Here Is The Only Public Company With Direct Exposure To The RPA Industry

Blue Prism PLC (“BP”) is among three leaders in an emerging robotics process automation (RPA) niche industry that, along with other more mature SaaS/Cloud enterprise software firms, is pioneering the “re-platforming” of enterprises, across a wide swath of industries, through automation and the surfacing of new data sets that were not available just five years ago.

These new data sets resist mean reversion because the discoveries between data and actions were previously too quanderous for humans to perceive or were simply impossible to discern and diffuse. Embedded inside this niche industry and company is the full potential for AI to draw lessons from its own experience – unlike traditional software that can only extend human actions (deterministic) – and the fast-emerging capacity to translate basic human reasoning into business logic (probabilistic) for machines. Absorbing this new technology into organizational values and practices presents challenges, but they are fast melting away against the payback profiles for RPA deployments that can be measured in terms of months or less and the trend towards more task-oriented entry points for first-touch applications that are low-risk, high-value automations.

BP’s connected-RPA SaaS offering provides large enterprises with an intelligent digital workforce (software robots) capable of self-learning and continuous improvement, empowering users to automate billions of transactions while returning hundreds of millions of hours of work back into the business. Enhancing productivity using easy graphical user interface (GUI) forms and dashboards makes this technology accessible by business users who lack deep programming skills and would otherwise require complex application development in Python or R (ie. data scientists). This type of automation employs robots to control the triggering, orchestration, execution, and termination of manual tasks often across business operations’ system boundaries. By pairing business workers with a nimble easy-to-deploy technology, businesses keep initiatives cost-effective during periods of expansion (revenues captured) and contraction (costs saved). BP pioneered RPA, which has become the fastest growing segment of the enterprise software industry, according to Gartner. Today, BP is the only publicly-traded company with direct exposure to RPA. North America continues to dominate the RPA software market, with a 51% share in 2018, followed by Western Europe, while Japan came in third, with adoption growth of 124% in 2018. BP has offices in 15 countries and sells into 67 countries.

Mihir Shukla, the CEO and co-founder of Automation Anywhere (a BP competitor), describes the industry as: “RPA is a technology that allows you to type on any application, read any application screens, apply set of rules, and with artificial intelligence make decisions. What it means is that bots can operate any software application in the world because it is able to do what any human being is able to do except making judgment calls. And when you think about it, banks, insurance companies, logistic companies, have thousands and thousands of people sitting in cubicles doing something, and not everybody is making a judgment call. That’s why, with RPA, and for the first time ever, you are able to automate this vast amount of work.”

In 2017, BP was named one of MIT Tech Review’s 50 Smartest Companies and was the winner of the UK Tech Awards. Another point to consider is RPA’s price and talent advantage for not being a “Bay Area” technology. The current market leader is a private company (UiPath) that originated out of Romania, and BP (the #2 player) is based in the UK.

Summary Metrics and GTM

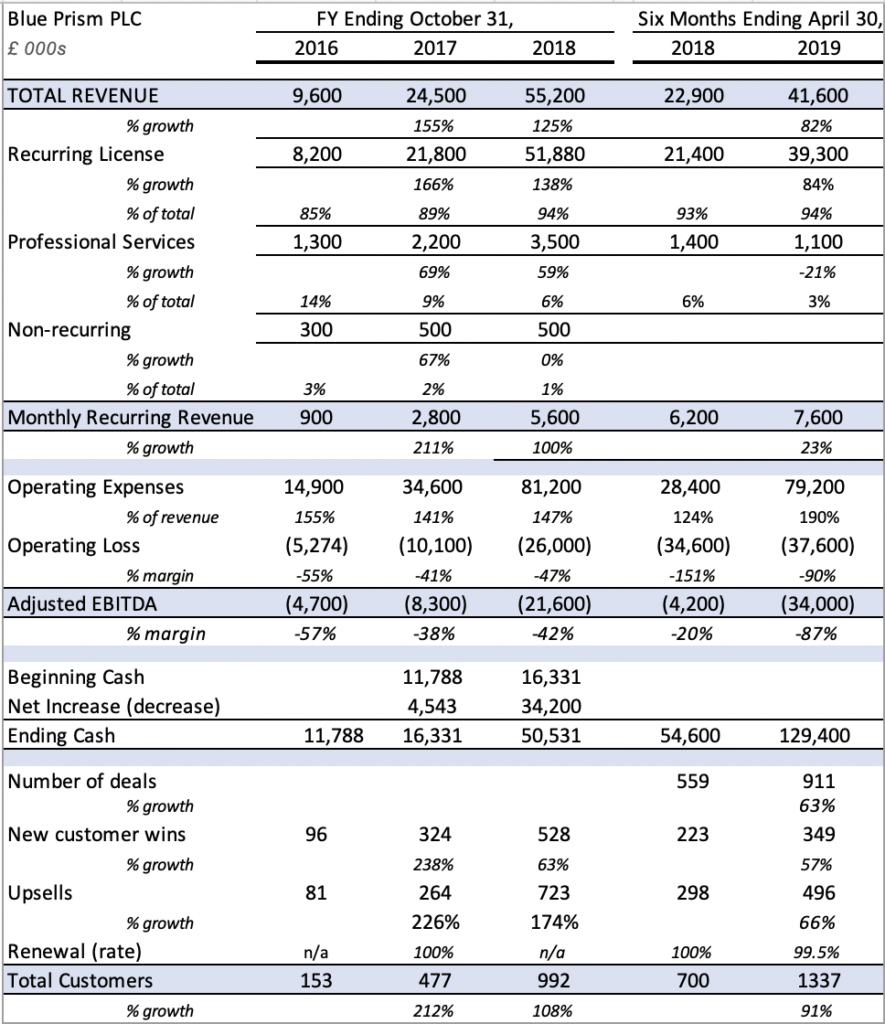

The company grew revenues in the most recent 6-month period (ending April 30, 2019) by 82% and has a 4-year CAGR of 108% (2015-2018). Recurring license revenue represents more than 90% of revenue. BP has experienced negative cash flows and has raised funds through secondary offerings to fund growth initiates and acquisitions.

BP employs a “land and expand” sales strategy to land customers with a small deal, and then sell into the organization to expand its footprint to more seats and additional departments. This strategy was expanded recently with the launch of a new Digital Exchange (DX) platform. DX increased the rate of customer acquisition at the expense of near-term initial deal sizes, with a corresponding near-term reduction in the MRR growth rate. The platform is for customers, partners and others who want to consume capabilities of the digital worker in smaller increments (and via credit card payment if necessary). DX simplifies the on-ramp for larger digital transformation. It also enables suppliers to provide their content into a digital exchange so that customers can use their services rapidly. This brings the producers and the consumers together on a single platform. BP’s success with up sells and retention rates is expected to drive improved sales efficiency next year when these new customers gain an understanding of the economics and expand the use of of BP’s technology.

In terms of large enterprise customers, the company sells solutions through technology alliance partners and independent software vendors (ISVs) that create software to enable productivity for the digital workers inside enterprises. Global solution integrators such as EY, Deloitte, KPMG and Accenture bring these capabilities into the market as well as consult. These partners have built entire practices around intelligence automation or digital transformation, and they have BP people within the practices, thus bringing BP into the largest organizations without the need for a large direct sales force. Other ISVs provide RPA as a service, such as platform and managed services providers.

The RPA space is experiencing rapid development beyond the recent trend towards smaller entry-level deal sizes at the task level. It has evolved from an on-premise based license model to a managed services or cloud-based model that is tethered to the broader transition towards enterprise hybrid and cloud computing. And as back-office automation scales towards ubiquity, AI is expanding the technology’s potential in front-office settings – and this is where RPA is scratching on the surface at the heart of the firm’s value. Today, IT departments spend most of their budget on maintaining and updating processes and systems, rather than focusing on new initiatives; this leaves organizations vulnerable to competitors who can innovate faster and in ways unique to the industry and firm. FOMO is therefore an element in the rapid adoption of RPA. The future is connected RPA, which leverages RPA in conjunction with AI machine learning capabilities and leveraging it with business processes that are typically dependent on other applications. It is this connected value that will drive RPA into the next generation. Today, BP has an AI engine for building connectors to advanced AI tools from Amazon, Google, IBM, and other AI platforms.

Some of BP’s 1,300 customers:

The company serves a diverse number of industries including: financial services, health & life sciences, media & tech, hospitality and industrial & manufacturing.

Products

BP is a SaaS licensing company. It sells its Connected-RPA product to large enterprise customers via ISVs and other venders. Its new Digital Exchange (DX) product, designed for the mid-tear enterprise customer, is easier and cheaper in terms of initial launch of services for smaller more tactical deployments. It allows users to ‘drag and drop’ content from the DX, improve usability, and increase the speed of third-party development created by an ecosystem of technology partnerships such as ABBYY and Google. Several use cases for an initial point of attack is to optimize at the task level. This could include digital customer acquisition and customer churn. From there, the path parallels “full stack” deployment for end-to-end robotics control and measurement across many functional areas.

Products and solutions are as varied as the industries served – plasticity is key. BP is built on the Microsoft .NET Framework and it can automate any application and support any platform.

Here is BP’s RPA impact with a typical large enterprise insurance provider:

· New business – Improve straight-through processing and life insurance upgrades by combining Digital Workers, such as software robots, and social data to analyze patterns for refined underwriting strategy.

· Policy administration – Automate updates to personal bank details and reject or cancel policies with delinquencies by learning delinquency patterns. This can help insurers avoid policy drop outs.

· Claims – Automate first notice of loss (FNOL) submissions into various systems, and provide notifications to loss adjusters by continually assessing risk, predicting fraud and identifying thefts.

· Digital mailroom operations – Use optical character recognition (OCR) and intelligent character recognition (ICR) to digitize the handwritten, semi-structured data to lower the cost of paper-based customer interactions.

· Cognitive virtual assistants – These can improve customer experience while lowering cost of operations and acquisition across voice, chat and social media channels.

The industries that are strongest adopters have the most compelling specific use cases. Fannie Mae has used BP’s RPA platform to automate a review and notification process within its mortgage operations area. Mashreq worked with BP to automate multiple functions, including banking operations, compliance, customer care and help desk operations. In the healthcare industry, Ascension Health has used BP’s RPA technology for back-office functions, and to manage the licensure and certification of clinicians.

According to BP, the economics relative to traditional low-cost offshoring are compelling. While an onshore FTE costing $80K can be replaced by an offshore FTE for $30K, a robot developed with the BP toolkit can perform the same function for $15K or less – without the drawbacks of managing and training offshore labor.

Who is adopting automation?

Thoughtonomy Acquisition

In June of 2019, BP agreed to purchase Thoughtonomy with an aggregate consideration of up to $100m (on a cash free debt free basis). The transaction contemplates approximately $21m in cash outlays over time (18 months out) with the balance payable in newly-issued common shares (two years out).

Thoughtonomy is a SaaSx-based product and cloud services business that combines BP’s RPA platform alongside additional embedded and integrated artificial intelligence (AI) and cloud capabilities, including Computer Vision, Natural Language Processing and Machine Learning to provide a cloud-based, on-demand, intelligent automation platform. Additional features include ready-to use channel interfaces such as chatbots and web-forms and an integrated AI-enabled digital workforce manager. The two companies have years of cooperative operating history.

This acquisition combines the power of BP’s connectedRPA platform with a fully integrated suite of AI and RPA capabilities without the overhead of setting up a dedicated infrastructure to support the program. Thoughtonomy’s offering builds on and extends BP’s Digital Exchange, making it easier for BP users to access AI capabilities. Finally, Thoughtonomy’s well placed position in financial services further drives BP’s RPA adoption in this key market.

Thoughtonomy is expected to expand BP’s market coverage in three ways. First is access to the mid-tier enterprise, which is the next wave of growth for automation, specifically for BP’s connected RPA strategy. Mid-tier companies don’t have a lot of infrastructure on their premises and can’t afford to accommodate the same amount of infrastructure that a larger firm can. Thus a cloud-based solution is important for this market. Second, mid-tier organizations like packaged automation capabilities, unlike larger enterprises that seek choice and customization. While larger enterprises prefer to pick from multiple vendors for features such as OCR, AI and others, mid-tier firms want all the AI and RPA capabilities bundled into an easy-to-deploy package. The third important aspect of synergy from Thoughtonomy is the company’s relationship with Microsoft, which itself has been targeting mid-tier enterprises.

The company expects results from the acquisition to accrete after twelve months. The near-term impact is: $2-3m in revenue, 77 direct customers and $800k in MRR. Also, the acquisition will to eliminate Thoughtonomy’s mildly competitive offering.

Market Opportunity

The RPA industry was estimated to be $1.7b in 2018 and is expected to grow to $4.3b in 2022.

The total addressable RPA market is $50 billion, according to a recent evaluation from management consulting company Zinnov. The Zinnov report also predicts rapid growth, with RPA spend increasing by 37% a year, hitting $11 billion by 2024, and it estimates the worldwide talent pool has increased to 210,000 in 2019. The industry is new and evolving, so it is worth considering TAM estimates relative to software in general. The annual enterprise software space is worth approximately $400 billion and has a 2018 growth rate of 9.3%. Cloud penetration is approximately 33% across all industries, and the migration from on-premise to cloud often provides the catalyst for process re-evaluation and new technology implementation that leverages RPA. So I’m assuming RPA can achieve 10% of annual enterprise software spend in the coming years.

Competition

Gartner describes the RPA leaders as BP, UiPath and Automation Anywhere in its new RPA Magic Quadrant.

Last April, UIPath, a Romanian company, raised $568 million in a series D round of funding at a $7 billion valuation, led by hedge fund Coatue Management, with participation from Alphabet’s CapitalG, Sequoia, Accel, Madrona Venture Group, IVP, Dragoneer, Wellington, Sands Capital, and funds advised by T. Rowe Price & Associates. : TechCrunch → the firm traded at a rich private market valuation of 15x revenue.

UiPath is reported to have grown recurring revenue from $1 million to $100 million is less than two years between 2015-2017. UiPath’s $225 million Series C valued the business at $3 billion, according to PitchBook. UiPath is likely planning a 2020 IPO.

And last year, Automation Anywhere raised $300 million from SoftBank at a $2.6 billion valuation.

Secondary players include a fragmented collection of startups and early-stage ventures, as follows (according to Gartner):

Challengers

Niche players

Visionaries

Ownership

Significant holders of BP include Merian Global Investors UK (13%), Abrams Bison Investments (9%), Oppenheimer (4%) and Fidelity (4.3%) and CEO Alastair Bathgate (6.3%).

Valuation

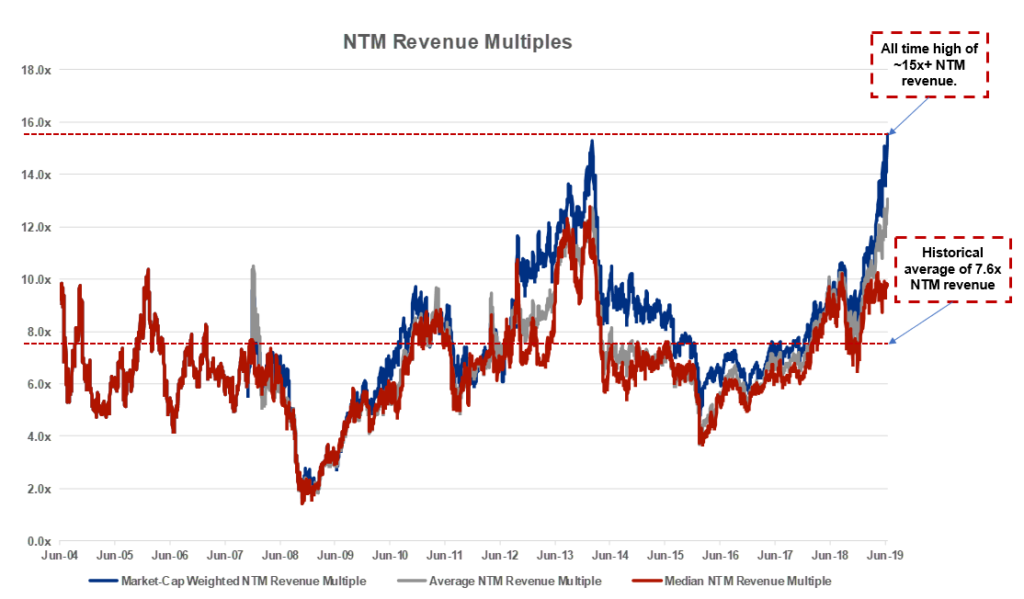

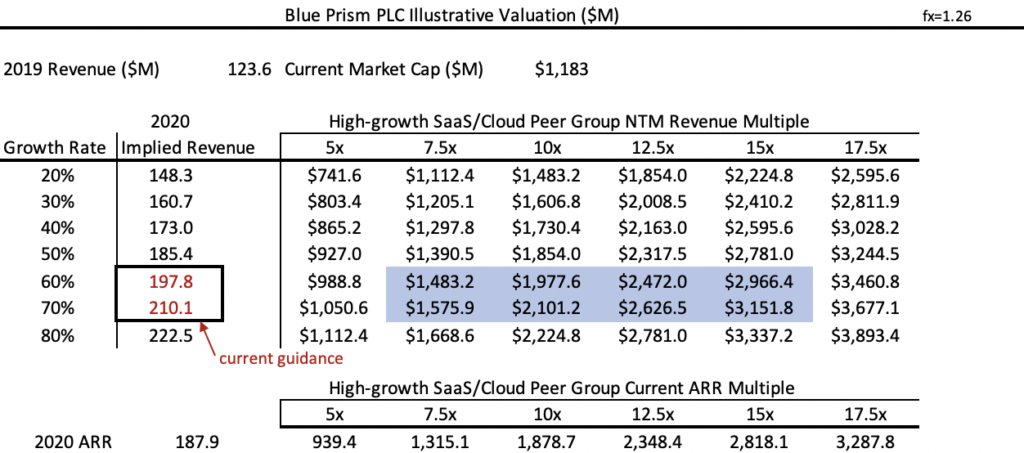

BP’s peer group is the high growth SaaS/Cloud universe of companies. My analysis includes 16 companies that filed S-1s in 2018, compiled by Alex Clayton, and the overall industry valuation applies to the larger SaaS/Cloud universe of publicly traded companies. These 16 companies make up the public enterprise cloud computing companies that have been tearing through a giant wave of IPOs and M&A activity. These companies are experiencing high growth rates, and, like BP, have little or no free cash flow. This makes valuation based on a multiple of next twelve months’ revenue (NTM) or annual recurring revenue for 2020 the most relevant metric. Currently, the universe is selling at an all-time high of 15x NTM revenue.

On the acquisition front, Red Hat, Ultimate Software and Mulesoft were the largest. Most recent is Salesforce’s acquisition of Tableau at 8x (@ 18% guided growth rate) in 2019. Recent business combinations include Cloudera/Hubspot and Twilio/SendGrid.

Here are the 16 SaaS logos:

Here is the trend in terms of historical multiple for a broad universe of cloud companies:

In terms of forward revenue growth, the public enterprise software company’s growth rates among the recent IPOs are averaging 26%.

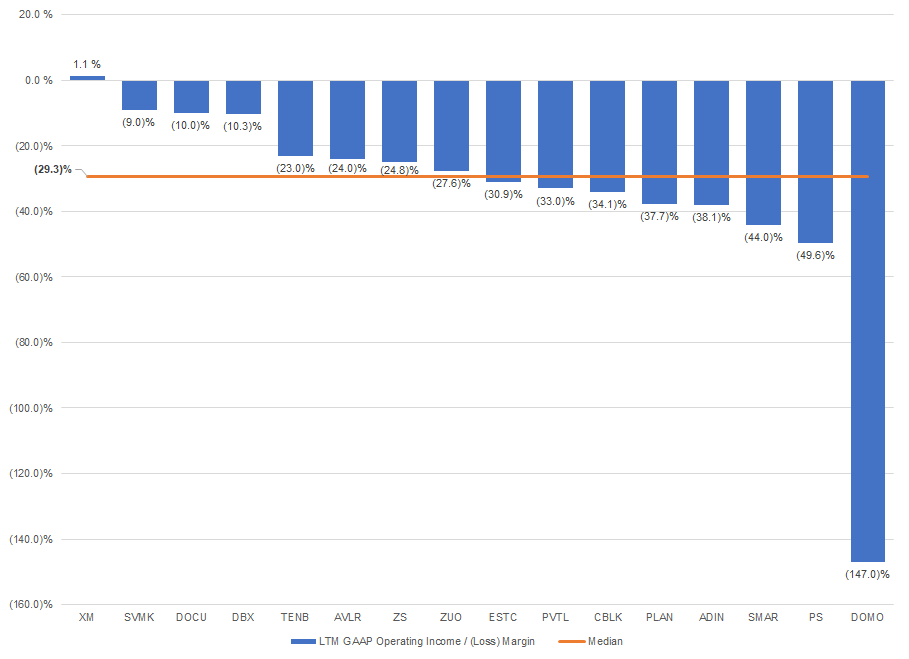

Public market valuations for BP’s peer group favor top line growth over EBITDA performance as the majority of recent peer group IPOs have massive negative operating margins and expanding valuation multiples.

Losses are endemic….

BP’s near-term sacrifice in terms of sales efficiency as it ramps its workforce, pricing options and acquisition velocity has caused its multiple decline to 5.5x, far below its peers, yet its superior, multi-year growth rate remains far higher than its public market peers. Applying the current average multiple range of 7.6-15x to BP’s 2020 revenue projection indicates that the company is currently undervalued in a range of 128-250% relative to its peers.

The catalysts for expanding BP’s current high-growth performance include: continued traction in the strategic U.S market geography; Thoughtonomy’s customer base, technology and access to business in the mid-tear market; and improved sales efficiency driven by current investments in: human capital to support growth, sales force expansion towards higher touch sales, and pricing changes towards smaller more tactical pricing options for new customers that will yield higher sales next year.

Key stats:

- The universe is selling at an all-time high of 15x NTM revenue with a historical average of 7.6;

- Salesforce’s acquisition of Tableau at 8x (@ 18% guided growth rate) in 2019 —> compared this to BP’s 108% CAGR and +80% growth rate in the most recent 6-month period.

- In terms of forward revenue growth, the 16 recent IPO public enterprise software companies’ growth rates are averaging 26%, again —> compared this to BP’s 108% CAGR and +80% growth rate in the most recent 6-month period;

- Industry leader UiPath traded at a private market valuation of 15x in 2019 in line with general private market over valuations.

The ideas presented in this post do not constitute a recommendation to buy or sell any security.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

How does Blue Prism compare with UI Path and the other private companies? What are its revenues now and its growth rate. I understand that UI Path is up to $400 million in sales by July-up from $155 million in 2018 and $300 million last year. Can you send me the word doc or PDF of the article above. For some reason , I could not print it. Thank you. Best, Michael

May I simply say what a relief to uncover an individual who really understands

what they are discussing online. You certainly know how

to bring a problem to light and make it important.

A lot more people must look at this and understand this

side of the story. I was surprised that you are not more popular given that you certainly possess

the gift.