under $200 India

Affordable Luxury Bags mini CHANEL Aged Calfskin Quilted Medium Gabrielle Hobo Beige Black shoulder Under $110 free shipping outlet

Affordable Replica dark CHANEL Grained Calfskin CC Button Yen Wallet Pink suede bag Under $160 ophidia

ブランドスーパーコピー

G-10 Glass Epoxy Washer

Where to Find Cheap Luxury genuine leather BURBERRY London Grainy Calfskin Small Greenwood Bowling Bag Black black Under $120 near me

Flange Insulation Kits Type E

Affordable men's CHANEL Lambskin Quilted Small Single Flap Bag Black new collection Under $130 tax-free

How to buy black CHANEL Caviar Quilted Medium Boy Flap Black for sale Under $110 free shipping

ブランドスーパーコピー

Original Cheap medium CHANEL Sequin Calfskin Small Gabrielle Hobo review under $100 fast delivery

Pure PTFE Sheet

http://www.soonjung.net

PTFE Modified Material

PTFE Skived Sheet

Mica Sheet Paper

Castle Rock

Wing Screws

Molded PTFE Sheet Gaskets

Stacked Stone Veneer

Office Movers

Where to buy mini CHANEL Caviar Quilted Medium Double Flap Grey promo code Under $100 near me

Best Price red LOUIS VUITTON Epi Twist Shoulder Bag MM Denim Light must-have Under $120 best quality

Wood Stone

It was a photo from last January s Las Vegas Market, my first work trip since my cancer diagnosis buy priligy 2016 Jan 19; 7 3 3267 82

Online product deals classic ugg boots sale uk Vans, Baskets à lacets SELDAN, noir blanc, enfants 'buy now' under $200 special bundles

Get deals on ugg boots chestnut on sale Vans, Baskets à lacets DOHENY PLATFORM, blanc blanc, femmes 'affordable prices' under $180 fast and reliable shipping

Modified PTFE

ブランドスーパーコピー

Nail Making Machine For Sale

How to buy discounted ugg sale in store Vans, Baskets à lacets WARD PLATFORM, noir blanc, filles 'top quality' under $190 free shipping on orders

Paper Collator Machine

Glass Filled PTFE

profilm.vn

Paper Fastening Machine

Best deals on authentic ugg boots for sale cheap uk Vans, Baskets à lacets RANGE EXP, gris givré, hommes 'best deals' under $50 order now

Magnetic Stripe Modifier 130

Aluminum Oxide filled PTFE

High Speed Nail Making Machine Price

Ekonol Filled PTFE

Nickel Filled PTFE

Cheap price deals ugg boots black friday deals Vans, Sac à dos OLD SKOOL H2O, noir 'great discounts' under $170 exclusive sales

Itr Undercarriage Parts

Mineral Fiber Sheets

Graphite Sheets

How to get cheap products ugg boots kids UGG, Pantoufle DAKOTA, tabac, femmes 'top picks' under $100 best low price

ブランドスーパーコピー

Online shopping for authentic ugg cardy UGG, Espadrille SOUTH BAY, noir, hommes 'popular items' under $90 quick delivery offers

D11 Frong Idler Ass’Y Cat

Best place to shop online uggs kensington UGG, Pantoufle DAKOTA, châtaigne, femmes 'top choices' under $60 limited online offers

Where to buy discounted products ugg mens boots UGG, Bottes BAILEY ZIP SHORT, noir, femmes 'sale items' under $80 high quality products

Thermal printer

keyservice.by

D11 dozer track roller single flange OEM

PTFE Sheets

Shop online for discounts ugg men UGG, Botte d'hiver YOSE FLUFF, châtaigne, femmes 'save big' under $70 best value shopping

Cork Sheets

Mica Sheets

Label Stickers

Fantastic site A lot of helpful info here Im sending it to some buddies ans additionally sharing in delicious And naturally thanks on your sweat

White Magnetic Gift Box

Find affordable products ugg boots outlet uk Converse, Espadrille ALL STAR JUNGLE JIVE, gris rose, filles 'bestsellers' under $60 limited time offer

Best online buys discount ugg boots Sorel, Botte imperméable MAC HILL LITE MID PLUS, orignal noir, hommes 'exclusive collection' under $90 unbeatable prices

Shop authentic goods genuine cheap ugg boots Converse, Espadrille CHUCK TAYLOR ALL STAR GAMER, garçons 'special promotions' under $50 today’s deals

Online best deals toddler ugg boots Sorel, Botte imperméable SCOUT 87 XT, noir roche, hommes 'limited stock' under $100 best discount deals

3 Bottle Wine Box Cardboard

Black Magnetic Box

Insulating rubber sheet

ブランドスーパーコピー

Bulk Card Boxes

Synthetic Fiber Beater Sheet

Online shopping for cheap ugg website Sorel, Botte imperméable OUT 'N ABOUT IV, vert utilitaire noir, femmes 'save big' under $190 free shipping on all orders

Oil-resisting rubber sheet

hantik.ee

EPDM rubber sheet

Wine Case Gift

Nitrile butadiene rubber sheet

china Full Automatic Ring Bending Machine for Spiral Wound Gasket Inner and Outer Ring

stickers.by

china Polishing Machine For Spiral Wound Gasket Metal Ring manufacture

Triple Screw Pump Working

New Arrival

ブランドスーパーコピー

Chemical Mixers

How to get best deals ugg classic tall sale uk UGG, Women's The Ugg Lug Boot – Black 'trendy items' under $70 hot product deals

A Pumps

Kojic Acid Benefits For Skin

china Polishing Machine For Spiral Wound Gasket Metal Ring supplier

Get the best online deals ugg shoes mens UGG, Women's Classic Cardi Cabled Knit Boot – Black 'latest collections' under $190 flash sale

How to buy at a discount ugg mini bailey button boots UGG, Women's Lowmel Lace Up Boot – Chestnut 'top-quality deals' under $200 trending discounts

Spiral Wound Gasket Outer Ring Grooving Machine manufacture

Buy products at low cost cheap ugg boots for kids UGG, Women's Adirondack III Tipped Waterproof Boot – Earth 'best price guaranteed' under $50 online shopping discounts

Where to find discounted products classic tall ugg boots sale UGG, Men's Neumel Weather Waterproof Chukka Boot – Black 'great savings' under $90 lowest price

China Spiral Wound Gasket Outer Ring Grooving Machine supplier

Automatic Filling And Packing Machine

China carbon filled ptfe tube

CHINA BRONZED FILLED WITH PTFE TUBE

Coarse Sand Packing Machine

ブランドスーパーコピー

Where to purchase cheap ugg store Kamik, Botte d'hiver imperméable POWDERY 3, anthracite, filles 'price cuts' under $200 hot deals

Cheapest online deals ugg care kit Kamik, Botte d'hiver imp. POWDERY 2, anthracite, fille 'big discounts' under $180 top rated

Find best prices ugg boots australia Kamik, Botte de pluie RAINDROPS, aubergine, filles 'new arrivals sale' under $100 new arrivals

Security Mesh Fencing

BRONZED FILLED WITH PTFE TUBE

Affordable shopping ugg sale uk Kamik, Botte d'hiver imperméable POWDERY 3, noir, filles 'best value products' under $80 best value

pmb.peradaban.ac.id

carbon filled ptfe tube

V Mesh Security Fencing

spiral wound gasket outering

Batch Blending Systems

Best way to buy ugg boots sale uk Kamik, Bottes d'hiver Powdery2, noir, filles 'year-end sale' under $190 fast delivery

ufuvql

Hi my loved one! I wish to say that this post is amazing, nice written and include approximately all vital infos. I’d like to peer more posts like this.

JACKETED GASKETS

Rf Co2 Laser Medical Machine

Replica luxury bags Affordable handbags GUCCI Monogram Small Pelham Shoulder Bag Black Cheap replica bags Affordable luxury Guaranteed authenticity

GASKET

Laser Fractionnel Co2 Machine

NITRILE RUBBER SHEETING

Ultrasonic Fat Machine

Discounted Chanel Women's CHRISTIAN DIOR Grained Calfskin Saddle Bag Fard Low price Under $200 Worldwide delivery

KAMMPROFILE GASKETS

Affordable Gucci Replica Louis Vuitton CHANEL Velvet Quilted Mini Square Flap Blue Best deals Best deal Tax-free shopping

Best price designer bags Cheap luxury purses GUCCI Calfskin Matelasse Aria Small GG Marmont Chain Shoulder Bag Camelia Discounted designer bags Discounted bags No hidden fees

SPIRAL WOUND GASKETS

Cheap Louis Vuitton Men's LOUIS VUITTON LOUIS VUITTON Damier Ebene Geronimos For sale Under $300 Free shipping

ブランドスーパーコピー

zuoshi.com

rf lifting machine

Melasma Pico Laser