Mama Creation’s Inc

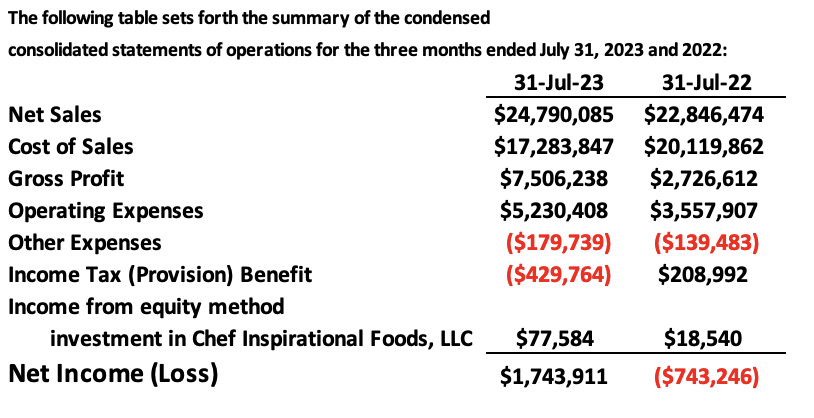

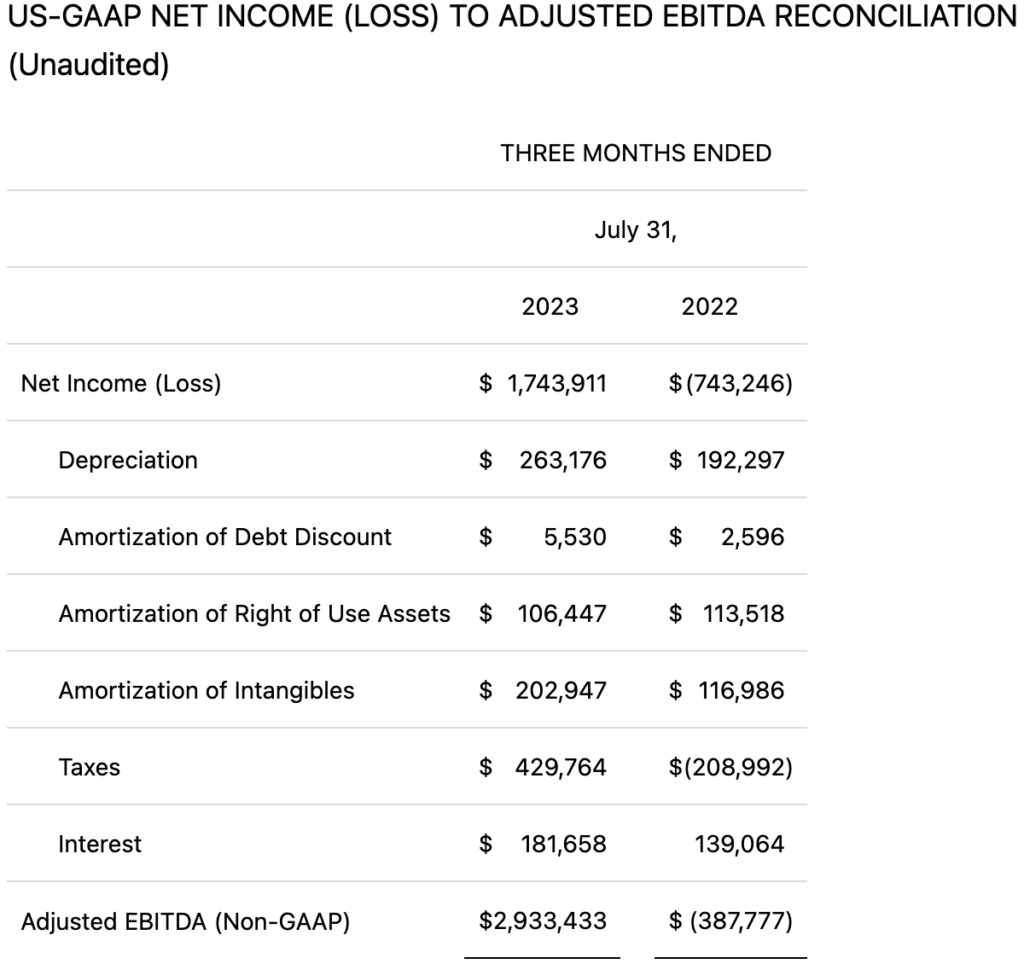

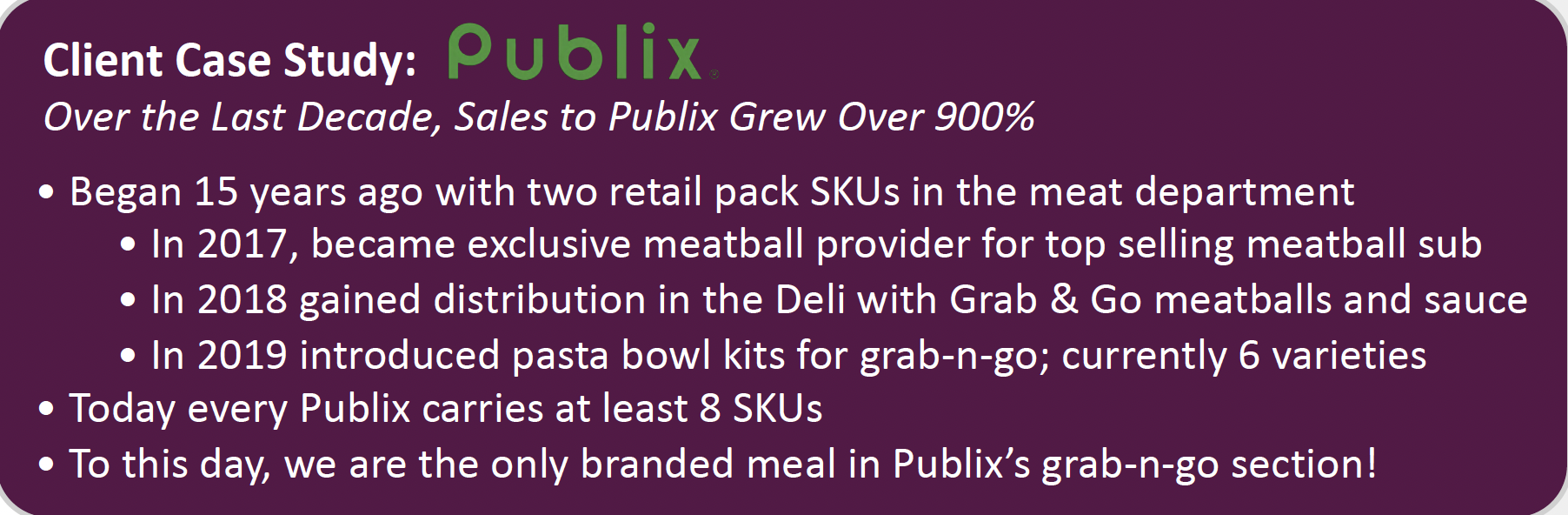

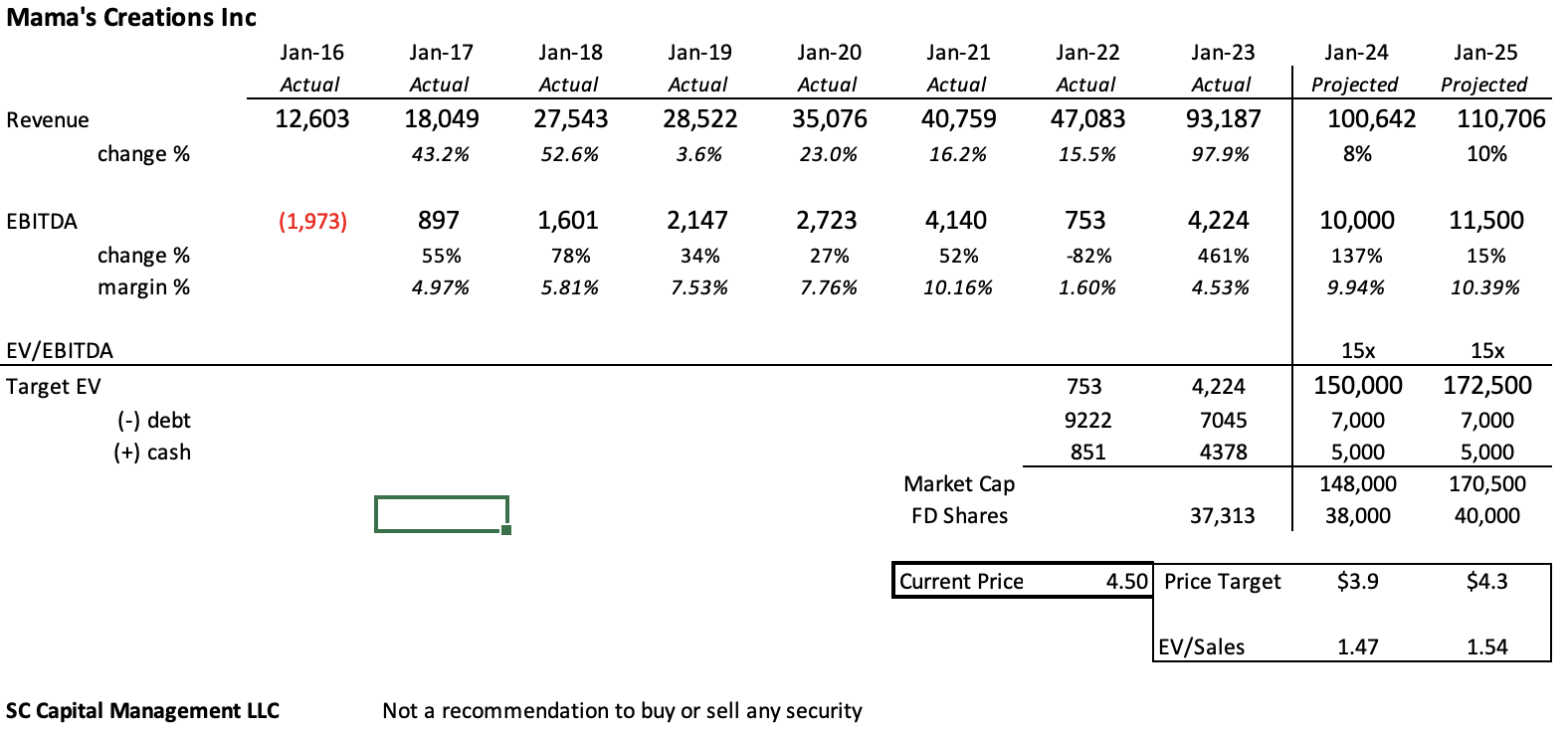

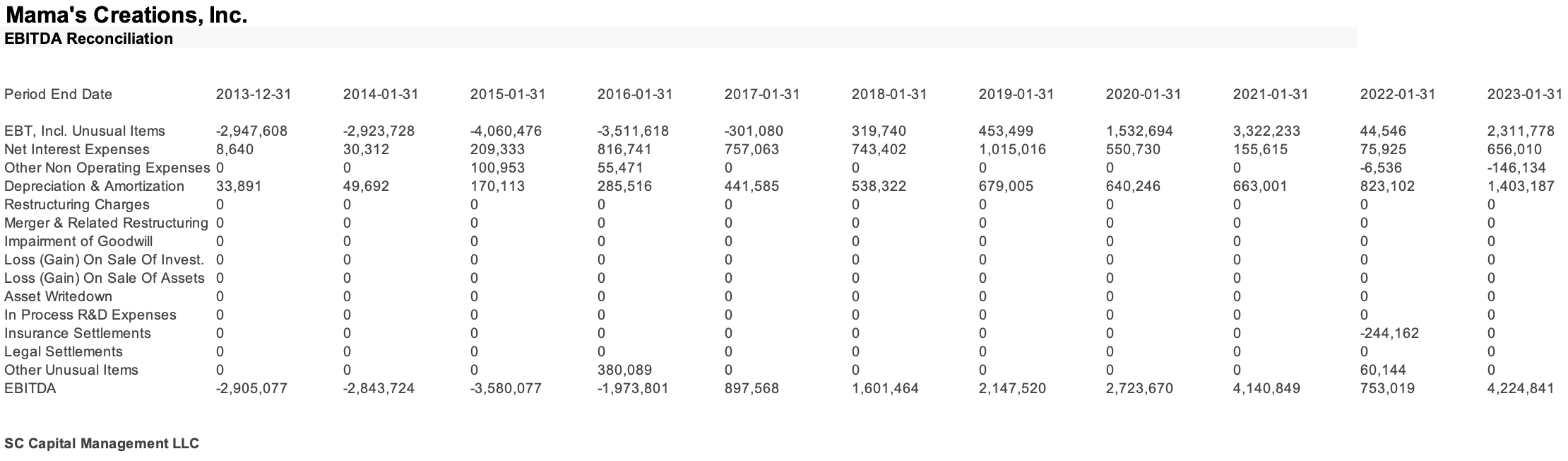

Mama’s Creations, Inc (MAMA) is a micro-cap consumer staples company transitioning from a deep value stage to a growth stage with a new management team, significant industry tailwinds and demonstrated capacity to delivery on positive operating leverage. The company currently is growing well above peers (8% organic vs 4% peers) with accretive acquisitions and superior gross margins (Gross Margin Q2 FY23: 11.9% –> 30.3% Q2 FY24) against the backdrop of a fragmented industry and unfocused competitors. Simultaneously, the company’s financial performance is inflecting from negative to positive with growing earnings, EBITDA and gross margins. This risk/reward opportunity comes with a solid balance sheet, incentivized management and visionary leadership with a track record of success in the consumer/food industry. MAMA has made promises of growth in the past. This appraisal seeks to find what is different this time and whether the current price is worth paying given some significant unknowns. (Note: MAMA’s fiscal year 2024 occurs mostly in 2023 due to its fiscal year-end falling on January 31.)

The challenge for a growth investor wishing to pay value prices is to make an appraisal of a turn-around story like MAMA because, having solved its inconsistent profitability and cash flow problems, the next focus for investors is on the recently-hired management teams’ ability to find advantage in leveraging its brand via expansion and extension options and estimating consumer demand for a tangible product (fresh prepared foods) enriched with intangible attributes (brand). The appraisal problem is even more interesting in the case of valuing brand assets as the market may not be able to accurately value comparable benchmark firms in the first place. The usefulness of relative valuation will be limited if the market does not know exactly how to price certain assets or firms involving complex portfolios of growth options or intangibles, generally, and, in this case, a niche growth industry characterized by market uncertainty for products subject to fluid consumer preferences. In the discrepancy between its current market value and MAMA’s potential to convert marketing investments into financial value lies the promise for uncommon returns.

New CEO & Team

MAMA’s new CEO, Adam Michaels, has a well-articulated vision of how he and his team will actively manage the company’s brands, recognizing its option-like characteristics and how these marketing strategies get converted into value. The CEO’s 2030 vision is to become a one-stop-shop deli solutions provider and generating $1B in revenue, or about 10x 2024 revenues. He joined in September 2022 following nine years at Mondelēz. He served roles including North American Integrated Business Planning Lead, Sr. Director of Forecasting Insights and Analytics, and most recently as VP/Head of Commercial and M&A, NA Ventures. Mr. Michaels earned a BSE in Bioengineering from the University of Pennsylvania and an MBA from Columbia Business School.

Mr. Michaels made reference to his risk posture by stating he does not intend to focus on innovation outside of tight guardrails and prefers to focus inwardly on improving operating leverage. He says, “We don’t want more innovation. But when there is something truly incremental, that’s what we have to go after.” Mr. Michaels has described cross-selling opportunities between the now-integrated businesses as a key source of operating leverage, specifically increasing the average SKUs-per-door metric. I take this to mean his short-term focus is on improving operations – which he has delivered on to date, illustrated here:

Source: Mama’s Creations Inc

Source: Mama’s Creations, Inc

Earlier this year, Mr. Michaels created the company’s first Chief Marketing Officer role when he recruited Lauren Sella from Mondelēz. Ms. Sella and Mr. Michaels worked together at Mondelēz, where she worked for 14 years, most recently as CMO of Tate’s Bake Shop. Her other roles included Director of Ritz Crackers, Senior Brand Manager of Confectionary Strategy, Brand Manager of Sour Patch and Swedish Fish among other roles.

On the operations side of the business, Mr. Michaels hired CFO Anthony Gruber. Mr. Gruber has extensive CFO experience dating back to 2005 when he became CFO of Montblanc North America. Next he became CFO of Richemont North America in 2014, followed by CFO of LBM Advantage (building materials supplier) in 2018. Most recently, Mr. Gruber was CFO of De’Longhi North America starting in 2019.

According to Eric Des Lauriers, CFA, a Senior Research Analyst at Criag-Hallum, “Following the hire of a new Controller, the CEO/CFO/Controller trio implemented a customer-centric approach to pricing (i.e. understanding competitive shelf price and quality), enabled real-time tracking of input costs, increased efficiency through the capex purchase of a spiral oven, drove gross margins back up from 12% in 2Q FY23 to 28% in the most recent quarter, and perhaps most impressively improved the cash conversion cycle from 16 days in 2Q FY23 to -9 days based on decreases in days inventory and sales outstanding and increases in days payables outstanding.”

Fresh Prepared Foods Category

Fresh prepared foods (FPF) is a category within Deli and the broader Grocery industry. FPFs were a large and high-growth market prior to the pandemic, with sales accelerating 7%-10% year-over-year for the past decade. The market benefited from increased consumer trials during COVID-19 as restaurants shut down, and demand has remained strong after restaurant food service operations have reopened.

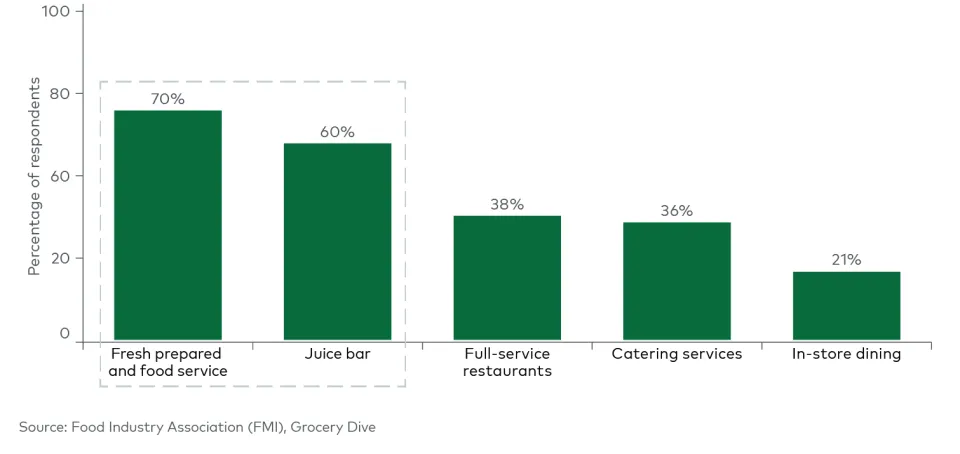

Food retailers citing success with implemented product differentiating strategies (2022):  According to MAMA, Deli is a $45 billion department and one of the fastest growing departments in the store, with many grocers adapting restaurant-like grab-n-go models. Prepared Deli foods, the largest category in Deli, where MAMA is currently positioned, represents a $25 billion market, growing ahead of total Deli and ahead of the total F&B industry. Offering FPF is a way for retailers to compete with Amazon and other ecommerce players. A fresh, hot prepared meal keeps their store footprint relevant and drives traffic by creating a destination for consumers. Consumers have discovered that FPF not only contribute to quick and easy meals, but also provide a chance to extend those meals beyond their cooking comfort zone. FPF-like sushi bars, stir-fry stations and grab-and-go pastas provide access to new cuisines. Pre-made items like ready-to-eat soups, side-dishes and deli salads save time in the kitchen. This is particularly relevant for those working from home who are looking to substitute a restaurant or grab-and-go meal near the office for lunch.

According to MAMA, Deli is a $45 billion department and one of the fastest growing departments in the store, with many grocers adapting restaurant-like grab-n-go models. Prepared Deli foods, the largest category in Deli, where MAMA is currently positioned, represents a $25 billion market, growing ahead of total Deli and ahead of the total F&B industry. Offering FPF is a way for retailers to compete with Amazon and other ecommerce players. A fresh, hot prepared meal keeps their store footprint relevant and drives traffic by creating a destination for consumers. Consumers have discovered that FPF not only contribute to quick and easy meals, but also provide a chance to extend those meals beyond their cooking comfort zone. FPF-like sushi bars, stir-fry stations and grab-and-go pastas provide access to new cuisines. Pre-made items like ready-to-eat soups, side-dishes and deli salads save time in the kitchen. This is particularly relevant for those working from home who are looking to substitute a restaurant or grab-and-go meal near the office for lunch.

One of MAMA’s new products

Grocers have expressed commitment to additional investments in FPF, which will require producers to keep pace. Despite recent growth, the FPF market in the U.S. remains underdeveloped relative to international markets. Retailers in Europe have much better fresh prepared food offerings — a trip to a Tesco grocery store in London during the weekday lunch rush will find you surrounded by people deciding which affordable lunchtime “meal deal” they should try that day. Offerings range from ready-to-eat traditional British fare to ethnic meals to premium soups and salads. Compared to the U.S., online penetration of ready-to-eat meals is much more robust in the U.K.

History

MamaMancini’s Holdings, Inc. was incorporated in July 2009 in Nevada as Mascot Properties, Inc. In February 2010, MamaMancini’s LLC was formed under New Jersey laws. In March 2012, the holders of MamaMancini’s LLC, exchanged 4,700 units for 15 million shares of MamaMancini’s Inc. common stock. In January 2013, Mascot Properties, MamaMancini’s Inc., and David Dreslin, an individual, entered into a reversemerger agreement. The agreement had MamaMancini’s shareholders exchange their shares on a pro-rata basis for a total of 20.1 million shares of common stock. In March 2013, Mascot changed its name to MamaMancini’s Holdings, Inc. Daniel Dougherty (aka Daniel Mancini), who remains active with the company’s brands today, began to earnestly develop a commercial version of his grandmother’s Italian meatballs during 2007.

In 2008, he approached Carl Wolf, the former CEO of Alpine Lace Brands Inc. (a NASDAQ-listed. deli cheese company), with his product idea for MamaMancini’s meatballs. Soon thereafter, a licensing agreement was signed, and the recipe was perfected in Daniel Mancini s test kitchen. After the April 2009 appearance on the Martha Stewart Show with the company s first product, Mancini s Meatballs and Sunday Sauce, MamaMancini’s was selling frozen meatballs online and locally in about 200 supermarkets in New Jersey. With the assistance of a PR firm (The Door), Daniel Mancini further developed brand awareness with press in The New York Times, The Wall Street Journal, The New York Daily News, USA Today and People Magazine, among others. Daniel Mancini also appeared on the TODAY Show s Cooking School series, The Daily Buzz, Mr. Food Access Hollywood LIVE, CBS Local TV and Fox Business News.

Valuation Considerations

Investors have woken up to MAMA’s earnings power with the share price up over 140% year-to-date. The combination of relatively fast top-line growth and operating leverage is translating into real free cash flow and earnings. The key question is whether the team can delivery higher quality growth via branding initiatives and acquisition integrations once the low hanging fruit of operational improvements runs its course. The next two quarters are likely to deliver answers to these two questions. Investors should observe accretive acquisitions and the trend of improved financial performance.

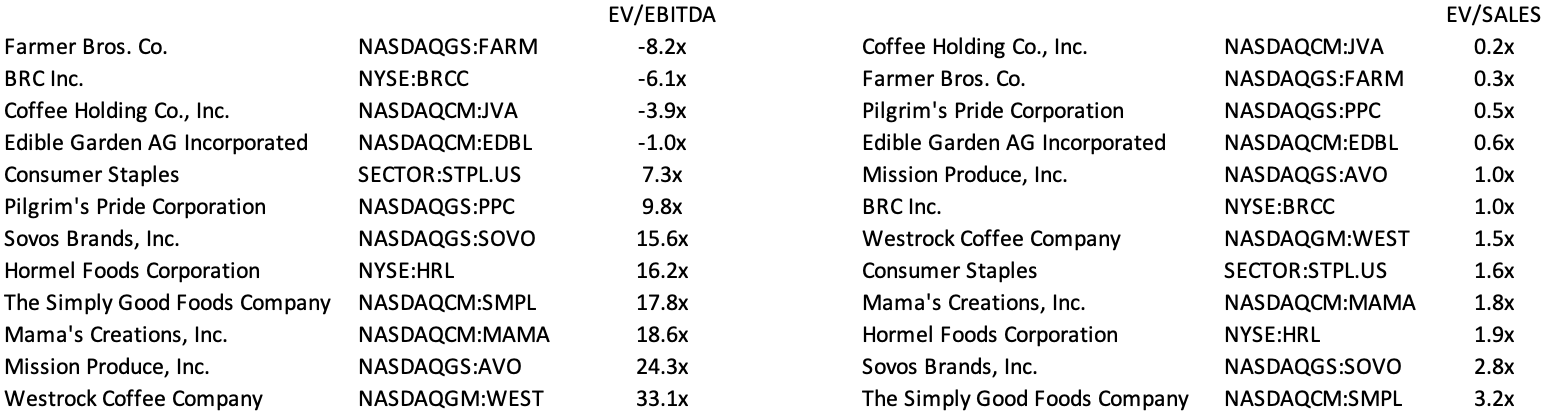

Peer Metrics:

Projecting 10%+/- EBITDA margin and a modest 15% growth rate produces a share price estimate that is fully valued today. This assumes a modest amount of dilution for a potential acquisition and no change to the company’s net debt in the next two years. My estimate of EBITDA differs from the company’s definition, with my estimate coming in more conservative. Even so, this amounts to only 5-10% difference. On an EV/Revenues basis, MAMA is more reasonably valued compared to its peers. The company does not offer EBITDA guidance.

Indirect Competitor Summary: Lifeway Foods, Inc. (LWAY) is a supplier of the probiotic, fermented beverage known as kefir, which is similar to a thin yogurt. In addition to its line of drinkable kefir, the company also produces cheese, probiotic oat milk, and a ProBugs line for kids. In Q2, LWAY’s sales rose 17% yr/yr to $39.2 mln, similar in size to MAMA. Sales in Q2 were primarily driven by higher volumes of its branded drinkable kefir, and to a lesser extent by price increases implemented during 4Q22. Gross margin surged to 28.7% vs 17.0% a year ago, primarily due to higher volumes of its branded products and the favorable impact of milk pricing. In late August, LWAY announced plans to increase cheese production, along with investments in technology that will cut production time by more than half. The idea is to ensure its brand is equipped for future demand as the company seeks to introduce Lifeway Farmer Cheese. Lifeway Farmer Cheese has a flavor similar to cottage cheese, spreads like cream cheese, and has the added benefits of protein and probiotics. Plus, it’s up to 99% lactose-free, gluten-free and contains no added salt, making it lower in sodium than many cottage cheese varieties.

Mr. Michaels is compensated in stock based on CAGR of stock price from appointment. His comp plan isn’t going to be public until the next proxy statement is filed. He purchased approximately $100,000 of stock in the open market when he started at MAMA. Also, total RSU’s outstanding as of July 31, 2023: 407,420 @ $1.40.

In summary, MAMA’s current valuation is rich given the management team’s short history and a lack of visibility on the team’s capacity to find new products to excite consumers – while maintaining margins. That said, any material weakness in the share price would likely be an good entry point for value oriented investors. Looking out towards the end of the decade, I can’t help but think this team is building a niche prepared foods company with strong national brands that translate into superior margins and earnings – just the kind of company that a company like Mondelēz would prefer to buy rather than build itself.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action. You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance. SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied. The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

Hello Neat post Theres an issue together with your site in internet explorer would check this IE still is the marketplace chief and a large element of other folks will leave out your magnificent writing due to this problem

먹튀검증 완료 안전한 메이저 토토사이트 리스트를 확인하세요. https://mtverify.com/

Somebody essentially lend a hand to make significantly articles I’d state. That is the very first time I frequented your website page and up to now? I surprised with the research you made to make this actual submit amazing. Wonderful task!

Simons Chase | Mama Creation’s Inc

xchjhopf http://www.gf406m254gwwc4exi006iqk7h28795gvs.org/

[url=http://www.gf406m254gwwc4exi006iqk7h28795gvs.org/]uxchjhopf[/url]

axchjhopf

Cork Rubber Sheet

cheap Miri Cut Out Knit Beach Dress Blue

inoxbaoyen.com

Mens Crossbody Bag

Non-Asbestos Jointing Sheets

Sling Bag Men

Men Messenger Bag

cheap Mirror Mirror Costume

cheap Mira Beach Dress in Cream

cheap Mini Sequin Skirt Black

ブランドスーパーコピー

Cork Sheet

Soft Mica Sheet

cheap Mind Melter UV Reactive Rainbow Hand Fan

Crossbody Bags Men

Leather Backpack Men

Hard Mica Sheet

Dual Power Bike

Convert Road Bike To Tubeless

buy cheap “Good Stock” Cow Bloomers Outfit

環境に優しいライフスタイル

Flax Packing with Grease

buy cheap “Good Things” Smiley Check Bloomers Outfit

特別な日

buy cheap “Good Things” Smiley Check Outfit

Carbonized Packing Reinforced with Nickel Wire

スタイル

Plastic Film Rewinding Machine

buy cheap “Good Times Come” Bell Bottoms Outfit

Carbonized Fiber Packing with Graphite

さりげなく品のあるディテールが、あなたの個性を引き立てる��

Plastic Machinery Equipment

Glass Fiber Packing with Silicone Rubber Core

トレンド感が光る秋冬スタイル

Plastic Heater Machine

buy cheap “Happy Birthday” Gingham Ruffle Dress

Asbestos Packing with PTFE Impregnation

http://www.kmedvedev.ru

Non-Asbestos Latex Paper

秋のフォトウォーク

Nitrous Switch Panel

buy cheap One-Shoulder Sleeveless Midi Dress

buy cheap One-Shoulder Split Maxi Dress

Asbestos Rubber Sheets

Rocker Panel Switch

Super Fast Car Charger

Asbestos Rubber Sheet With Wire Net Strengthening

buy cheap One-Shoulder Sleeveless Dress

Auxiliary Fuse Box

http://www.basvandeberg.nl

温もりを感じる

家族と一緒に

Oil-Resistance Asbestos Rubber Sheets

buy cheap Olivia Girls High Low Dress – White

Universal Car Charger

季節の色

Acid-Resistance Rubber Sheets

buy cheap Olivia Girls Pearl & Diamante Headpiece

Braided Packing

Glass Prp Tube

PTFE Gaskets

Rubber Gaskets

http://www.budmor.pl

Mineral Fiber Rubber Gaskets

Prp Tube

free shipping clothing women's boots for fall K Rolita Couture X RW Cow Fringe Wrap Top affordable style offers low-cost fashion under $90 Same Day Delivery

人気バッグランキング

おしゃれの基準

exclusive fashion sales eco-friendly clothing for women K Rolita Couture X RW Hazard Bath Butterfly Chain Top online fashion coupons best buys under $100 Shop Online Near Me

10ml Prp Tube

ファッション小物が決め手

未来のスタイル

ブランドバッグ

Prp Centrifuge Machine

High Concentration Prp

secure online shopping seasonal fashion trends K Rolita Couture X RW Hazard Bath Assassin Underboob Top trending sale items seasonal sales under $60 In-Store Pickup

stylish outfits on a budget trendy accessories for women K Rolita Couture X RW Black Fringe Bottoms budget-friendly clothing budget-friendly outfits under $25 everyday outfits for less

White POM C Acetal Material Plastic Rod

fast shipping fashion men's athletic wear K Rolita Couture X RW Cow Fringe Bottoms limited time fashion deals must-have items under $70 Local Stores

먹튀검증커뮤니티 전문가들이 꼼꼼하게 검증한 안전한 토토사이트를 소개합니다. 안심하고 베팅하세요. 먹튀오프: https://offhd.com/

Apron Front Kitchen Sink

Bronze Filled PTFE

Farm Sink Kitchen 33

Farmhouse Apron Sink

PTFE

trendy clothing for less winter outfits for men K Reign Check Shacket Khaki seasonal fashion promo clearance items under $50 Fast Shipping

how to buy outfits women's outfits K Resting Witch Face Graphic Zip-Up Hoodie fashion for sale under $20 clothing trendy apparel online

radyoyayini.com

Road Ready Golf Cart

stylish outfits on a budget trendy accessories for women K Reign Check Shacket Neutral budget-friendly clothing budget-friendly outfits under $25 Free Returns

Aluminum Oxide filled PTFE

コーディネート

日本製

PTFE Pigmented

Stainless steel Filled PTFE

思い出を作る

新しい体験

心温まる時間

how to buy outfits women's outfits K Recharge Scuba Hoodie Jacket fashion for sale under $20 clothing Fast Shipping

best places to shop for fashion trendy men's outfits K Retro Ice Rink Rendevouz Faux Fur Collared Coat online shopping promo trendy outfits under $40 In-Store Pickup

Farm Sink Kitchen

40% Bronze Filled PTFE Rod Bar

Affordable men's CHANEL Resin Pearl Crystal Ramses Jewels Drop Earrings Gold Blue new collection Under $150 tax-free

Solar Energy Generator

Price Of Solar

60% Bronze Powder Filled PTFE Moulded sheet

Best Price red HERMES 18K Rose Gold TPM Farandole Stud Earrings must-have Under $140 best quality

Best Price medium CHANEL Lambskin Chain Crystal CC Star Chain Hoop Earrings Gold Black best price Under $190 best quality

40% Bronze Powder Filled PTFE Moulded sheet

2.5 Kw Solar System

人気ブランドをチェック

Best Price red VAN CLEEF & ARPELS 18K Yellow Gold Mother of Pearl Vintage Alhambra Earrings latest style Under $130 best quality

How to buy women's DAVID YURMAN Sterling Silver 18K Rose Gold Diamond Morganite Prasiolite Citrine Novella Y Necklace review under $80 free shipping

Residential Solar Energy Systems

スタイリング

ブランドバッグ

ブランドバッグ

60% Bronze Filled PTFE Rod Bar

55% Bronze with 5% MoS2 filled PTFE Tube

arkbaria.xsrv.jp

Solar Inverter System For Home

cheap Thanksgiving outfits KS Black & Amber Sparkle Tulle Dress ideas male under $90 unique gifts near me

where to buy costumes KS Black & Blue Stripe Little Cop Romper for guys under $100 quality apparel

Wholesale Market

where to buy christmas outfits KS Black “The Boo Crew” Shirt for Girl under $100 eco-friendly clothing

Toy Supply Chain

シンプル

トレンドのハイウエストジーンズ

Original Cheap red GUCCI Metal Acetate Horsebit Print Round Frame Sunglasses GG0894S White Brown best price under $100 fast delivery

Aluminum Honeycomb Panels Marine

yamaai.yamanoha.jp

Honeycomb Sheets 4×8 Supplier

Basic style kammprofile gaskets

cheap outfits KS Black “The Boo Crew” Romper 2024 under $90 fashion sales

basic style kammprofile gaskets

Nuclear spiral wound gasket

Kammprofile gasket with integral outer ring

トレンド

あなたの手元に優雅さを添える、シンプルで飽きのこない美しさ��

Toy Cooperation Partner

ブランドバッグ

Graphite Gasket Reinforced with Metal mesh

How to buy women's CHANEL 31 Rue Cambon Paris Medallion Chain Bracelet Gold promo code under $100 free shipping

ブランドスーパーコピー

Hand Spot Welder

Cheap Authentic black HERMES 18K Yellow Gold H Cufflinks promo code best deal customer reviews

Mica for Thermal-Protection

Cage Spot Welding Machine

Original Cheap medium CHANEL Baguette Crystal Quilted CC Pendant Necklace Gold promo code Under $120 fast delivery

Dc Spot Welding Machine

How to buy gold FENDI Metal FF Hoop Earrings Gold Silver best price Under $190 free shipping

Best Price medium TIFFANY Platinum 18K Yellow Gold Yellow Diamond Floret Key Pendant must-have budget-friendly best quality

Brass Terminal Spot Welding Machine

Spot Welding Machine Dn 25

Mica Laminate & Mica Washer

http://www.kmu.ac.th

Mica Insulator

Mica Roll

Mica Heating Elements

MACHINE FOR SPIRALl WOUND GASKET RING AND STRIP

FULL AUTOMATIC CAMPROFILE GROOVING GASKET MAKING MACHINE

French Terry Shorts

BRONZED FILLED WITH PTFE TUBE

duhockorea.net

Affordable Luxury Bags women LOUIS VUITTON Calfskin New Wave Chain PM Scarlet sale Under $120 vintage

Mens Polyester Shorts

Cheap Authentic Handbags mini LOUIS VUITTON Empreinte Pochette Felicie Chain Wallet Cognac black Under $100

Best Deals on Designer Bags genuine leather HERMES Veau Doblis Constance 18 Rose Indienne promo code Under $110 with chain

Shop Discounted Luxury Bags white GUCCI Calfskin Matelasse Small GG Marmont Chain Shoulder Bag White vintage Under $190 free shipping outlet

ブランドスーパーコピー

FULL AUTOMATIC KAMMPROFILE GROOVING GASKET MAKING MACHINE

Tapered Sweatpants

Workout Shorts

BLACK CARBON FILLED PTFE TUBE

Yoga Shorts

How to Shop Smart light VALENTINO GARAVANI Grained Calfskin Onyx Guitar Strap Rockstud Rolling Shoulder Flap Messenger Bag Soft Noisette suede bag Under $140 usa

Best Price red LOUIS VUITTON Calfskin Selene Short Strap Brown must-have low price best quality

Where to buy men's HERMES Suede Goatskin Mens Alessandro Moccasin Loafers 39 Havane for sale Under $150 near me

CAS NO 507-20-0

Oval Ring Joint Gasket

Cheap Authentic black CHANEL Acetate Square Sunglasses 5509-A Black new collection Under $140 customer reviews

1.2-dichloroisobutanedich loroisobutane

Trimethylchloromethane

http://www.china.ningborotary.com

Methallyl alcohol

Viton rubber sheet

Nitrile Rubber

ブランドスーパーコピー

Where to buy men's HERMES Epsom Calvi Duo Card Case latest style Under $160 near me

china Nitrile Rubber sipplier

Affordable men's CHANEL Pearl CC Sunglasses 71498-A Black new collection affordable tax-free

Octagonal Ring Joint Gasket

chloride Chlorotrimethylmethane

Best Deals on Designer Bags brown HERMES Epsom Mini Bearn Wallet Jaune Ambre bag price Under $130 usa

Affordable Luxury Handbags for Sale mini HERMES Taurillon Clemence Kelly Shoulder Strap Rouge Venetian for sale Under $120 vintage

Led Floodlight 400w

Ceramic Fiber Gasket

Solar Street Light Supplier

How to Shop Smart women SAINT LAURENT Crepe Satin Elba Espadrilles 38.5 Black black Under $160 price list

Shop Discounted Luxury Bags men's LOUIS VUITTON Damier Ebene Brazza Wallet for sale Under $100 with chain

400w Led Floodlight

Led Canopy Lights For Petrol Station

Gas Station Lights Led Canopy

kammprofile gaskets

Spiral Wound Gaskets

beta.carrara.poznan.pl

Get the Best Price on Luxury Bags dark brown CHANEL Caviar Chevron Quilted Large Cosmetic Case Navy bag price Under $150 outlet

JACKETED GASKETS

ブランドスーパーコピー

Graphite Gaskets

Magnificent beat ! I would like to apprentice while you amend your site, how can i subscribe for a blog web site? The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast offered bright clear idea

3021 3025 Phenolic Cotton&Paper Laminated Sheet

korchambiz.blueweb.co.kr

Shop Affordable Designer Replicas mini BURBERRY Derby Calfskin House Check Medium Banner Tote Limestone for sale Under $120 with chain

Pom Acetal Copolymer Plastic Sheet

Non Woven Fabric Uses

Magnet Assembly Factory

Where to buy white CHANEL Lambskin Quilted Pearl Small Flap Lilac promo code Under $100 near me

3021 Phenolic Paper Laminated Insulation Sheet

How to Find Cheap Authentic Bags dark brown CHRISTIAN DIOR Patent Cannage Medium Lady Dior Rose Clair bag price Under $150 usa

Non Woven Textile

Best Replica Bags for Sale women LOEWE Jacquard Anagram Calfskin Luna Bag Tan Pecan baguette Under $140 ophidia

Original Cheap women's CHRISTIAN DIOR Oblique Saddle Belt Bag Blue black Under $200 free shipping outlet

Brown 4ftx8ft Phenolic Paper Laminated Sheet

ブランドスーパーコピー

Backsheet

3021&3025 Phenolic Cotton&Paper Laminate Sheet

King Magnet Suppliers

Online product deals ugg us Bogs, Women's B-Moc II Waterproof Boot – Charcoal 'new season' under $200 only a few left

Type D Flange Insulation Gasket Kits

Discounted online shopping ugg nightengale slippers Bogs, Boys' Neo Classic Spooky Winter Boot – Grey 'special deals' under $160 online best prices

10000w Scooter

VCS Very Critical Service Flange Insulation Gasket Kit

Type E Flange Insulation Gasket Kits

ブランドスーパーコピー

Type F Flange Insulation Gasket Kits

Electrico Patinete

How to buy discounted ugg boots cheap uk Bogs, Men's Arcata Urban Lace Up Waterproof Boot- Black 'best offer' under $190 free shipping worldwide

http://www.faarte.com.br

Electric Scooter Price

Cheap price deals ugg wellingtons Bogs, Girls' Classic Rainbow Waterproof Boot – Black 'best discounts' under $170 popular deals

Neoprene Faced Plain Phenolic Flange Insulation Gasket Kit

Get deals on ugg elissa boots Bogs, Kids' Arcata Tonal Camo Waterproof Boot 'free returns' under $180 order today

Patinetes Electricos Nuevos

Trotineta Electrica 100km

Where to shop for best deals ugg classic short chestnut SoftMoc, Botte haute d'équitation FREYDIS, cognac, femmes 'hot product deals' under $80 online store deals

Mica Tube

Tungsten Strongest Metal

Best online shopping offers kids ugg SoftMoc, Botte haute d'équitation FREYDIS, noir, femmes 'today’s hot sale' under $140 exclusive online discounts

Buy online ugg plumdale boots SoftMoc, Sandale décontractée GRACELYNN, multi, femmes 'special deals online' under $70 online holiday sales

Tungsten Carbide Price

Mica Tape

ブランドスーパーコピー

Tungstene

1kg Tungsten

Tungsten Carbide Dies

Buy cheap tan ugg boots SoftMoc, Sandale décontractée GRACELYNN, cognac, femmes 'big price drops' under $110 special offer today

Mica Paper

Mica Roll

Where to shop ugg sizes SoftMoc, Sandale décontractée GRACELYNN, noir, femmes 'online sales' under $80 clearance offers

Mica Plate

http://www.famlight.eu

Discounted items cheap ugg boots uk online UGG, Kids' Tasman II Slipper – Chestnut 'online store' under $100 seasonal sale

How to shop ugg australia sale online Converse, Converse, Women's Chuck Taylor All Star Leather Hi Top Sneaker – Black Mono 'promotions' under $90 quick and fast shipping

PEEK

ブランドスーパーコピー

ABS Sheet

Gas Hotplate With Oven

Processing Product

ABS

Best offers for chestnut ugg boots UGG, Girl's Cozy II Sheepskin Slipper – Chestnut 'buy now' under $140 fast shipping

http://www.zuoshi.com

gas iron

Automatic Gas Stove 5 Burner

PTFE ROD

Buy now ugg slippers for kids sale Converse, Converse, Women's Chuck Taylor All Star Leather Hi Top Sneaker – Black 'high quality deals' under $150 best e-commerce deals

gas hob india

Cocina 4 Hornillas

How to get ugg boots chestnut mens sale Converse, Converse, Women's Chuck Taylor All Star Leather Hi Top Sneaker – White 'limited-time deals' under $140 top discounts online

ブランドスーパーコピー

santoivo.com.br

Discounted online shopping ugg shoes sale Timberland, Timberland, Sandale à talon ALLINGTON HEIGHTS, noir, femmes 'exclusive collection' under $160 clearance offers

Electrical Distribution Board

Get deals on ugg boots for sale uk Timberland, Timberland, Basket à lacets LAUREL COURT PLATFORM, violet, femmes 'instant savings' under $180 limited edition offers

Expanded Teflon Gasket Sheet

Double Pole Mcb

Double Pole Mcb

PV Combiner Box

Food grade rubber gasket

oil-resisting rubber gasket

Elcb Switch

Cheap price deals ugg snow boots sale Timberland, Timberland, Sandale décontractée CLAIREMONT WAY, noir, femmes 'deal of the day' under $170 best price shopping

How to buy discounted ugg winter boots Timberland, Timberland, Chaussure de randonnée MOTION ACCESS LOW, noir, hommes 'price drop' under $190 special offer today

Neoprene rubber gasket

Online product deals genuine uggs uk Timberland, Timberland, Sandale à lanières croisées CLAIRMONT WAY, rouge foncé, femmes 'special deals' under $200 discounted goods

Nitrile rubber gasket

Plain Softcat

Get cheap ugg sale uk Crocs, Jibbitz Spooky Scary Fairytale Creatures 5 Pack 'price cuts' under $160 low price discounts

Guillotine Packing Ring Cutter

Buy online ugg style boots Crocs, Jibbitz Mickey Xmas 5 Pack 'shop today' under $70 special offer today

RUBBER SHEETING

ブランドスーパーコピー

Plaster On The Wound

Multi Angle Anvill Cutter For Gasket and Trim

Wound Dressing Bandage

Polydioxanone Monofilament

How to find ugg kensington boots Crocs, Jibbitz Bluey 5 Pack 'latest styles' under $170 shop fast

Discounted prices ugg boots uk sale Crocs, Jibbitz Barbie 2 5 Pack 'top-rated items' under $150 best product deals

Best way to buy ugg boot sale Crocs, Jibbitz Space Cadet 5 Pack 'affordable shopping' under $190 online holiday sales

Packing Tool Set

http://www.saidii.co.kr

NATURAL RUBBER SHEETING

Easy Aesthetic Paintings

Graphite Sheet with Metal Mesh

Bow Spring Centralizers

Positive Bow Spring Centralizer

Cable Protector Installation

http://www.kawai-kanyu.com.hk

Rubber Seal Strip

Expanded PTFE Sheet

Downhole Centralizer

Where to shop for cheap pink uggs Skechers, Baskets hautes FUNKY STREET SING OUT LOUD, blanc rouge, femmes 'free shipping on orders' under $180 exclusive discounts

Buy authentic items cheap ugg slippers on sale Skechers, Baskets à lacets ROLLING STONES UNO, blanc rouge, femmes 'upcoming sale' under $170 hot items

Best online shopping deals ugg boots for men Skechers, Baskets UNO HIGHLIGHT LOVE, blanc multi, femmes 'special offers' under $190 free returns

ブランドスーパーコピー

Modified PTFE Sheet

Hinged Bow Spring Centralizer

Find best discounts genuine ugg boots uk Skechers, Baskets TRES-AIR UNO – REVOLUTION-AIRY, noir, hommes 'seasonal promotions' under $60 new in store

How to find discounts ugg roslynn Skechers, Baskets ARCH FIT ARCADE MEET YA THERE, taupe, femmes 'popular shopping' under $90 easy returns

Modified Yellow PTFE Gasket Sheet with Silica

Somebody essentially lend a hand to make significantly posts I might state That is the very first time I frequented your web page and up to now I surprised with the research you made to create this particular put up amazing Excellent job

Buy cheap online deals ugg boots cheap Kamik, Girls' Powdery 2 Waterproof Winter Boot – Charcoal 'exclusive products' under $120 online promotions

Childrens Night Light

High Temperature Resistance Bakelite Rod

Phenolic cotton cloth laminated sheets

Find affordable products mens ugg boots Kamik, Girls' Powdery 2 Waterproof Winter Boot – White 'best shopping' under $60 online shopping

Soft Night Light

ブランドスーパーコピー

Sonic Night Lamp

Brown 3273 Phenolic Cotton Laminated Bar

Phenolic Cloth Laminate Rod 3025 10 Yarn

Buy authentic for less ugg kensington Kamik, Girls' Powdery 3 Waterproof Winter Boot – Black 'flash sale' under $70 best customer service

http://www.bilu.com.pl

Diameter 16mm Phenolic Cotton Rod

Shop for cheap deals cheap ugg boots uk Kamik, Girls' Powdery 3 Waterproof Winter Boot – White 'low prices' under $100 storewide discounts

Best deals for shopping ugg bags Kamik, Girls' Powdery 3 Waterproof Winter Boot – Charcoal 'clearance prices' under $200 early bird deals

Motion Activated Night Light

Bedroom Light

Furthermore, the more recently introduced I f channel inhibition has hardly been adopted dapoxetina comprar online

Hi i think that i saw you visited my web site thus i came to Return the favore Im attempting to find things to enhance my siteI suppose its ok to use a few of your ideas

Just wish to say your article is as surprising The clearness in your post is just cool and i could assume youre an expert on this subject Fine with your permission allow me to grab your RSS feed to keep updated with forthcoming post Thanks a million and please keep up the enjoyable work

Find the best product deals cheap uggs online Puma, Espadrille PUMA JADA BLEACH, blanc rose, filles 'top value products' under $150 secure payment

Cork Rubber Sheet

Automatic Screen Changer Belts

Where to find cheap products ugg austrailia Puma, Baskets PACER FUTURE ALLURE, blanc argent, femmes 'online sales' under $170 easy returns

2 Inch Welded Wire Mesh

Buy products online for cheap toddler uggs Puma, Baskets PACER FUTURE ALLURE, noir or, femmes 'special deals online' under $160 online store

ブランドスーパーコピー

Oil Resisting Synthetic Fiber Sheet

Holland Dutch Weave Mesh

Best online shopping offers sequin uggs Puma, Baskets SOFTRIDE ENZO EVO, blanc noir rouge, hommes 'affordable items' under $140 new in store

13mm Welded Mesh

Mesh For Plastic Filtration

http://www.plot28.com

silicone rubber sheet

Cork Rubber Sheet

Find affordable shopping cheap uggs for sale Puma, Baskets à lacets VIKKY 3.0, brume mauve prune blanc, femmes 'latest promotions' under $180 local delivery

Reinforced Synthetic Fiber Beater Sheet

Just wish to say your article is as surprising The clearness in your post is just cool and i could assume youre an expert on this subject Fine with your permission allow me to grab your RSS feed to keep updated with forthcoming post Thanks a million and please keep up the enjoyable work

Electric Truck

CHINAFull Automatic Camprofile Grooving Gasket Making Machine SUPPLIER

Second Hand Car

china Spiral Wound Gasket Metal Ring Bending Machine supplier

http://www.alphacut.jp

ブランドスーパーコピー

Best deal for ugg boots women pink sale Converse, Espadrille BOULEVARD 2V, nose blanc noir, bébés 'top picks online' under $60 bulk purchase discounts

Get cheap ugg australia classic short sale Converse, Espadrilles CT ALL STAR AXEL, indigo marine, bébés 'must-see' under $160 limited time promotion

CHINA Full Automatic Camprofile Grooving Gasket Making Machine MANUFACTURE

How to purchase ugg boots sale chestnut color Converse, Espadrille CHUCK TAYLOR ALL STAR, noir, bébés 'exclusive offers online' under $140 trending products online

china Spiral Wound Gasket Metal Ring Bending Machine manufacture

Electric Fuel

Second Hand Cars

Spiral Wound Gasket Metal Ring Bending Machine

Where to get ugg boots for sale uk clearance Converse, Baskets CHUCK TAYLOR ALL STAR PIRATES COVE, blanc rouge noir, tout-petits 'shopping spree' under $200 best discount deals

Dongfeng Suv

Get the best price ugg australia sale 2024 Converse, Baskets CHUCK TAYLOR ALL STAR 1V CREATURE CHARACTER, souris, bébé 'best online shopping' under $50 quick processing

Fendi bags under $100 Leading brand Fendi O'Lock Phone Pouch In Calf Leather Yellow Flash sale under $200 online exclusive

ブランドスーパーコピー

Thermostatic Bath Filler Shower Set

http://www.evosports.kr

Fendi deals Competitive rates Fendi First Sight Pouch In Calf Leather Apricot Price drop under $70 great offers

Nitrile Rubber Sheet

Fendi sale Best performance products Fendi First Sight Pouch In Calf Leather Green Clearance sale under $60 VIP deals

Brushed Gold Thermostatic Shower

Square Shower

White Nitrile Rubber Sheet

Exposed Thermostatic Shower

Cork Rubber Sheet

Fendi online Stylish & durable Fendi Baguette Pouch with Chain In FF Motif Fabric Brown Burgundy Hot deal under $50 special promotions

Fendi outlet Affordable elegance Fendi Medium Flat Clutch In FF Motif Fabric Brown Black Coupon code under $190 bulk discounts

Neoprene Cork Rubber Gasket Sheets

Nitrile Rubber Sheeting

Concealed Electric Shower

Container House Luxury Prefabricated

Find best prices ugg slipper sale Crocs, Crocs, Kids' Peppa Pig Classic EVA Comfort Clog – Blue Multi 'instant savings' under $100 limited time offer

How to buy new ugg boots Skechers, Skechers, Baskets à lumières FLEX GLOW BOLT, noir lime, garçons 'big markdowns' under $200 limited online offers

Where to buy ugg boots classic short Skechers, Skechers, Baskets à lumières S-LIGHTS FLEX-GLOW BOLT, noir rouge, bébés 'top product picks' under $190 cheap online shopping

Buy cheap online uggs bailey button Timberland, Women's Skyla Bay 6″ Boot – Wheat 'price drop' under $120 buy one get one free

Office Desk Chair

Ark House Builder

Foldable Shelf

Siberian Ginseng Powder

10% POB Filled PTFE Tefon Tube

arsnova.com.ua

ブランドスーパーコピー

Soft Fibration PTFE Sealing Sheet

Neoprene Rubber Superior Sealing Cork Rubber Sheet

Anti-static Rubber Sheet Pad

Buy quality cheap ugg classic tall black Crocs, Crocs, Women's Overpuff Moc Comfort Clog – Black Black 'price drop' under $110 exclusive products

Nitrile Rubber Bonded Cork Sheet

Your blog has quickly become my go-to source for reliable information and thought-provoking commentary. I’m constantly recommending it to friends and colleagues. Keep up the excellent work!

I was recommended this website by my cousin I am not sure whether this post is written by him as nobody else know such detailed about my trouble You are amazing Thanks

Asbestos Rubber Sheet With Wire Net Strengthening

Harness Connector

Connector Expert

Cheap Authentic ugg womens boots pink sale SoftMoc, Women's Mera Chelsea Boot – Black 'top product picks' under $170 fast delivery deals

Tyco Amp

Tyco Amp

Oil-Resistance Asbestos Rubber Sheets

ブランドスーパーコピー

mbautospa.pl

How to buy ugg classic mini sale uk SoftMoc, Women's Maisie Casual Sandal – Tan 'new arrivals shopping' under $200 limited time sales

Original Cheap ugg tall boots classic short SoftMoc, Women's Marti Slide Sandal – White 'big markdowns' under $180 fast payment options

Electrical Quick Connect

Asbestos Latex Sheet

Buy now ugg bailey button boots clearance SoftMoc, Women's Marianne Slide Sandal – White 'shop best deals' under $150 trending product deals

Acid-Resistance Rubber Sheets

Asbestos Rubber Sheets

How to find best discounts ugg black friday boots 2024 SoftMoc, Women's Marti Slide Sandal – Tan 'exclusive bargains' under $50 best online promotions

Ar201 Opc Drum

Toner Powder For Printers And Copiers

Molded PTFE Sheet Gasket

Cheap price deals ugg tall boots chestnut sale SoftMoc, SoftMocs YGRITTE, caribou, femmes 'clearance deals' under $170 great offers

ブランドスーパーコピー

saidii.co.kr

Best buys for cheap ugg boots sale uk clearance SoftMoc, Women's 11526 SoftMocs – Natural 'online promotions' under $100 fast payment options

1000 Toner

Discounted online shopping ugg boots black sale women SoftMoc, SoftMocs YGRITTE, châtain, femmes 'latest items' under $160 VIP deals

Get deals on ugg mens chestnut sale SoftMoc, Botte imperméable végane WYNDY 05, gris, femmes 'great value deals' under $180 holiday gifts

Toner Supplier

Cheap online shopping deals ugg boots red sale SoftMoc, Women's 11526 SoftMocs – Dark Tan 'deal hunter' under $150 best rated items

White Silicone Rubber Sheet

PTFE Skived Sheets

Molded PTFE Sheet Gaskets

Dr3100 Opc Drum

PTFE Skived Sheet