Mama Creation’s Inc

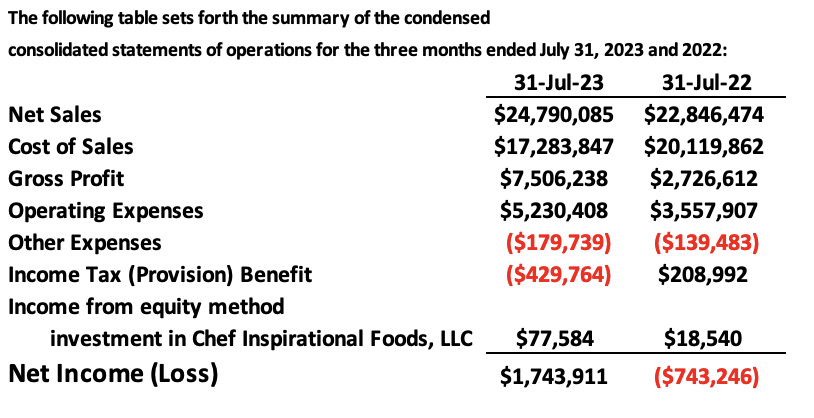

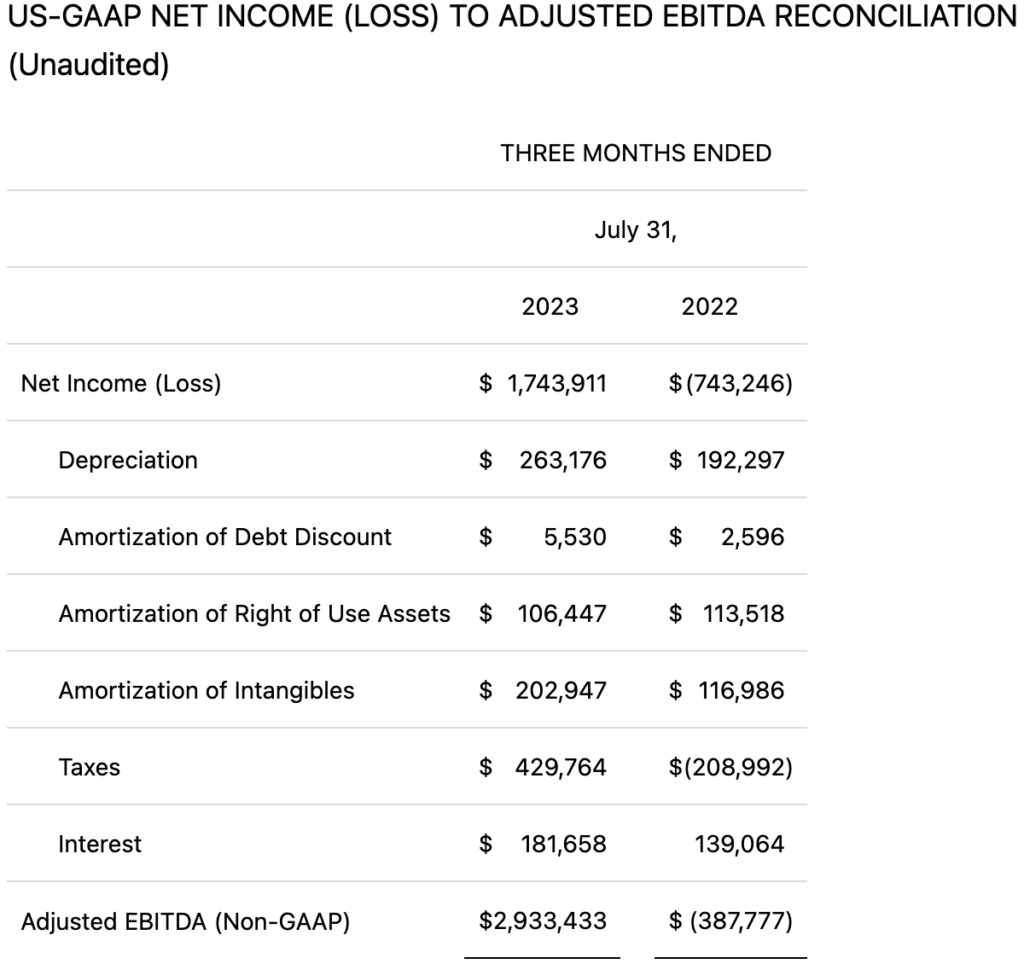

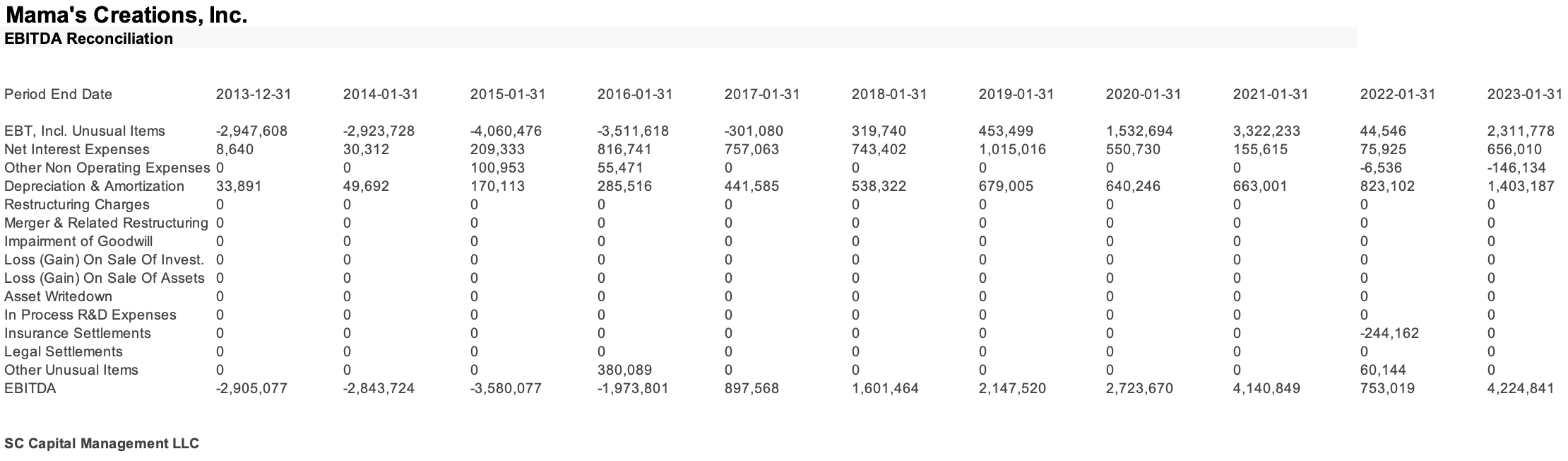

Mama’s Creations, Inc (MAMA) is a micro-cap consumer staples company transitioning from a deep value stage to a growth stage with a new management team, significant industry tailwinds and demonstrated capacity to delivery on positive operating leverage. The company currently is growing well above peers (8% organic vs 4% peers) with accretive acquisitions and superior gross margins (Gross Margin Q2 FY23: 11.9% –> 30.3% Q2 FY24) against the backdrop of a fragmented industry and unfocused competitors. Simultaneously, the company’s financial performance is inflecting from negative to positive with growing earnings, EBITDA and gross margins. This risk/reward opportunity comes with a solid balance sheet, incentivized management and visionary leadership with a track record of success in the consumer/food industry. MAMA has made promises of growth in the past. This appraisal seeks to find what is different this time and whether the current price is worth paying given some significant unknowns. (Note: MAMA’s fiscal year 2024 occurs mostly in 2023 due to its fiscal year-end falling on January 31.)

The challenge for a growth investor wishing to pay value prices is to make an appraisal of a turn-around story like MAMA because, having solved its inconsistent profitability and cash flow problems, the next focus for investors is on the recently-hired management teams’ ability to find advantage in leveraging its brand via expansion and extension options and estimating consumer demand for a tangible product (fresh prepared foods) enriched with intangible attributes (brand). The appraisal problem is even more interesting in the case of valuing brand assets as the market may not be able to accurately value comparable benchmark firms in the first place. The usefulness of relative valuation will be limited if the market does not know exactly how to price certain assets or firms involving complex portfolios of growth options or intangibles, generally, and, in this case, a niche growth industry characterized by market uncertainty for products subject to fluid consumer preferences. In the discrepancy between its current market value and MAMA’s potential to convert marketing investments into financial value lies the promise for uncommon returns.

New CEO & Team

MAMA’s new CEO, Adam Michaels, has a well-articulated vision of how he and his team will actively manage the company’s brands, recognizing its option-like characteristics and how these marketing strategies get converted into value. The CEO’s 2030 vision is to become a one-stop-shop deli solutions provider and generating $1B in revenue, or about 10x 2024 revenues. He joined in September 2022 following nine years at Mondelēz. He served roles including North American Integrated Business Planning Lead, Sr. Director of Forecasting Insights and Analytics, and most recently as VP/Head of Commercial and M&A, NA Ventures. Mr. Michaels earned a BSE in Bioengineering from the University of Pennsylvania and an MBA from Columbia Business School.

Mr. Michaels made reference to his risk posture by stating he does not intend to focus on innovation outside of tight guardrails and prefers to focus inwardly on improving operating leverage. He says, “We don’t want more innovation. But when there is something truly incremental, that’s what we have to go after.” Mr. Michaels has described cross-selling opportunities between the now-integrated businesses as a key source of operating leverage, specifically increasing the average SKUs-per-door metric. I take this to mean his short-term focus is on improving operations – which he has delivered on to date, illustrated here:

Source: Mama’s Creations Inc

Source: Mama’s Creations, Inc

Earlier this year, Mr. Michaels created the company’s first Chief Marketing Officer role when he recruited Lauren Sella from Mondelēz. Ms. Sella and Mr. Michaels worked together at Mondelēz, where she worked for 14 years, most recently as CMO of Tate’s Bake Shop. Her other roles included Director of Ritz Crackers, Senior Brand Manager of Confectionary Strategy, Brand Manager of Sour Patch and Swedish Fish among other roles.

On the operations side of the business, Mr. Michaels hired CFO Anthony Gruber. Mr. Gruber has extensive CFO experience dating back to 2005 when he became CFO of Montblanc North America. Next he became CFO of Richemont North America in 2014, followed by CFO of LBM Advantage (building materials supplier) in 2018. Most recently, Mr. Gruber was CFO of De’Longhi North America starting in 2019.

According to Eric Des Lauriers, CFA, a Senior Research Analyst at Criag-Hallum, “Following the hire of a new Controller, the CEO/CFO/Controller trio implemented a customer-centric approach to pricing (i.e. understanding competitive shelf price and quality), enabled real-time tracking of input costs, increased efficiency through the capex purchase of a spiral oven, drove gross margins back up from 12% in 2Q FY23 to 28% in the most recent quarter, and perhaps most impressively improved the cash conversion cycle from 16 days in 2Q FY23 to -9 days based on decreases in days inventory and sales outstanding and increases in days payables outstanding.”

Fresh Prepared Foods Category

Fresh prepared foods (FPF) is a category within Deli and the broader Grocery industry. FPFs were a large and high-growth market prior to the pandemic, with sales accelerating 7%-10% year-over-year for the past decade. The market benefited from increased consumer trials during COVID-19 as restaurants shut down, and demand has remained strong after restaurant food service operations have reopened.

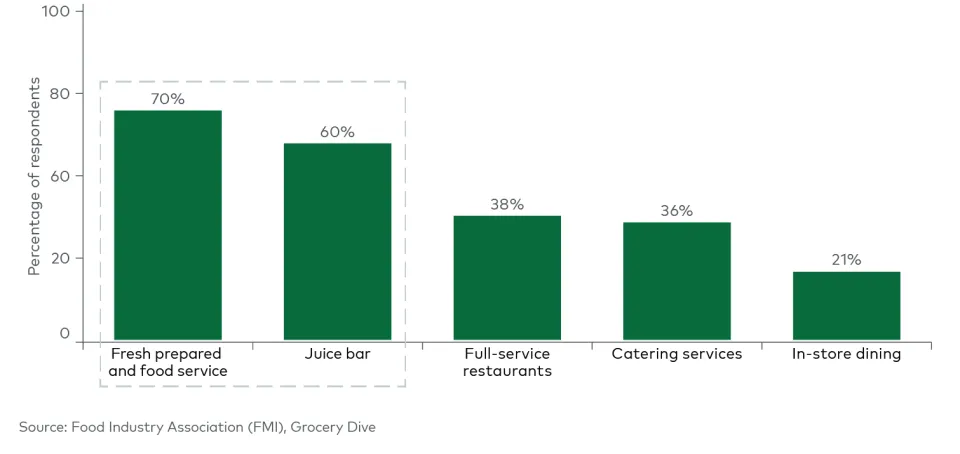

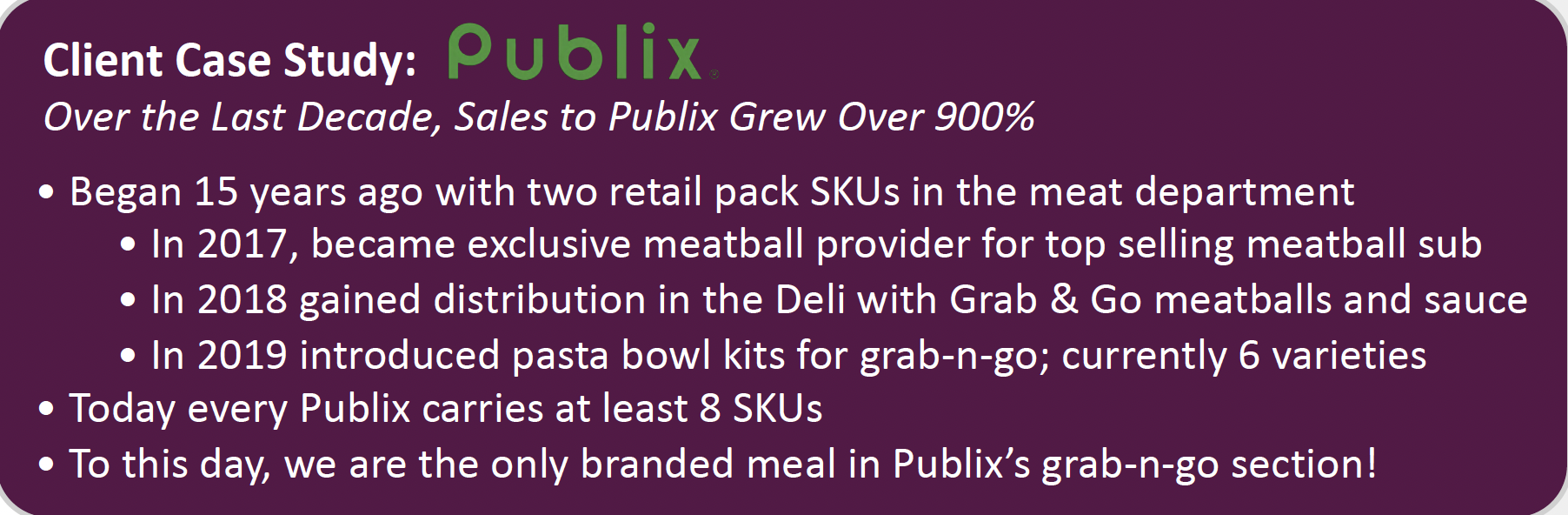

Food retailers citing success with implemented product differentiating strategies (2022):  According to MAMA, Deli is a $45 billion department and one of the fastest growing departments in the store, with many grocers adapting restaurant-like grab-n-go models. Prepared Deli foods, the largest category in Deli, where MAMA is currently positioned, represents a $25 billion market, growing ahead of total Deli and ahead of the total F&B industry. Offering FPF is a way for retailers to compete with Amazon and other ecommerce players. A fresh, hot prepared meal keeps their store footprint relevant and drives traffic by creating a destination for consumers. Consumers have discovered that FPF not only contribute to quick and easy meals, but also provide a chance to extend those meals beyond their cooking comfort zone. FPF-like sushi bars, stir-fry stations and grab-and-go pastas provide access to new cuisines. Pre-made items like ready-to-eat soups, side-dishes and deli salads save time in the kitchen. This is particularly relevant for those working from home who are looking to substitute a restaurant or grab-and-go meal near the office for lunch.

According to MAMA, Deli is a $45 billion department and one of the fastest growing departments in the store, with many grocers adapting restaurant-like grab-n-go models. Prepared Deli foods, the largest category in Deli, where MAMA is currently positioned, represents a $25 billion market, growing ahead of total Deli and ahead of the total F&B industry. Offering FPF is a way for retailers to compete with Amazon and other ecommerce players. A fresh, hot prepared meal keeps their store footprint relevant and drives traffic by creating a destination for consumers. Consumers have discovered that FPF not only contribute to quick and easy meals, but also provide a chance to extend those meals beyond their cooking comfort zone. FPF-like sushi bars, stir-fry stations and grab-and-go pastas provide access to new cuisines. Pre-made items like ready-to-eat soups, side-dishes and deli salads save time in the kitchen. This is particularly relevant for those working from home who are looking to substitute a restaurant or grab-and-go meal near the office for lunch.

One of MAMA’s new products

Grocers have expressed commitment to additional investments in FPF, which will require producers to keep pace. Despite recent growth, the FPF market in the U.S. remains underdeveloped relative to international markets. Retailers in Europe have much better fresh prepared food offerings — a trip to a Tesco grocery store in London during the weekday lunch rush will find you surrounded by people deciding which affordable lunchtime “meal deal” they should try that day. Offerings range from ready-to-eat traditional British fare to ethnic meals to premium soups and salads. Compared to the U.S., online penetration of ready-to-eat meals is much more robust in the U.K.

History

MamaMancini’s Holdings, Inc. was incorporated in July 2009 in Nevada as Mascot Properties, Inc. In February 2010, MamaMancini’s LLC was formed under New Jersey laws. In March 2012, the holders of MamaMancini’s LLC, exchanged 4,700 units for 15 million shares of MamaMancini’s Inc. common stock. In January 2013, Mascot Properties, MamaMancini’s Inc., and David Dreslin, an individual, entered into a reversemerger agreement. The agreement had MamaMancini’s shareholders exchange their shares on a pro-rata basis for a total of 20.1 million shares of common stock. In March 2013, Mascot changed its name to MamaMancini’s Holdings, Inc. Daniel Dougherty (aka Daniel Mancini), who remains active with the company’s brands today, began to earnestly develop a commercial version of his grandmother’s Italian meatballs during 2007.

In 2008, he approached Carl Wolf, the former CEO of Alpine Lace Brands Inc. (a NASDAQ-listed. deli cheese company), with his product idea for MamaMancini’s meatballs. Soon thereafter, a licensing agreement was signed, and the recipe was perfected in Daniel Mancini s test kitchen. After the April 2009 appearance on the Martha Stewart Show with the company s first product, Mancini s Meatballs and Sunday Sauce, MamaMancini’s was selling frozen meatballs online and locally in about 200 supermarkets in New Jersey. With the assistance of a PR firm (The Door), Daniel Mancini further developed brand awareness with press in The New York Times, The Wall Street Journal, The New York Daily News, USA Today and People Magazine, among others. Daniel Mancini also appeared on the TODAY Show s Cooking School series, The Daily Buzz, Mr. Food Access Hollywood LIVE, CBS Local TV and Fox Business News.

Valuation Considerations

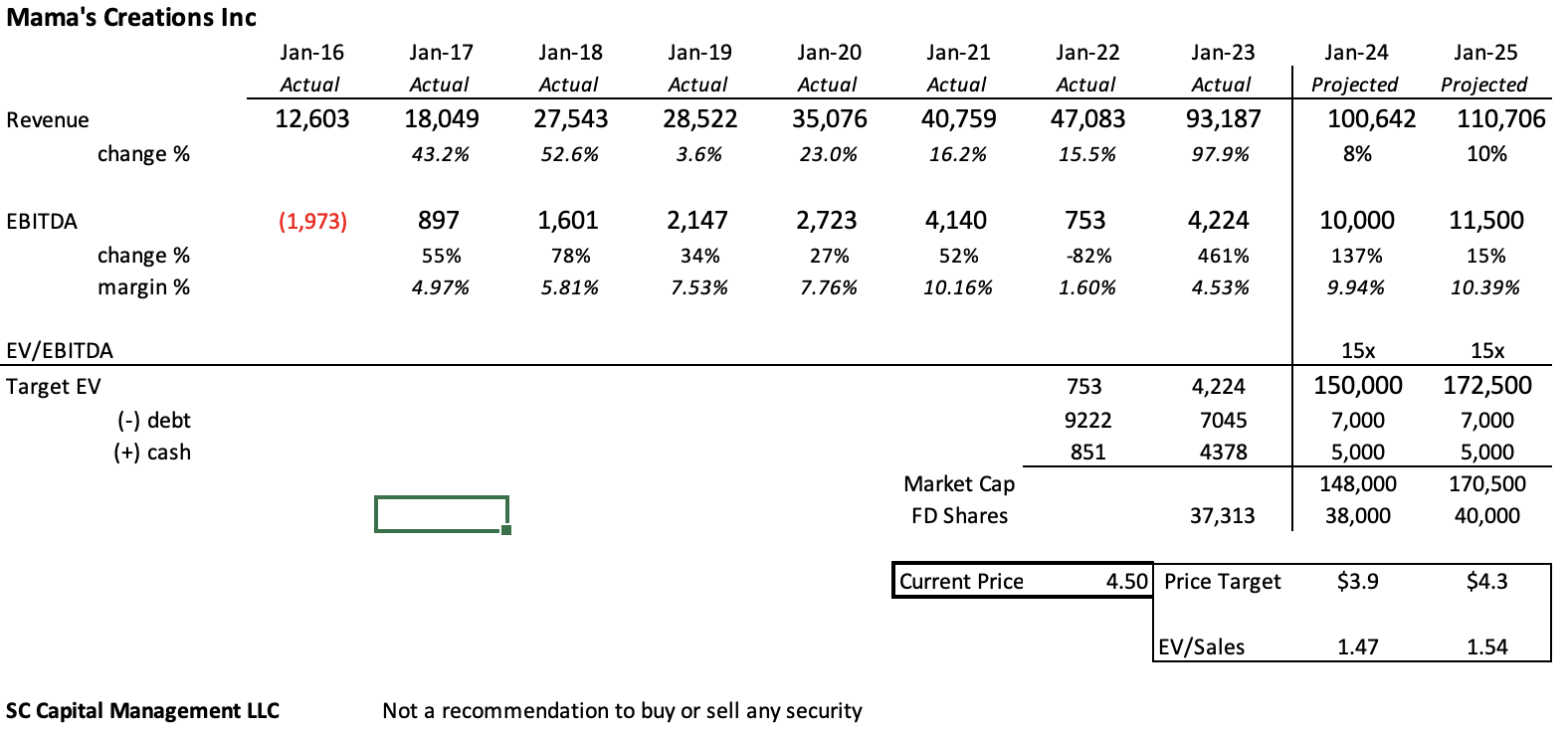

Investors have woken up to MAMA’s earnings power with the share price up over 140% year-to-date. The combination of relatively fast top-line growth and operating leverage is translating into real free cash flow and earnings. The key question is whether the team can delivery higher quality growth via branding initiatives and acquisition integrations once the low hanging fruit of operational improvements runs its course. The next two quarters are likely to deliver answers to these two questions. Investors should observe accretive acquisitions and the trend of improved financial performance.

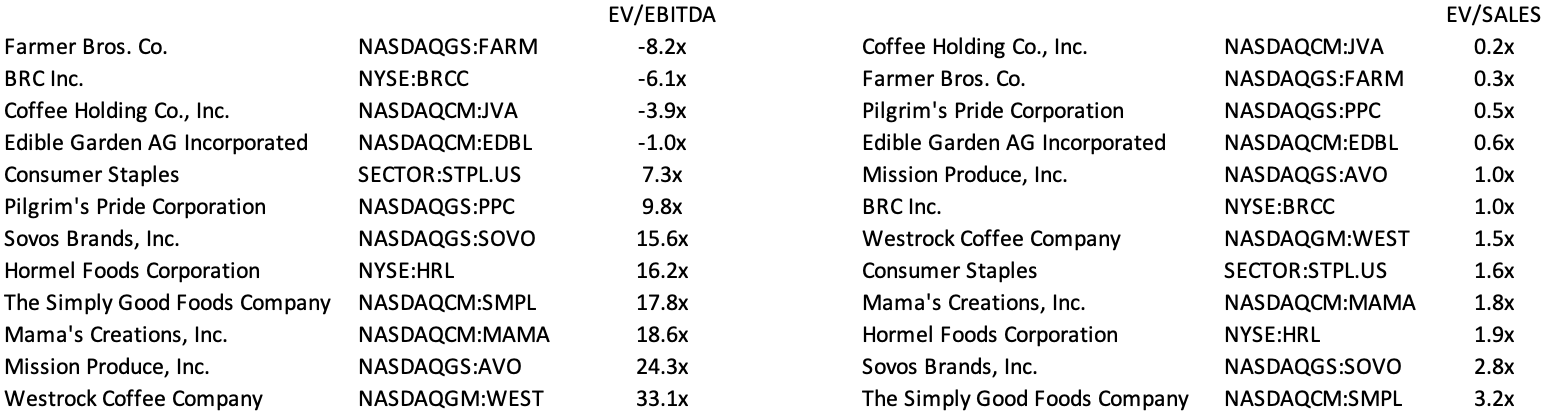

Peer Metrics:

Projecting 10%+/- EBITDA margin and a modest 15% growth rate produces a share price estimate that is fully valued today. This assumes a modest amount of dilution for a potential acquisition and no change to the company’s net debt in the next two years. My estimate of EBITDA differs from the company’s definition, with my estimate coming in more conservative. Even so, this amounts to only 5-10% difference. On an EV/Revenues basis, MAMA is more reasonably valued compared to its peers. The company does not offer EBITDA guidance.

Indirect Competitor Summary: Lifeway Foods, Inc. (LWAY) is a supplier of the probiotic, fermented beverage known as kefir, which is similar to a thin yogurt. In addition to its line of drinkable kefir, the company also produces cheese, probiotic oat milk, and a ProBugs line for kids. In Q2, LWAY’s sales rose 17% yr/yr to $39.2 mln, similar in size to MAMA. Sales in Q2 were primarily driven by higher volumes of its branded drinkable kefir, and to a lesser extent by price increases implemented during 4Q22. Gross margin surged to 28.7% vs 17.0% a year ago, primarily due to higher volumes of its branded products and the favorable impact of milk pricing. In late August, LWAY announced plans to increase cheese production, along with investments in technology that will cut production time by more than half. The idea is to ensure its brand is equipped for future demand as the company seeks to introduce Lifeway Farmer Cheese. Lifeway Farmer Cheese has a flavor similar to cottage cheese, spreads like cream cheese, and has the added benefits of protein and probiotics. Plus, it’s up to 99% lactose-free, gluten-free and contains no added salt, making it lower in sodium than many cottage cheese varieties.

Mr. Michaels is compensated in stock based on CAGR of stock price from appointment. His comp plan isn’t going to be public until the next proxy statement is filed. He purchased approximately $100,000 of stock in the open market when he started at MAMA. Also, total RSU’s outstanding as of July 31, 2023: 407,420 @ $1.40.

In summary, MAMA’s current valuation is rich given the management team’s short history and a lack of visibility on the team’s capacity to find new products to excite consumers – while maintaining margins. That said, any material weakness in the share price would likely be an good entry point for value oriented investors. Looking out towards the end of the decade, I can’t help but think this team is building a niche prepared foods company with strong national brands that translate into superior margins and earnings – just the kind of company that a company like Mondelēz would prefer to buy rather than build itself.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action. You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance. SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied. The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

Leave a Reply