Facebook’s Conduct Shows Not All Network Effect Are Positive

Network effects are a much-cited economic construct applied to market concentration and increasing returns for strategies pursued by some leading tech companies.

This dynamic economic agent is also known as demand side economies of scale. W. Brian Arthur, the economist credited with first developing the theory, described the condition of increasing returns as a game of strategic positioning and building up a user base to the point where “lock in” of dominant players occurs. Companies able to tap network effects have been rewarded with huge valuations and highly defensible businesses.

But what about negative network effects? What if the same dynamic applies to the U.S.’s pay-to-play political industry where the government promotes or approves of something through a policy, subsidy or financial guarantee due to private sector influence. Benefits accrue only to the purchaser of the network effects, and consumers, induced by the false signal of large network size, ultimately suffer from asymmetric risk and experience what I’m calling a loss of intangible net worth for each additional member after the “bandwagon” wares off. If this were the case, then you would see companies experience rapid revenue growth (out of line with traditional asset leverage models), executives accumulating huge fortunes and political campaign coffers swelling. But the most striking feature would be the anti-social outcomes, the ones not available without the instant critical mass of government-supported network effects, the ones that, at scale, monetize a society’s intangible net worth.

Network effects can be earned or purchased, weak or strong, offensive or defensive, but they are always powerful. It’s why they are pursued with such vigor. Take the case of Facebook, a company considered to be a textbook case of massive value created with network effects. Yet there are persistent questions about Facebook’s impact on society. One data point to consider concerns leaked documents that describe how the social network shared psychological insights on young people with advertisers. According to reports dating back to 2016, Facebook told Australian advertisers it can identify teens feeling “insecure” and “worthless” stemming from such things as body confidence and weight loss. In the marketing world, this segment is called vulnerable narcissists – and these are among the most emotionally vulnerable in society including, “high schoolers, college students and young working Australians and New Zealanders.” Facebook is described as having the capacity to monitor posts and photos in real time to determine when young people feel “stressed”, “defeated”, “overwhelmed”, “anxious”, “nervous”, “stupid”, “silly”, “useless” and a “failure.” Exploiting emotional vulnerability for profit can certainly be considered a sociopathic targeting of intangible well-being. Consider this: A New, More Rigorous Study Confirms: The More You Use Facebook, the Worse You Feel

Today, this all sounds like familiar conduct for Facebook. Starting with Cambridge Analytica, the political consulting firm that did work for the Trump campaign and harvested raw data from up to 87 million Facebook profiles, the social media company has been under constant attack in recent years for issues ranging from massive privacy violations to political interference from nefarious Russians.

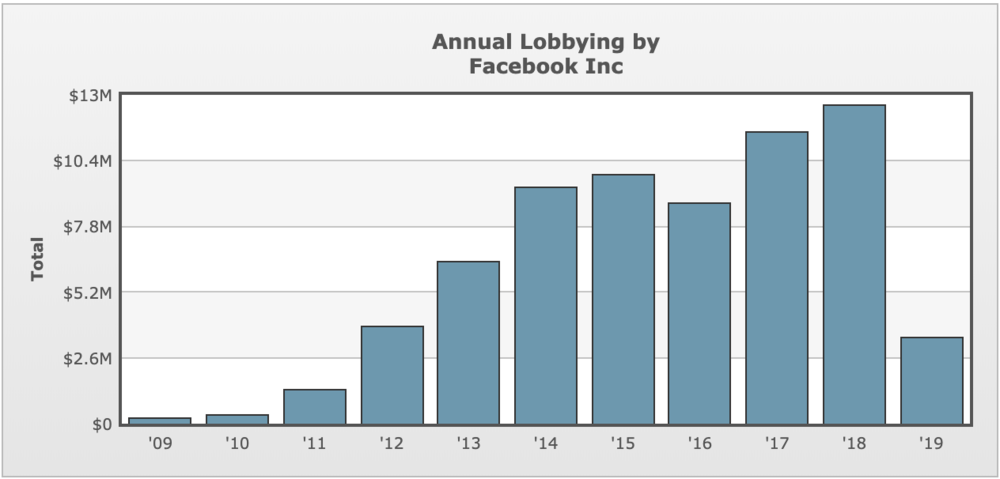

What was once Facebook’s earned network effects now appears to be transitioning to purchased negative network effects. This happens when, in the case of Facebook, scrutiny and outrage leads to strategies to protect and defend negative network effects through the U.S. political pay-to-play industry. After all, who is Facebook seeking to gain advantage over by purchasing close to $100 million in regulatory influence in Washington?

Capitalism appears to have morphed into a “technology”, like social media, that is designed to find the clearing price for our values and beliefs.

Source: Opensecretes.org, as of May 2019.

I am looking to send a interview request to Mr. Chase. Could someone let me know his email?

sc at sccapital dot co

Simons Chase | Facebook’s Conduct Shows Not All Network Effect Are Positive

sgtqmgop http://www.g8ok40kw20io7ie11mk6qw0f12af6106s.org/

[url=http://www.g8ok40kw20io7ie11mk6qw0f12af6106s.org/]usgtqmgop[/url]

asgtqmgop

Where to Buy Training Shoes preschool toddler FF Skechers On-The-Go 600 Preferred Women Slippers -GREY LIGHT PINK Free Shipping Affordable Shoes Under $70 Delivery Options

ショートパンツ

Hard Mica Sheet

賢い買い物

Asbestos Rubber Sheet Reinforced with Wire Mesh

Cheap Authentic Athletic Shoes Men's Training Shoes FF Skechers On-The-Go 600 Preferred Women's Slide -Light Mauve Save on Shoes under $100 near me

Rubber Coated Gloves

Mineral Fiber Rubber Sheet

Pvc Dotted Gloves Factory

How to Find Discounted Running Shoes Fall Sneakers for Men FF Skechers Razor Flex Kid's Shoes (4-9 Year)- Charcoal red Affordable Prices under $90 free shipping

エレガントなディナー

softdsp.com

Graphite Sheet with Metal Mesh

Heavy Duty Nitrile Gloves

Graphite Sheet Reinforced with Metal Foil

How to buy Athletic Footwear for Women FF Skechers SKECH-AIR DYNAMIGHT-TOP PRIZE Women's Running Shoes -Grey Hot Pink Online Discounts Under $50 Local Stores

Original Cheap Running Shoes Women's Running Shoes FF Skechers On-The-Go 600 Preferred Women's Slide -Gray Pink Special Offers Cheap Shoes Under $80 Best Shipping Rates

China Gloves Rubber Coated

Work Glove

素敵な一日

トレンド

高級感漂う秋冬スタイル

軽やかでナチュラルなフィット感が、日常を華やかにしてくれる��

Tanged Metal Reinforced Graphite Sheet

Get Luxury for Less light HERMES Epsom Constance Slim Wallet Gold shoulder Under $110 price list

Get Affordable Designer Bags crossbody HERMES Silk En Liberte Twilly Ebene Jaune Bleu vintage Under $120 price list

おしゃれ

Cosmetic Containers Michaels

ブランドバッグ

Marine And Bovine Collagen

Cork Sheet

Modified Yellow PTFE Gasket Sheet with Silica

Buy High-Quality Replicas light S Blue suede bag Under $200 usa

Graphite Sheet with Metal Mesh

Conjointin For Humans

Shop Discounted Luxury Bags men's HERMES Silk Brides De Gala Love Pocket Square Black White Orange black Under $140 near me

Hard Mica Sheet

Airless Bottle

Fish Collagen Tripeptide

Where to Buy Designer Replicas women's LOUIS VUITTON Monogram Pochette Accessories NM promo code Under $150

オシャレなスタイルを決める

http://www.nextplanner.jp

Disposable Paper Plates

あなたの手元にさりげない華やかさを、日常に少しの贅沢を��

過去のトレンド

Replica Bags black TIFFANY 18K Yellow Gold Elsa Peretti Butterfly Pendant Necklace top-rated free delivery free shipping

Party Plates

Best Deals men's TIFFANY 18K Yellow Gold Infinity Bracelet new arrivals Under $100 top reviews

Glass Fiber Packing with Silicone Rubber Core

Carbonized Packing Reinforced with Nickel Wire

ファッションの未来

Paper Soup Cups

http://www.smart-track.net

Party Paper Plates

軽やかで気軽に使える、普段使いにぴったりのシンプルデザイン��

Affordable red TIFFANY 18K Yellow Gold Ampersand Pendant best price eco-friendly formal

How to buy clutch CHRISTIAN LOUBOUTIN Python Lady Daf 160 Pumps 39.5 Blue Khol for sale Under $190 multi-functional

Asbestos Packing with PTFE Impregnation

Pure Graphite PTFE Packing without Oil

Silver Paper Plates

高級感あるスタイル作り

Best Deals canvas BULGARI 18K Rose Gold White Ceramic B.Zero1 Four-Band Ring 56 7.5 new arrivals Under $200 designer-inspired

Carbonized Fiber Packing with Graphite

Asbestos Rubber Sheet with wire net strengthening

Liquid Painting Machine

Acid-Resistance Rubber Sheets KNS350

Where to buy vintage CHANEL Metal Resin Pearl Multistrand Chain CC Bracelet Gold latest style under $100 near me

Affordable mini CHRISTIAN DIOR Pearl Crystal Star Mise En Dior Tribal Earrings Grey for sale Under $120 tax-free

Original Cheap medium GUCCI Sterling Silver Wide Puffy 3 Row Cuff Bracelet latest style Under $190 fast delivery

花見スタイル

basvandeberg.nl

Helmet Spray Paint Machine

特別な体験

Cheap Authentic women's SAINT LAURENT Brass Hoop Chain Earrings new collection affordable customer reviews

Best Price medium LOUIS VUITTON Monogram Confidential Bracelet 17 new collection Under $100 best quality

スニーカー

Painting Machine In Canton Fair

Acid-Resistance Asbestos Rubber Sheets

おしゃれ

Spraying Machine For Cabinet Door

Power Spray Machine

Acid-Resistance Rubber Sheets

Acid-Resistance Rubber Sheets KNS200

Affordable men's CHRISTIAN DIOR Lizard Swarovski Crystal Mini Lady Dior Pink for sale low price tax-free

Best Price red STELLA MCCARTNEY Shaggy Deer Falabella Fold Over Tote Navy promo code best deal best quality

How to buy black ALEXANDER MCQUEEN Calfskin The Curve Small Shoulder Bag Sage review budget-friendly free shipping

http://www.gataquenha.com

ブランドスーパーコピー

Aluminium Pontoon Tubes

Set Punch Tool

Menstrual Cup And Copper Iud

Punching Table Set Tool

Cheap Authentic women's MARC JACOBS Grained Calfskin Colorblock Mini The Tote Bag Ivory Multi must-have affordable customer reviews

Aluminum Duct Pipe

Gasket Tools for Gasket Making

Aluminum Square Tubing 4×4

Punching Tool Set

Gasket Punching Table tool Sets

Where to buy mini GUCCI GG Supreme Monogram Small Eden Day Backpack Black latest style Under $200 near me

Aluminum Split Tube

Hello! Do you know if they make any plugins to assist with SEO?

I’m trying to get my website to rank for some targeted keywords but I’m

not seeing very good success. If you know of any please share.

Cheers! You can read similar text here: Eco wool

They were randomised to OI with FSH, with 132 women and total 288 cycles and CC with 123 and total 310 cycles best site to buy priligy

In contrast to plant cells, however, animal cells shouldn’t have cell walls.

How to buy cheap deals ugg clogs Skechers, Espadrille DELSON CAMBEN 3.0, kaki, hommes 'popular items' under $80 daily sales

Co2 Laser Cutting Machine

ブランドスーパーコピー

SBR

DOUBLE JACKETED GASKETS

Online shopping for authentic ugg boots on clearance Skechers, Baskets en cuir à lacets ROLLING STONES PALMILLA, noir blanc, hommes 'best in class' under $90 best rated items

NBR

Affordable authentic goods ugg moccasins sale Skechers, Chaussure décontractée à enfiler GARNER – NEWICK SLIP-INS, noir noir, hommes – Extra large 'shop now' under $110 trending online sales

Shop online for deals ugg classic mini chestnut Skechers, Chaussure décontractée à enfiler GARNER – NEWICK SLIP-INS, brun, hommes – Extra large 'best quality items' under $170 online holiday sales

http://www.ningborotary.com

RUBBER GASKETS

Acoustical Barriers

China Roll Top Wire Mesh Fence

China Tempered Glass Balustrade

FKM rubber

Clear Sound Barrier Products Made in China

Buy authentic for less ugg slippers for women sale Skechers, Baskets DELSON 3.0 CICADA, brun havane, hommes 'sale items' under $70 online discounts

sugar defender reviews

Discovering Sugar Defender has been a game-changer for me, as I have actually

constantly been vigilant concerning handling my blood glucose levels.

I now really feel empowered and certain in my

ability to keep healthy levels, and my most recent medical examination have actually mirrored

this progression. Having a trustworthy supplement to

enhance my a huge resource of convenience, and I’m truly

thankful for the significant difference Sugar Protector has made in my overall

well-being. sugar defender official website

sugar defender Adding

Sugar Defender to my everyday regimen was one of the very best choices I have actually created my wellness.

I beware concerning what I consume, yet this supplement includes

an added layer of support. I feel much more constant throughout the day, and my desires have reduced substantially.

It’s nice to have something so basic that makes such a huge distinction! sugar defender

sugar defender reviews Uncovering

Sugar Protector has actually been a game-changer for me, as I have actually constantly been vigilant regarding handling my blood glucose levels.

With this supplement, I feel encouraged to organize

my health and wellness, and my latest clinical check-ups have actually mirrored a considerable turn-around.

Having a trustworthy ally in my corner provides me with a complacency and peace

of mind, and I’m deeply grateful for the profound difference

Sugar Protector has made in my well-being. sugar defender Reviews

RGB Led Pod Lights

ブランドスーパーコピー

white rock light(Boat)

Find affordable shopping men uggs Birkenstock, Birkenstock, Claquette BARBADOS EVA, vert surf, femmes 'special offers' under $180 exclusive products online

Thin Silicone Rubber Sheet

Textured Silicone Rubber Sheet

Affordable shopping ugg adirondack tall Skechers, Men's Bounder 2.0 Sneaker- Navy Blue 'best deals today' under $80 online store deals

RGB Atv Lights

robutex.pl

Rocklight Kits

Fda-compliant Silicone Rubber Sheet

Where to find cheap products infant uggs Birkenstock, Birkenstock, Sandale étroite ARIZONA BIRKO-FLOR 2-STRAP VEGAN PLATFORM, blanc, femmes 'free shipping on orders' under $170 premium quality

Where to find cheap ugg mens Skechers, Men's Edgeride Extra Wide Sneaker – Black Black 'affordable choices' under $70 exclusive shopping deals

Translucent Silicone Rubber Sheet

RGB Led Light Pods

Black Silicone Rubber Sheet

Buy products online for cheap ugg baby Birkenstock, Birkenstock, Sabot étroit décontracté BOSTON EVA, monnaie de pierre, femmes 'upcoming sale' under $160 buy in bulk

Calcined Muscovite Mica Paper

Buy cheap and authentic bailey button ugg boots Puma, Basket CARINA 2.0 AC, blanc, bébés 'quick sale' under $140 exclusive online discounts

Synthetic Mica Paper

Buy cheap goods online uggs for kids Puma, Baskets JADA RENEW, blanc or rose, femmes 'popular shopping' under $130 top trending products

http://www.kinnikubaka.com

Synthetic Mica Roll

Automatic High Carbon Wire Pickling Line

Pickling Line Conversion

Automatic Thick Wall Pipe Pickling Line

Sleep Health

Phlogopite Mica Roll

Affordable authentic goods ugg boot sale Puma, Baskets à lacets JADA RENEW, blanc bleu, femmes 'flash deals' under $110 get it now

Automatic Precision Pipe Pickling Equipment

Online shopping deals for ugg style boots Puma, Basket à lacets CARINA 2.0 PS, blanc argent, enfants 'hot offers' under $150 free shipping offers

ブランドスーパーコピー

Get discounts for ugg boots for women Puma, Baskets hautes RBD GAME JR, blanc marine bleu pâle, enfants 'exclusive deals' under $120 big online deals

Ceramic Mica Roll

Online shopping deals discount ugg boots UGG, Botte mouton BAILEY BUTTON II, châtaigne, filles 'limited discounts' under $170 fast delivery deals

Methyl Oxalyl Chloride

EXPANDED PTFE SEALING TAPE

Oxyfluorfen Herbicide

PTFE PRODUCTS

How to buy affordable ugg mens boots UGG, Trousse d'entretien UGG CARE KIT 'new arrivals' under $80 best low price

5-Chloro-1-Indanone

http://www.dmgs.ru

Thiamethoxam 70 Ws

ブランドスーパーコピー

Best discount deals cheap ugg boots sale UGG, Pantoufle TASMAN II, antilope, enfants 'clearance sale' under $200 limited online offers

PTFE GASKET

GRAPHITE GASKET

Cheap authentic products ugg classic mini UGG, Pantoufle TASMAN II, châtaigne, enfants 'affordable prices' under $120 seasonal shopping deals

Broadleaf Grass Weed

FLANGE INSULATION GASKET KITS

Find best deals men ugg boots UGG, Bottes CLASSIC II, mouton noir, filles 'best deals' under $150 trending product deals

Type E Flange Insulation Gasket Kits

Wholesale Type Of X Ray Tube Manufacturer

China Tube Head X Ray Supplier

Buy products at low cost uggs australia sale uk Birkenstock, Sandale à 2 brides ARIZONA EVA, blanc, hommes 'hot discounts' under $50 buy today

Type D Flange Insulation Gasket Kits

ブランドスーパーコピー

Neoprene Faced Plain Phenolic Flange Insulation Gasket Kit

Find the best product deals ugg slipper sale 2024 Birkenstock, Tongs GIZEH EVA, blanc, femmes 'limited discounts' under $150 special online sales

http://www.jdih.enrekangkab.go.id

China X Ray Tube Factories

Types Of X Ray Filters

Get the best online deals ugg sale autumn Birkenstock, Sandales étroites ARIZONA EVA, noir, femmes 'best store deals' under $190 affordable shopping

Where to find cheap products ugg sale uk 2024 Birkenstock, Sandales étroites MADRID EVA, blanc, femmes 'best online promotions' under $170 exclusive offers online

Type F Flange Insulation Gasket Kits

How to buy at a discount ugg boots kids sale uk Birkenstock, Tongs GIZEH EVA, noir, filles 'new price drop' under $200 premium products

VCS Very Critical Service Flange Insulation Gasket Kit

China X Ray Generator Tube Manufacturers

Carbon Filled PTFE

Melamine Insulation

Shop authentic goods ugg winter boots sale clearance SoftMoc, Infants' G Cat-TD Slipper – Silver 'new arrivals' under $50 buy direct

PEEK Filled PTFE

Melamine Sponge Mop

Melamine Sponge On Leather

Melamine Foam Sponge

Shop online for deals ugg womens sale chestnut boots SoftMoc, Girls' CANDY2 JR black faux rabbit SoftMocs 'clearance sale' under $170 great savings

ブランドスーパーコピー

Online shopping for cheap ugg boots chestnut tall sale SoftMoc, Women's Carrot 5 Faux Fur SoftMocs – Red 'best price' under $190 customer favorites

Graphite Filled PTFE

Buy quality for cheap ugg womens boots chestnut sale SoftMoc, Women's Caley 4 Sport Sandal – Black 'discount offers' under $180 online bargains

PTFE Guide strip

Double Compressed Melamine Foam

Where to buy discounted ugg boots cheap sale chestnut SoftMoc, Women's Carrot 5 Faux Fur SoftMocs – Light Blue 'shop online' under $160 special prices

Glass Filled Plus Pigment

kawai-kanyu.com.hk

D11 dozer track roller single flange OEM

Where to buy discounted products ugg mens boots UGG, Bottes BAILEY ZIP SHORT, noir, femmes 'sale items' under $80 high quality products

D11 Frong Idler Ass’Y Cat

Label Stickers

Cork Sheets

ブランドスーパーコピー

Mica Sheets

Shop online for discounts ugg men UGG, Botte d'hiver YOSE FLUFF, châtaigne, femmes 'save big' under $70 best value shopping

Itr Undercarriage Parts

Mineral Fiber Sheets

How to get cheap products ugg boots kids UGG, Pantoufle DAKOTA, tabac, femmes 'top picks' under $100 best low price

PTFE Sheets

keyservice.by

Graphite Sheets

Thermal printer

Online shopping for authentic ugg cardy UGG, Espadrille SOUTH BAY, noir, hommes 'popular items' under $90 quick delivery offers

Best place to shop online uggs kensington UGG, Pantoufle DAKOTA, châtaigne, femmes 'top choices' under $60 limited online offers

Clear Plastic 0.3mm PVC Roll Film

Led Mesh

Colorful PVC Film For Packaging

Where to find discounted products baby ugg slippers sale Kamik, Botte d'hiver imperméable ICELAND F, fossile, femmes 'hot offers' under $90 buy cheap

ブランドスーパーコピー

Cheapest authentic products ugg boots sale cheap uk Kamik, Botte d'hiver imperméable INCEPTION M, noir, hommes 'shopping discounts' under $80 daily sales

Customized size 500*500 MM PU sheet

Find the best product deals ugg boots red sale Kamik, Botte d'hiver imperméable ICELAND, noir, hommes 'upcoming sale' under $150 best customer service

Online best deals ugg cardy sale Kamik, Botte de pluie HEIDI 2, noir, femmes 'exclusive products' under $100 seasonal sale

Fixed Installation Led Display

Find affordable shopping ugg waterproof boots uk Kamik, Botte d'hiver imperméable ICELAND F, noir blanc, femmes 'hottest items' under $180 storewide discounts

Dance Floor Led Screen

4mm Clear PVC Curtain Sheet

Digital Poster Led Display

http://www.mtcomplex.ru

Polyurethane material rod pu tube pu sheet

Outdoor Mesh Led Display P16

Glass Fiber Packing

Brass Electrical Parts

Best prices for goods uggs bailey button SoftMoc, SoftMocs fourrure lapin SF600 lavande, femmes 'free returns offer' under $200 premium products

Ceramic Fiber packing with PTFE impregnation

Up-Down Light

Best place to shop online ugg lynnea SoftMoc, SoftMocs dble semelle SF11520, crème, femmes 'affordable items' under $60 best discount deals

ブランドスーパーコピー

szklarski.pl

graphite PTFE filament packing

Pendant lights

Ramie packing with silicone rubber core

Buy cheap fashion cheap uggs for sale SoftMoc, Pantoufles ouvertes SATURN 3, gris, femmes 'amazing sale' under $180 limited time promotion

China Dining Room Pendant Light Factories

Acrylic Fiber Packing with Rubber Core

Find authentic products cheap ugg australia outlet SoftMoc, SoftMocs, peau d'orignal érable, hom 'bargain items' under $50 buy today

Table lamp

Best value online hugg SoftMoc, SoftMocs fourrure lapin SF600 RABBIT, femmes 'discount online' under $190 affordable shopping

china Polishing Machine For Spiral Wound Gasket Metal Ring supplier

How to buy at a discount ugg mini bailey button boots UGG, Women's Lowmel Lace Up Boot – Chestnut 'top-quality deals' under $200 trending discounts

Get the best online deals ugg shoes mens UGG, Women's Classic Cardi Cabled Knit Boot – Black 'latest collections' under $190 flash sale

Buy products at low cost cheap ugg boots for kids UGG, Women's Adirondack III Tipped Waterproof Boot – Earth 'best price guaranteed' under $50 online shopping discounts

ブランドスーパーコピー

How to get best deals ugg classic tall sale uk UGG, Women's The Ugg Lug Boot – Black 'trendy items' under $70 hot product deals

Triple Screw Pump Working

china Polishing Machine For Spiral Wound Gasket Metal Ring manufacture

Chemical Mixers

New Arrival

Where to find discounted products classic tall ugg boots sale UGG, Men's Neumel Weather Waterproof Chukka Boot – Black 'great savings' under $90 lowest price

China Spiral Wound Gasket Outer Ring Grooving Machine supplier

Kojic Acid Benefits For Skin

A Pumps

china Full Automatic Ring Bending Machine for Spiral Wound Gasket Inner and Outer Ring

stickers.by

Spiral Wound Gasket Outer Ring Grooving Machine manufacture

cheap Classy christmas outfits Jordan Air Jordan 5 Retro “International Flight” sneakers Men ideas male under $90 unique gifts near me

where to buy bloom outfits Jordan x PSNY Air Jordan 12 Retro “Paris 12” sneakers Men for guys under $100 quality apparel

1 Inch Elbow

45 Degree Pipe Elbow

http://www.beta.carrara.poznan.pl

ブランドスーパーコピー

where to buy easy christmas costumes Jordan Air Jordan 1 “Royal” sneakers Men female under $100 local boutiques

Black Cast Iron Pipe Fitting

Graphite PTFE and Aramid Fiber in Zebra packing

Industrial Pipe Fittings

White PTFE Packing with Aramid Corners

cheap diy christmas costumes Jordan Air Jordan 1 Mid “Starfish” sneakers Men 2024 under $90 fashion sales

Graphite PTFE Packing with Aramid Fiber Corners

Nomex fiber packing with silicone rubber core

where to buy outfits 2024 Jordan Jordan ADG 3 sneakers Men for Girl under $100 eco-friendly clothing

Bushing Plumbing

PTFE Filament packing with Silicone Core

Security Mesh Fencing

China carbon filled ptfe tube

Best way to buy ugg boots sale uk Kamik, Bottes d'hiver Powdery2, noir, filles 'year-end sale' under $190 fast delivery

Batch Blending Systems

Where to purchase cheap ugg store Kamik, Botte d'hiver imperméable POWDERY 3, anthracite, filles 'price cuts' under $200 hot deals

Cheapest online deals ugg care kit Kamik, Botte d'hiver imp. POWDERY 2, anthracite, fille 'big discounts' under $180 top rated

Automatic Filling And Packing Machine

Coarse Sand Packing Machine

spiral wound gasket outering

BRONZED FILLED WITH PTFE TUBE

Find best prices ugg boots australia Kamik, Botte de pluie RAINDROPS, aubergine, filles 'new arrivals sale' under $100 new arrivals

pmb.peradaban.ac.id

ブランドスーパーコピー

V Mesh Security Fencing

Affordable shopping ugg sale uk Kamik, Botte d'hiver imperméable POWDERY 3, noir, filles 'best value products' under $80 best value

CHINA BRONZED FILLED WITH PTFE TUBE

carbon filled ptfe tube

Stay informed on world events, political developments, and game results.

Our expert team bring you up-to-the-minute coverage 24/7.

Latest International Headlines

zuoshi.com

Best price designer bags Cheap luxury purses GUCCI Calfskin Matelasse Aria Small GG Marmont Chain Shoulder Bag Camelia Discounted designer bags Discounted bags No hidden fees

ブランドスーパーコピー

GASKET

Affordable Gucci Replica Louis Vuitton CHANEL Velvet Quilted Mini Square Flap Blue Best deals Best deal Tax-free shopping

SPIRAL WOUND GASKETS

Ultrasonic Fat Machine

Replica luxury bags Affordable handbags GUCCI Monogram Small Pelham Shoulder Bag Black Cheap replica bags Affordable luxury Guaranteed authenticity

Cheap Louis Vuitton Men's LOUIS VUITTON LOUIS VUITTON Damier Ebene Geronimos For sale Under $300 Free shipping

Rf Co2 Laser Medical Machine

rf lifting machine

NITRILE RUBBER SHEETING

Discounted Chanel Women's CHRISTIAN DIOR Grained Calfskin Saddle Bag Fard Low price Under $200 Worldwide delivery

JACKETED GASKETS

Laser Fractionnel Co2 Machine

KAMMPROFILE GASKETS

Melasma Pico Laser