How Technology Is Driving Lithium Demand And Supply

Lithium, the earth’s least dense and most electrically-conductive metal, is in the grips of a chemical reaction with Elon Musk who ignited a major consumer shift toward EVs, starting in the U.S. At the same time, China dominates lithium battery production and is also the world’s largest market for EV sales by units. In fact, 101 of the world’s 136 lithium battery plants are located in China. Upstream, Chinese chemical companies account for 80% of the world’s total output of raw materials for making lithium-based batteries.

The intersection of these two forces is Telsa’s new Gigafactory 3 in Shanghai, China. The factory is the first and only foreign passenger car plant in China exempt from being operated as a joint venture. That’s right, it is 100% owned by Tesla. The company currently ships China-made Model 3s to Europe. Its Chinese-made cars are produced with lithium iron phosphate (LFP) batteries, a new chemistry for Telsa. In October, it sold 54,391 China-made vehicles, including 40,666 for export, according to the China Passenger Car Association. And in November, Telsa and China’s Ganfeng Lithium Co Ltd signed a new contract to supply to Tesla with battery-grade lithium products for three years starting from 2022.

Global demand for lithium last year was about 320,000 tons. Of this, battery manufacturing for the EV industry was around 280,000 tons. Analysts at Citi predict that 75% of all mined lithium will go into EVs by 2025.

By 2028, it is forecast that the top producers of lithium battery cells based on production capacity will be CATL, LG Chem, and Tesla. Supply imbalances could threaten the viability of OEMs unable to source battery-grade lithium and other rare earths as demand for EV cars and light commercial vehicles soars.

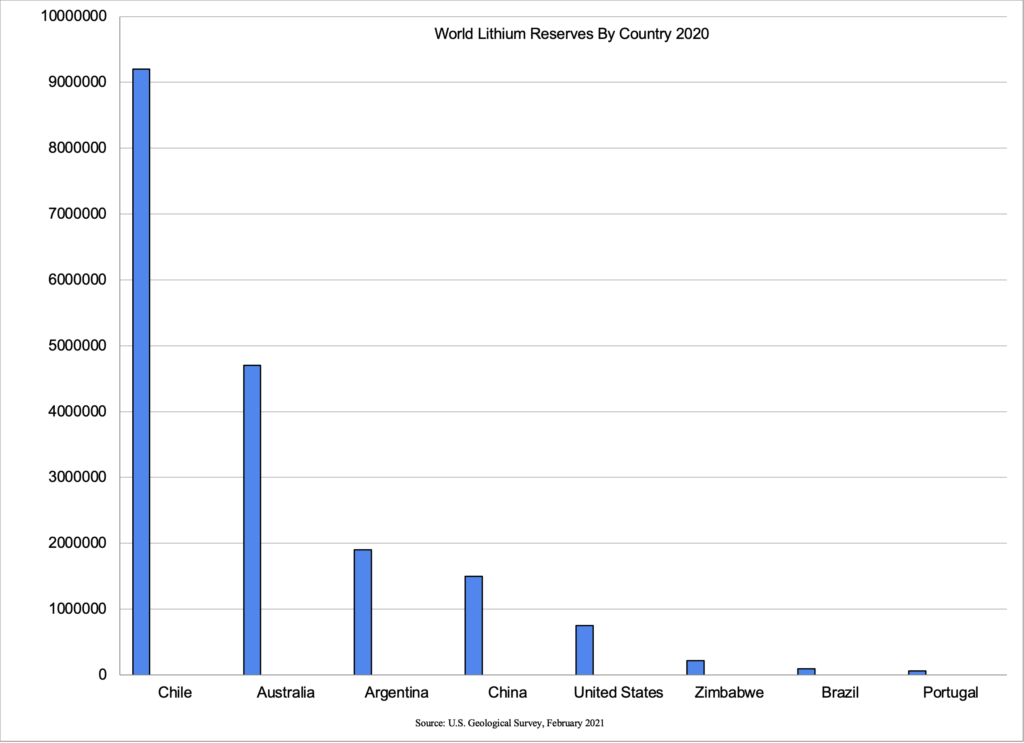

Lithium is mainly sourced from either spodumene (hard rock) or brine. Australia contains the majority of spodumene mines, while brine production is concentrated in South America, mainly in Chile and Argentina. Lithium carbonate and lithium hydroxide are the two lithium compounds employed for battery cathode production, with carbonate currently making up the bulk of usage. In brine production lithium chloride is extracted from alkaline brine lakes before being converted to carbonate.

“Embedded emissions” from raw materials used to make EV battery is becomes a factor in both public perception and production costs. According to Rystad Energy, hard rock lithium mining requires large amounts of water and can release up to 15 tons of CO2 for every ton of lithium produced. Extracting lithium from brine deposits, while emitting less CO2, requires more water, and this process often takes place in parts of the world where water is scarce. Elon Musk adds long-distance travel (Australia–>China—>USA) to the negative externalities of the current battery supply chain network.

Supply and Demand

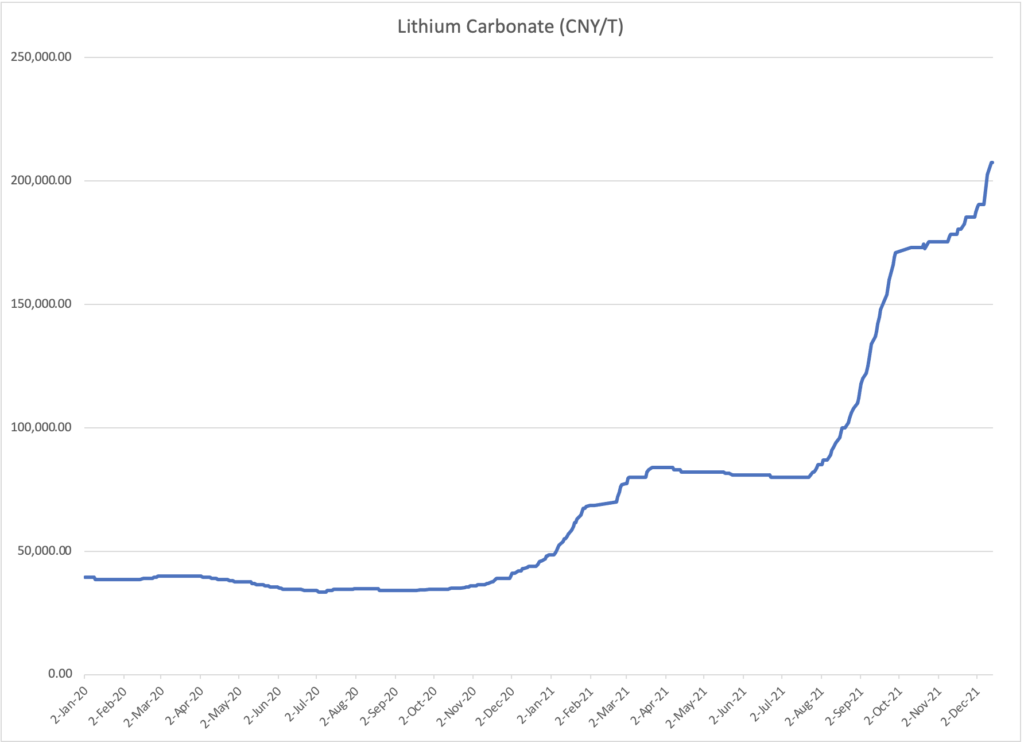

In 2021, lithium carbonate prices rose more than 400% after a protracted downturn between 2018 to 2020.

Lithium carbonate spot price China

OEMs are reacting to consumer demand for EVs. Here is an inventory of major OEMs announcements about EV investment in 2021: Toyota – $35 billion (10 years), VW – $90 billion (through 2026), Mercedes – $40 billion (through 2030), Stellantis – $30 billion (through 2025), GM – $35 billion (through 2025), Ford – $30 billion (through 2025). All of these companies are currently far less efficient at capital allocation to EVs compared to Tesla.

Ark Invest suggests that the acceleration in EV growth could be a function of several adoption s-curves occurring simultaneously. As battery costs continue to fall, pushing EVs across critical price points that attract new groups of buyers, new adoption cycles begin. According to Ark, another major adoption cycle should kick in when EVs hit the ~$25,000 price point during the next few years. Based on Wright’s Law, ARK forecasts that EV sales should increase roughly 20-fold from ~2.2 million in 2020 to 40 million units in 2025. Cathy Wood, Ark’s chief investment officer, and the Ark team have attracted criticism lately over a go-go growth investing style that is currently out of favor. But investors cannot impute Ark’s track record predicting Telsa’s rise and the faster-than-expected adoption of EVs in general. In 2022, Tesla is likely to exceed 1.5 million electric car sales, up from around what should be about 900,000 in 2021. Benchmark Minerals expects U.S. EV demand to grow 12x by 2030.

Electric vehicles will grow from 0.7% of the global light-duty vehicle (LDV) fleet in 2020 to 31% in 2050, reaching 672 million EVs, predicts the US Energy Information Administration (EIA). The EIA estimates that the global LDV fleet overall – both gas and electric – contained 1.31 billion vehicles in 2020, and it expects this fleet to grow to 2.21 billion vehicles by 2050 as the result of an increase in economic activity, population, and private mobility. It also predicts that the global gas and diesel LDV fleet will peak in 2038 as the result of significant EV sales growth. The EIA defines LDVs as “passenger and fleet cars and trucks with a gross vehicle weight rating of 8,500 pounds or less.” It defines electric vehicles as any LDV with a charging plug, and that definition includes all-electric vehicles and plug-in hybrid electric vehicles. There are a constellation of factors influencing the balance of supply & demand for electric-grade lithium over the coming years. Some of these include: Chinese, European & USA government subsidies for EVs, Chinese government supervision over domestic rare earths market (ie. stockpiling), consumer demand for EVs, additions to new mining capacity, U.S. federal greenhouse gas emissions standards for passenger cars and light trucks, and a shift in battery chemistry towards LFP. One estimate suggests that by 2030, the lithium deficit could be between 455,000 and 1.7 million metric tons each year.

Here are some growth figures for global EV (plug-in and fully-electric) sales: July 2021 saw a 94% increase on July 2020, with a market share of 7.1% for July 2021, and 6.5% YTD. August 2021 saw a 114% increase on August 2020, with a market share of 7.7% for August 2021, and 6.6% YTD. September 2021 saw a record 685,000 sales for the month, up 98% on September 2020, with a market share of 10.2% (new record) for September 2021, and 7% YTD. In summary, consumer preference for EVs, government policy and a strong ESG factor are likely to drive demand for EVs that will outstrip the mining industry’s capacity to bring on production for years to come. The leading edge of this dynamic is the surge in lithium takeovers and strategic buy-ins. There has been a surge in junior lithium miner takeovers or buy-ins by the Chinese, especially in Argentina brine projects, in 2021:

- Bacanora Lithium – Taken over recently by Ganfeng Lithium;

- International Lithium Corp – Mariana Project final project share buyout by Ganfeng Lithium;

- Millennial Lithium Corp – 100% company buyout agreement with Lithium Americas;

- Neo Lithium 100% company buyout offer by Zijin Mining (at $774 million, and reported to be at 64% of NPV of $1.2 billion);

- Arena Minerals – Ganfeng Lithium project and equity stake, Lithium Americas equity stake;

- North America Lithium (“NAL”) – Sayona Mining & Piedmont Lithium (25%) acquire NAL;

- AVZ Minerals – Sold 24% of the Manono lithium and tin project JV to Suzhou CATH Energy Technologies (jointly owned by Chinese battery maker CATL) for US$240 million.

Newer Technology Promises Better ESG Credentials

Direct lithium extraction (DLE) is one promising technology that has yet to be deployed at scale. In October 2021, Lilac Solutions announced a joint venture with Lake Resources to produce battery-grand lithium at Lake’s Kachi Lithium Brine Project in Argentina. According to the company , the Lilac production process is lower cost and offers higher lithium recovery rates (80-90%) than other technologies to produce battery-quality lithium carbonate (99.97% purity), while also protecting the local environment, including water resources. Lilac will contribute technology, engineering teams, and an on-site demonstration plant, earning in to a maximum 25% stake in Lake’s Kachi project based on performance. Lilac will be expected to fund its pro-rata share of future development costs, currently estimated to be approximately US$50 million. Lake is funded to the final investment decision (FID) on construction finance for Kachi, anticipated in mid-2022, followed by construction, targeting 25,000 tons per annum lithium carbonate production, with commissioning and production in 2024. Lilac’s ion exchange technology is potentially transformative. The company claims it is capable of processing lithium from brine resources significantly faster, cheaper and more scalable than conventional methods. In 2020, a fund backed by Bill Gates and other high profile entrepreneurs led a US$20 million funding round for Lilac. Lake is a pre-production mining company and is therefore highly speculative. Another type of production is clay lithium projects. It carries the highest opex and capex and has very little production experience at scale. Elon Musk has suggested he plans to extract lithium from clays in Nevada.

Push For U.S. Domestic Supply

In October 2021, Tesla confirmed that it is moving Model 3 Standard Range production to lithium iron phosphate (LFP) battery cells at its Fremont factory. The subtext of this announcement, combined with other actions, suggest the company wants the production of the cell, which has been only produced in China, to eventually come from North America. Elon Musk has said multiple times that Tesla plans to shift more electric cars to LFP batteries in order to overcome nickel supply concerns and, “Create a domestic U.S. lithium supply chain by sourcing spodumene raw material within the U.S. thereby reducing emissions related to the transportation efforts of moving material from traditional lithium-producing countries in South America and Australia,” according to Tesla. LFP batteries are cheaper and safer, but they offer less energy density, which means less efficient and shorter range for electric vehicles. Currently, there is no US production of LFP battery cells.

Mid-stream production is likely to come online first. Last year, Piedmont Lithium Inc signed a five year off-take agreement to supply Tesla with one third of its initial production. Piedmont’s plans include an open-air pit more than 500 feet deep and facilities to produce lithium-based electric vehicle (EV) battery chemicals in North Carolina. Tesla’s plan is to process Piedmont’s spodumene concentrate into lithium hydroxide for battery production at its Texas Gigafactory. Piedmont’s ultimate plans include moving to the specialty chemical space for battery-grade lithium with a spodumene-to-hydroxide production capability. Piedmont is an exploration stage company developing a multi-asset, integrated lithium business in North America for the EV industry. The centerpiece of its operations is a wholly-owned Carolina Lithium Project located in the Carolina Tin-Spodumene Belt of Gaston County, North Carolina. Also, the company is geographically diversified with equity investments in strategic partnerships that own lithium resource assets in Quebec, Canada and Ghana that promise to position the company to be a large, low-cost, sustainable producer of lithium products and byproducts, including quartz, feldspar and mica, serving the North American and European electric vehicle and battery supply chains. The company estimates its NPV to be $2 billion based on current lithium prices. In December, Piedmont reported the results of a Bankable Feasibility Study for its 100% owned proposed integrated lithium hydroxide business. The study confirms that its North Carolina lithium project has the location, mineral resources, and operational advantages to be one of the world’s largest and lowest-cost producers of lithium hydroxide, with a sustainability footprint that is superior to incumbent producers, all in a strategic location to supply the rapidly growing EV supply chain in the US.

Current and forecasted battery manufacturing capacity exceeds 500 GWh with public announcements of over $25 billion in capital investments to occur in the U.S. by 2025. Based on an average requirement of 960 tons of lithium hydroxide per GWh of manufacturing capacity, the resultant U.S. demand for lithium hydroxide could exceed 460,000 t/y by 2027. In December 2021, Toyota announced plans to invest $1.3 billion to set up a new lithium-ion battery plant near Greensboro, North Carolina capable of providing power for up to 1.2 million electrified vehicles.

This summary of the lithium industry shows how technology and market demand/supply are extremely difficult to evaluate. Frontier mining projects carry layers of extreme risk including political, technical and market risk. NPVs can swing wildly based on changes in spot lithium prices, especially for early-stage greenfield and brownfield projects.

UPDATE: December 21, 2021: Rio Tinto Group agreed to buy a lithium mine in Argentina for $825 million as the world’s second-biggest miner accelerates its push into battery materials. Rio said Tuesday that it will buy the Rincon asset in Argentina from private equity buyers. The lithium brine project is in the so-called lithium triangle in South America, home to many of the best lithium deposits.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

My brother suggested I might like this website. He was totally right. This post actually made my day. You cann’t imagine just how much time I had spent for this information! Thanks!

prednisolone and isavuconazonium sulfate both decrease immunosuppressive effects; risk of infection reddit priligy