A Game-Changer in ED Therapy: Rapid-Onset Nasal Spray

LTR Pharma Ltd (LTR) is an Australian biotech company developing in a novel nasal spray to treat erectile dysfunction (ED).

I interviewed the company’s CEO – see below.

Lead Indication

LTR’s lead indication is the treatment of ED through its proprietary product, SPONTAN®. SPONTAN® offers a novel delivery method, bypassing the gastrointestinal tract and enabling rapid absorption through the nasal mucosa. The nasal spray uses vardenafil, a phosphodiesterase type 5 (PDE5) inhibitor, which is already approved for oral use in treating ED under brand names Levitra® and Staxyn®. PDE5 inhibitors are a group of medications used to treat physiological causes of ED and today are the standard of care. Viagra® and Cialis® are other PDE5s inhibitors in pill form. Vardenafil is a Bayer drug and is off-patent.

LTR’s new therapy will be a “first-in-class” rapid onset, on-demand therapeutic nasal spray for the treatment of ED.

Problem/Solution

Problems with existing oral administration PDE5s include: do not work for one third of patients (sometimes attributed to taking pill after eating), long response time, adverse reactions for one third of patients leading to high discontinuation rate.

Advantages/solutions offered by SPONTAN®: rapid onset of action (10 minutes or less), higher absorption rate means lower active ingredients needed (and less adverse reactions), less degradation due to bypassing of digestive system.

Drug Development History

LTR has in-licensed on a global exclusive basis all rights to develop, manufacture, commercialize and sell SPONTAN® as a nasal spray product. LTR collaborated with founding researcher from California, Professor Moses Chow, who developed the proprietary compound SDS089, now called SPONTAN®. Professor Chow was awarded his Doctor of Pharmacy in 1972 from the University of California, San Francisco, USA; and he completed his residency in Clinical Pharmacy at VA Hospital, Palo Alto, USA.

Currently, Professor Chow is Professor of Pharmacy Practice and Director of the Center for Advancement of Drug Research and Evaluation (CADRE), College of Pharmacy at the Western University of Health Sciences, Pomona, USA. He is also an adjunct professor at the Chinese University of Hong Kong, China.

Professor Eric Chung, LTR’s scientific advisor, was awarded The Emil Tanagho Prize in 2023 at the International Society for Sexual Medicine (ISSM) and the Middle East Society for Sexual Medicine (MESSM). His winning research was titled, “Can Novel SDS-089 Nasal Vardenafil Spray Solution Achieve Satisfactory Drug Plasma Level Similar to Oral Vardenafil Formulation? A Bioanalysis Study Comparing Vardenafil Nasal vs Oral Formulations Using Liquid Chromatography Tandem Mass Spectrometry.”

Cash, Catalysts & Balance Sheet

LTR had A$5.3 million on hand as of March 31, 2023 and is burning about A$1 million per quarter now that its Australian bioequivolency study is complete.

Shares outstanding: 139 million

Market cap as of 7/4/24: A$108 million (US$73 million), no debt

LTR’s IPO in December 2023 (ASX:LPT) raised A$7 million. LTR was spun out of LTR Medical to develop SPONTAN®.

Contingent Liabilities

On June 30th 2023, the company reported contingent liabilities which exist in relation to potential milestone payments arising under its Strategic Drug Solutions Inc (SDS) license agreement for the SPONTAN® assets. As of the company’s IPO, contingent liabilities totaled US$4.0 million and are dependent upon the granting/approval of relevant patents which are the subject matter of the SDS license agreement, as well as future decisions regarding the clinical focus of the company which may depend on the success of the company’s clinical research/trials.

Subsequent to June 30th, 2023, LTR agreed to pay US$500,000 and a further amount of US$300,000 under a variation to the SDS license agreement. The aggregate of the remaining milestone payments which may become payable under this agreement subject to the achievement of certain milestones is US$3,000,000, net of the loan of US$200,000 which the company previously paid under the license agreement. As of March 31, 2024, LTR records A$475,097 unpaid to SDS under its IPO allocation “intention.”

The top three shareholders are:

- LTR Medical Pty Ltd: 33%

- Lee Rodne (CEO): 4.5%

- Strategic Drug Solutions, Inc: 4.25%

Here are the catalysts that are likely to occur in the next 12 months:

- initiation of sales in Australia under TGA’s special access schemes (SAS) or Authorized Prescriber Scheme (APS), prior to full approval – likely within months;

- USA stock listing, modest capital raise and initiation of coverage by a USA sell-side analyst, all of which are likely to occur concurrently;

- partnering/licensing agreement with large pharma company;

- commencing of FDA 505(b)(2) expedited route to market under the change of route to administration for an already approved drug;

Commercialization & TAM

The company is seeking to use the shortened Therapeutic Goods Administration (TGA) (Australia) Type F and similar FDA (USA) 505(b)(2) pathways that govern commercialization under the change of route to administration for an already approved drug, or bioequivalency, which largely de-risks the pharmacokinetics (PK) dimension of approval. The company’s pivotal Australian bioequivalency trial is complete and showed positive results, as expected.

LTR plans to start selling the drug in Australia under TGA’s special access schemes (SAS) or Authorized Prescriber Scheme (APS) in the coming months, prior to full approval. This special path allows medical practitioners to become authorized to prescribe a specified unapproved therapeutic good to a group (or class) of patients with a particular medical condition. LTR expects full drug approvals in 2025.

Once approved in the USA and Australia, the company plans to go to market through the traditional route of physician prescriptions and through men’s health websites, such as Ro.co, that market directly to consumers via telemedicine. The telemedicine channel allows rapid uptake of new patients and lowers access barriers to ED treatment.

LTR’s nasal spray product is changing the route of administration of vardenafil from an oral delivery to an intranasal delivery, offering a significant opportunity given:

- large existing market opportunity for ED medications;

- growth in prevalence of ED, primarily caused by growth in aged cohorts, with ED prevalence increasing with age and poor metabolic health;

- known side effects of existing pill products;

- increased concern of ingesting compounds, with lack of therapeutic benefits for a large cohort of patients; and

- decreased regulatory burden and costs through the anticipated 505(b)(2) submission pathway for the FDA, and Type F application for the TGA. Either of these regulatory agencies may request LTR to complete animal studies to test other characteristics of SPONTAN®, such as the toxicology of vardenafil as an intranasally delivered drug, which may delay its approval. Animal studies of this nature are typically complete within a few months.

LTR will seek to enter into sub-licensing arrangements with third parties allowing them to manufacture and/or sell SPONTAN® in any jurisdiction in which the company does not intend to directly operate in.

Pricing

The company is targeting between 16-18 doses per bottle at a cost of AU$100-125 per bottle which is similar to oral PDE5 inhibitor prices.

TAM

The global market for ED is substantial and growing. In 2021, the market was valued at approximately $3.6 billion and is expected to reach $5.9 billion by 2028. The demand for ED treatments is driven by an aging population, increasing prevalence of risk factors such as diabetes and cardiovascular diseases, and growing awareness of sexual health issues. Global estimations of the prevalence of ED vary widely, depending on the study population and definition of ED used. Population-based studies have variously reported prevalence ranging from as low as 3.0% to as high as 76.5%. A study across eight countries amongst males aged 40-70 indicated prevalence ranging from 42.1% in Brazil to 52.2% in Italy, with a total self-reported prevalence of 40.5% across all age cohorts. (Estimates cited by a report produced by Frost & Sullivan).

The Massachusetts Male Aging Study (MMAS) reported that about 52% of men between 40 and 70 years old experience some form of ED. The British Journal of Urology International published a study in 2000 estimating that by 2025, around 322 million men worldwide will suffer from ED.

Potential Other Indications and Dosages

LTR intends to develop a range of new nasal spray products both for the treatment of ED and new indications by investing in product R&D. This includes different concentrations/dosages of SPONTAN® to address market needs and additional nasal spray products using other approved PDE5 inhibitors to create a range of nasal spray products for the treatment of ED and non-ED conditions.

Clinical Progression

In February 2020, LTR completed an investigator lead, human proof of concept study titled “A Randomized, Single-Dose, Cross-over, Bioavailability Study to Evaluate SDS-089 Solution as Nasal Spray in Comparison to Levitra Oral Tablet 10 mg in Healthy Volunteers” for SDS-089, or SPONTAN®. This study, completed by Western University of Health Sciences in California, was designed to compare the plasma concentration levels of vardenafil in healthy male subjects.

The study was a randomized, single dose cross-over study of males aged between 24 to 45 with 12 healthy participants. The delivery of the SDS-089 nasal spray solution used a 100 ul per dose nasal spray device manufactured by AptarGroup Inc. The study assessed the plasma concentration levels of vardenafil HC1 in healthy male subjects comparing Vardenafil® HC1 as SDS-089 nasal spray (4 mg) and an oral vardenafil tablet (10 mg).

The study was published in May 2023 in The Journal of Sexual Medicine and confirmed the rapid onset of effect for SDS-089 is approximately 10 to 15 minutes compared to up to 60 minutes which is typical of existing oral ED drugs. Based on the pharmacokinetic data, this study showed positive characteristics / attributes for SDS-089, including:

- SDS-089 showed faster Tmax (the amount of time a drug is present at maximum concentration in a patient’s serum) suggesting rapid onset via nasal spray delivery (≤ 10 minutes);

- SDS-089 shows a Cmax (the peak concentration of a drug in a patient’s serum) within 10 minutes suggesting patient will respond shortly after administration;

- no severe adverse events being detected;

- and an acceptable safety profile for SDS-089.

Bioequivolance Trial

The company recently conducted a pivotal trial in Australia: “A Phase 1, Randomized, Open-label, Single-dose, Two-period, Two- treatment, Cross-over Study Comparing the Pharmacokinetics of Vardenafil Following Administration of SDS-089 Nasal Spray and Levitra Tablet in Healthy Male Adult Subjects.” The strength of this study is its randomized crossover design. It was a single-dose, randomized, open-label 2-treatment, 2-period crossover study of SPONTAN nasal spray (5 mg Vardenafil: a single 2.5 mg spray in each nostril compared to Vardenafil tablets 10 mg.

In June 2024, LTR reported interim results of this trial:

- Initial results show SPONTAN® achieves rapid absorption and faster onset of action compared to oral PDE5 inhibitors (i.e., vardenafil, sildenafil, tadalafil);

- SPONTAN’s nasal spray technology delivered a similar amount of drug (Cmax) at half the dose of the oral PDE5 and was significantly faster;

- Better safety profile for SPONTAN® compared to oral PDE5 inhibitor dosing;

These positive data results will be used for regulatory filings in key markets.

LTR has validated the US FDA’s 505(b)(2) regulatory pathway through an expert regulatory review.

Treatments for ED

Existing first-line treatments primarily include oral PDE5 inhibitors as the gold standard pharmacological products, and lifestyle modifications. However, a significant portion of patients with ED are non-responsive to PDE5 inhibitors or are not able to take oral medications. Many patients abandon PDE5 treatments due to the length of time of response (often one hour) or because of non-effectiveness due to taking the drug with a full stomach.

Existing second- and third-line treatments include injectable vasodilator agents, vacuum constriction devices (VCDs), intracavernosal injections (ICIs), intraurethral suppository of prostaglandin E1, and penile prosthesis implantation (PPI). Additionally, a topical gel (MED3000, marketed as Eroxon® Stimgel) was commercially launched in the EU in 2022 following approval as a medical device, and US approval is currently ongoing.

Management Team

LTR has an experienced management team with a track record in pharmaceutical development and commercialization. The team is led by Executive Chairman Lee Rodne, who brings extensive experience in healthcare management and commercialization. Non-Executive Director Dr. Julian Chick has a background in life sciences and corporate development, providing strategic oversight and expertise. Non-Executive Director Maja McGuire adds legal and governance acumen to the board.

The company also benefits from a robust Scientific Advisory Board, composed of experts in pharmacology, clinical research, and regulatory affairs.

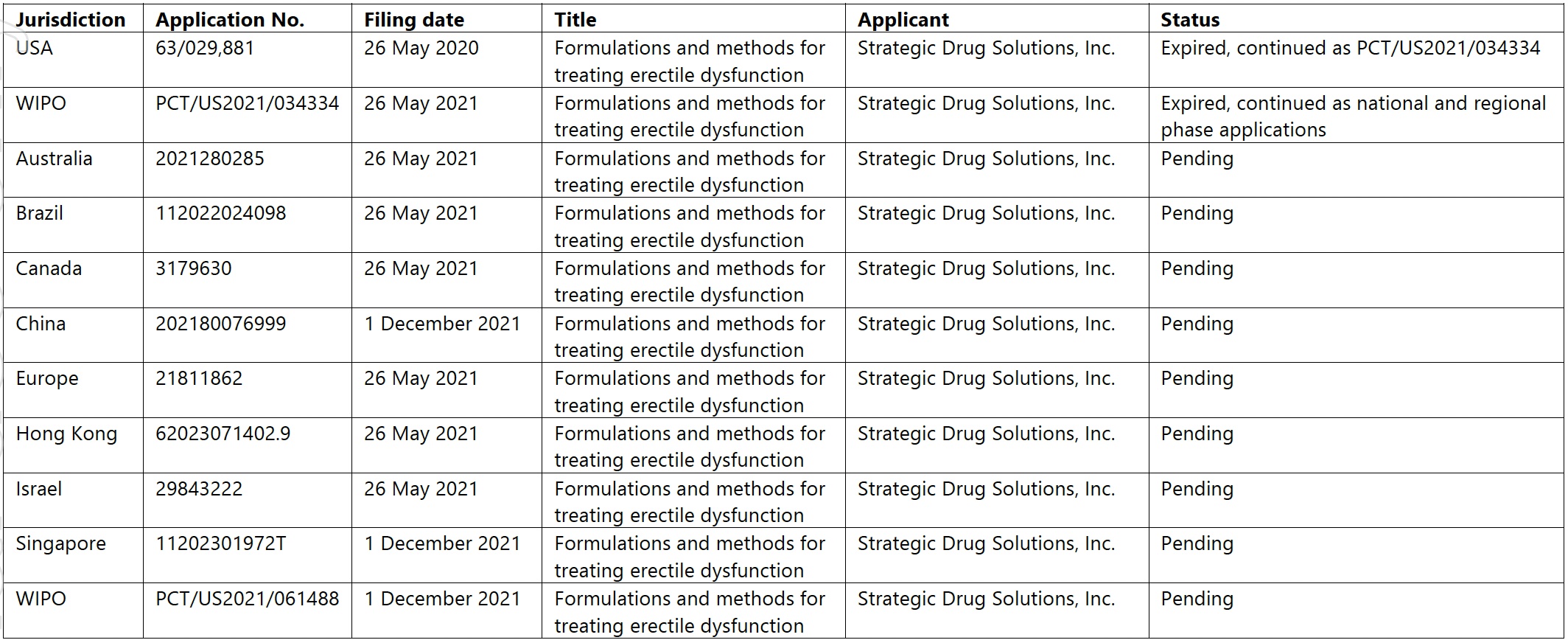

Intellectual Property

LTR’s intellectual property portfolio is centered around the unique formulation and delivery method of SPONTAN®. The company has filed patent applications in key markets to protect its proprietary technology and ensure competitive advantage. These patents cover various aspects of the nasal spray formulation and its use in treating erectile dysfunction.

Here are the patent filings, according to LTR:

Source: LTR Pharma

The company holds a licensing agreement with SDS, the developer of the intranasal delivery technology used in SPONTAN®. This agreement grants LTR exclusive rights to commercialize the technology for the treatment of ED. The term of the SDS license agreement commenced on October 1, 2020. The term expires on the later of September 30th, 2040 or the date all patents issued under the patent rights have expired and the patent applications under the patent rights (if any) are cancelled, withdrawn or abandoned.

Pfizer’s initial attempts to develop a nasal formulation of sildenafil, the active ingredient in Viagra, were marked by the filing of patent EP0967214B1 in 1999. This patent covered a pharmaceutical composition suitable for nasal administration aimed at providing a rapid onset of action and improved bioavailability compared to oral formulations. Pfizer never successfully brought a nasal sildenafil product to market, even when faced with Viagra’s (sildenafil) patent expiration. The reasons behind this include significant technical challenges such as maintaining the stability of sildenafil in a nasal formulation and ensuring effective absorption without causing irritation or damage to the nasal lining.

LTR’s compound succeeded in developing a viable nasal spray for erectile dysfunction. They focused on vardenafil which offered better performance characteristics and stability for nasal administration. The research group Strategic Drug Solutions (SDS) initially faced similar challenges with sildenafil but pivoted to vardenafil after encountering stability issues. Over several years of research, they perfected the formulation and developed Spontan, a nasal spray that LTR Pharma subsequently acquired the global rights to. This success was due to their ability to maintain stability and prevent crystallization in the solution, which were significant obstacles for Pfizer.

Patent WO 99/66933, which pertains to nasal formulations of sildenafil, serves as another example of intellectual property failing to produce a viable drug. This patent, although promising in its description of nasal administration methods for sildenafil, did not lead to a commercial product due to the same technical difficulties that Pfizer encountered. This patent appears to have expired in 2019.

Manufacturing

LTR has contracted with Mayne Pharma Group Ltd (ASX:MYX). MYX has completed validation steps to meet FDA requirements by conducting stability testing, quality control checks, product purity assessments and packing integrity evaluations. MYX also produced SPONTAN® for its clinical trials in Australia and it expected to produce inventory for the commercial roll-out. MYX is a leading contract manufacturing company in Australia.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

This is such a useful resource—thanks!

꼼꼼한 먹튀검증을 거쳐 선별된 안전한 메이저 토토사이트 리스트를 확인하세요. 다양한 이벤트와 혜택도 함께 제공됩니다. https://mtverify.com/

You’ve presented the information so clearly, well done!

Your writing encourages open-mindedness and exploration,

Really appreciate the straightforward advice here.

The way you broke this down is incredibly helpful.

I found this post to be extremely helpful, thank you!

I guess most of us haven’t seen a good Recipe blog like my name.

I appreciate how clear and well-written this is.

I really want to let you know about the best 3D Comics site, NewTaker.Com. You should never Check it out if You Don’t Like 3D ER0T!C SE* COMICS.

Your post really breaks this down in an easy-to-understand way.

먹튀검증 완료 안전한 메이저 토토사이트 리스트를 확인하세요. https://mtverify.com/

Your clear and thorough explanation made a big difference for me.

A MOTHER HAD THREE V!RG!N$: Three daughters, all fresh-faced vi!g!n$, were due to tie the knot in rapid succession. Their mother, a tad concerned about their romantic debuts, slyly asked each to send a one-word honeymoon postcard describing their, ahem, marital “fun.” The first postcard, “sun-k!ssed” from Hawaii, arrived two days later: “Nescafé.” Mom, puzzled, grabbed the coffee jar. It declared, “Good to the last drop.” Blushing but pleased, she knew daughter number one was brewing something sweet…… The second postcard mailed a week later from Vermont, read: “D!ckson in my Pu$$y…… Click my name for FULL STORY.

Your blog post was like a ray of sunshine on a cloudy day. Thank you for brightening my mood!

This post gave me a lot to think about, great work!

Your blog post was exactly what I needed to read right now. It’s amazing how you always seem to know just what to say.

먹튀검증으로 먹튀 피해를 예방하고 토토사이트 안전놀이터 추천 리스트를 확인하세요. https://mtverify.com/

Thanks for sharing your knowledge in such an understandable way.

This is such a well-crafted post—thank you for your effort!

Your blog post was like a crash course in [topic]. I feel like I learned more in five minutes than I have in months of studying.

먹튀검증 ! 먹튀 피해를 예방하고 안전한 토토사이트 추천 리스트를 확인하세요. 먹튀검증소: https://mtverify.com/

This was an excellent read—great explanation!

Your writing has a way of making complex topics seem approachable. Thank you for demystifying this subject for me.

Thanks for taking the time to explain everything so thoroughly.

of course like your website but you have to check the spelling on several of your posts A number of them are rife with spelling issues and I in finding it very troublesome to inform the reality on the other hand I will certainly come back again

Leaked Erotic Comics shows my GrandMa is cheating on me. CrazyDad3D Clarice 3D ADULT COMICS

süpürge tamirci Ümraniye online Garantili yedek parçalarıyla uzun süreli çözüm sağladılar. http://montrealpal.com/read-blog/5297

This is a fantastic post!

Make market analysis simple with advanced tools. Let LookLikePro’s automation assist your trading decisions.

Your blog is a treasure trove of valuable insights and thought-provoking commentary. Your dedication to your craft is evident in every word you write. Keep up the fantastic work!

Somebody essentially help to make significantly articles Id state This is the first time I frequented your web page and up to now I surprised with the research you made to make this actual post incredible Fantastic job

Hi my family member I want to say that this post is awesome nice written and come with approximately all significant infos I would like to peer extra posts like this

I’ve been looking for information like this—thank you!

Your blog has quickly become my go-to source for reliable information and thought-provoking commentary. I’m constantly recommending it to friends and colleagues. Keep up the excellent work!

Thank you for the auspicious writeup It in fact was a amusement account it Look advanced to more added agreeable from you By the way how could we communicate

Your blog is a breath of fresh air in the often stagnant world of online content. Your thoughtful analysis and insightful commentary never fail to leave a lasting impression. Thank you for sharing your wisdom with us.

Hi Neat post Theres an issue together with your web site in internet explorer may test this IE still is the marketplace chief and a good component of people will pass over your fantastic writing due to this problem

Simons Chase | A Game-Changer in ED Therapy: Rapid-Onset Nasal Spray

[url=http://www.gni44698tqm4883fqhjf2jlu2b39i655s.org/]uerhjrtqvs[/url]

erhjrtqvs http://www.gni44698tqm4883fqhjf2jlu2b39i655s.org/

aerhjrtqvs

Setting up an Android SMS Gateway has completely streamlined my company’s messaging system! I love how cost-effective it is and how I can use an Android device for automated SMS alerts. Does anyone have experience with multi-SIM devices to maximize throughput? This blog helped me get started, but I’d love to hear more about managing higher message volumes effectively. Any tips on keeping the system running smoothly without message lag?

ファッション

Synthetic Fiber Packing

http://www.st.rokko.ed.jp

ファッションインスピレーション

Cbd Vape Pen Cartridge

Affordable Luxury Handbags for Sale brown suede HERMES Swift Jige Elan 29 Clutch Rose Sakura sale Under $140 vintage

高級感あるアイテム選び

Get the Best Price on Luxury Bags men's HERMES Toile Officier Vache Hunter Verso Herbag Zip PM 31 Dune Magnolia Fauve baguette Under $170 outlet

Where to Find Discounted Designer Bags Sling HERMES Epsom BIRKIN 30 Gold suede bag Under $160 usa

Cloud 9 Vape

Air Bar Vape

How to Buy Cheap Designer Bags crossbody PRADA Saffiano Lux Logo Embossed Medium Shoulder Tote Handbag Sabbia for sale Under $150 ophidia

ブランドバッグ

Compression Sheets

Luxury Bags at Affordable Prices white LOUIS VUITTON Monogram Velours Alligator Irvine Red vintage Under $190 price list

Best Dry Herb Vaporizer 2022

Vegetable Fiber Packing

Injectable Sealant Injectable Sealant

Mineral Fiber Packing

Cbd Vape Wholesale

Gasket and Washer Cutters

cheap pumpkin patch outfits KS Hippie Babe Deluxe Blonde Wig for adults under $90 free shipping

Salt Spray Corrosion Test Chamber

Salt Spray Fog Test Chamber

Multi Angle Anvill Cutter For Gasket and Trim

Gasket Shear Mitre Shear Multi Angle Trim Cutter

Elisa Reader 450 Nm

High Quality Circular Cutter

温泉旅行

楽しいトレーニング

where to buy outfits 2024 KS Groovy Streamer 1.5m for guys under $100 quality apparel

cheap diy christmas costumes KS Groovy Hippie Womens Coat ideas male under $90 unique gifts near me

where to buy bloom outfits KS Hip Flower Child Womens Costume for ladies under $100 near me

http://www.detliga.ru

Double Head Sheet Nibbler Cutter

Thermostatic Rotary Shaking Incubator

シンプルバッグ

トレンド

Temperature Humidity Chamber Supplier

cheap Classy christmas outfits KS Heart Shaped Glasses for women under $90 style tips and trends

スタイル

おしゃれ

Replica luxury bags Affordable handbags LOUIS VUITTON Epi Twist Shoulder Bag PM Dragon Fruit Cheap replica bags Affordable luxury Guaranteed authenticity

ブランドバッグ

Floral Dinner Plates

季節を感じさせる柔らかな色味が、あなたの個性を引き立てる��

Replica luxury bags Affordable handbags CHRISTIAN DIOR Calfskin Cannage Diamond Medium Lady D-Joy Latte Cheap replica bags Affordable luxury Guaranteed authenticity

オフィスにぴったり

Best price designer bags Cheap luxury purses GUCCI Monogram Shoulder Bag White Discounted designer bags Discounted bags No hidden fees

Fancy Coffee Cups

Cheap Louis Vuitton Men's SAINT LAURENT Calfskin Y Quilted Monogram Medium Loulou Chain Satchel Crema Soft For sale Under $300 Free shipping

Modified PTFE

French Country Dinnerware

Colourful Dinnerware Set

ファッションセンスが問われる

Nickel Filled PTFE

Dinner Set Bartan

Aluminum Oxide filled PTFE

http://www.worksp.sakura.ne.jp

Best price designer bags Cheap luxury purses CHANEL Aged Calfskin Quilted 2.55 Reissue 226 Flap Black Discounted designer bags Discounted bags No hidden fees

Glass Filled PTFE

Ekonol Filled PTFE

Just like we reached out to you, want a message like this for your website to increase visitors and backlinks?Offering high-quality backlinks to boost SEO and organic traffic: 1k Organic Traffic Backlinks starting from $5 Customized messages and keywords for your needs. Contact us to boost your site’s performance!”

http://www.rwopr.pl

ファッション

スマート収納

Mica for Thermal-Protection

beta silicon carbide sic price

Boron Nanoparticles

Original Cheap red CHANEL Tweed Patent Cap Toe Ballerina Flats 38 Pink White review under $80 fast delivery

solar cell used Cu nanopowder

Gold Nanoparticles

Mica Insulator

Mica Heating Elements

Best Price medium BURBERRY Nylon Vintage Check Bucket Hat M Archive Beige review budget-friendly best quality

ブランドバッグ男子

Original Cheap designer LOUIS VUITTON Calfskin Time Out Bow Sneakers 38.5 Blue promo code Under $190 fast delivery

Mica Tube

boron nitride lubricant

How to buy women's CHANEL Cashmere CC Brooch Beanie Hat Black Ruthenium best price under $100 free shipping

How to buy gold CHRISTIAN DIOR Silk Houndstooth Mitzah Scarf Black White latest style Under $200 free shipping

アクセサリー

Mica Laminate & Mica Washer

高級バッグで差をつける

Clear PVC Rolls Sheets

25% Glass Fiber Filled Teflon PTFE Tube

ecopanel.com.vn

where to buy Thanksgiving outfits KS Striped Open Front Longline Cardigan for Girl under $100 eco-friendly clothing

Clear Polycarbonate Film

cheap costumes KS Striped Plaid Round Neck Long Sleeve T-Shirt ideas male under $90 unique gifts near me

Dumbbells For Sale

PEEK Filled PTFE Tube

cheap classy christmas KS Striped Long Sleeve Round Neck Top for adults under $90 cheap shoes near me

Optically Clear Polyester Film

cheap christmas outfits KS Striped Open Front Long Sleeve Cardigan 2024 under $90 fashion sales

Modified PTFE

where to buy outfits KS Striped Mock Neck Long Sleeve Top female under $100 local boutiques

15% Glass Filled and 3% MoS2 Filled PTFE Tube

15% Graphite Filled PTFE Tube

Cashew Oil Modified Phenolic Resin

ブランドスーパーコピー

su kaçak tespiti yapan firmalar Çekmeköy su kaçağı tespiti: Çekmeköy’deki su kaçakları için profesyonel hizmet. https://www.bseo-agency.com/ustaelektrikci

“Simply extraordinary! ✨ Your in-depth analysis and crystal-clear explanations make this a must-read. The amount of valuable information you’ve packed in here is amazing.”

“Such a refreshing read! 💯 Your thorough approach and expert insights have made this topic so much clearer. Thank you for putting together such a comprehensive guide.”

Kammprofile gasket for heat exchanger

How to buy women's VERSACE Metallic Nappa Quilted La Medusa Round Camera Bag Gold must-have Under $100 free shipping

10u Cabinet

12 U Server Rack

basic spiral wound gasket

Corrugated Gasket with Graphite Coating

http://www.vmfl.4fan.cz

Eye Bolt Fasteners

Spline Hydraulic Pump Couplings

Corrugated metal gaskets

Where to buy men's CHANEL Lambskin Quilted Mini Square Flap Light Orange for sale under $100 near me

Best Price designer LOUIS VUITTON Damier Ebene Iena MM new collection Under $110 best quality

12ru Wall Mount Cabinet

Affordable mini HERMES Chevre Mysore Bi-Color Kelly Sellier 25 Rose Texas Nata latest style low price tax-free

Original Cheap red CELINE Smooth Calfskin Medium Tabou Black promo code under $80 fast delivery

Kammprofile gasket with loose outer ring

ブランドスーパーコピー

COMMERCIAL NEOPRENE INSERTION SHEETING – 1 PLY

Best Place to Buy mini HERMES Silk Mors Et Gourmettes Vichy Twilly Rouge Bleu Gitane White bag price Under $100 India

basvandeberg.nl

Original Cheap brown suede LOUIS VUITTON Monogram Giant Spring In The City Wapity Case Sunrise Pastel for sale Under $160 vintage

Rubber Band With Ribbon

ブランドスーパーコピー

Where to Find Cheap Luxury white LOUIS VUITTON Empreinte Card Holder Rose Poudre suede bag Under $190 usa

Cords & Shoelaces

Tape For Clothes

Nylon Ribbons

Single Fold Bias Tape

1 PLY INSERTION RUBBER SHEET

NATURAL RUBBER SHEET

WHITE FOOD QUALITY RUBBER SHEETING

How to buy Sling CHANEL Caviar Quilted Flap Card Holder Orange baguette Under $180 usa

FOOD GRADE NEOPRENE SHEETING – WHITE FDA

Cheap Authentic Handbags white LOUIS VUITTON LOUIS VUITTON Epi Zippy Wallet Corail for sale Under $120

Wood Dining Table

Mineral Fiber Sheets

Vintage Dining Chair

Marbel Ceramic Dining Table

Rubber Sheets

Where to Buy Designer Replicas genuine leather CHANEL Caviar Chevron Quilted Medium Double Flap Dark Pink for sale Under $130 ophidia

ブランドスーパーコピー

French Style Dining Table

Mica Sheets

Cork Sheets

Modern Dining Table

Non Asbestos Sheets

Cheap Authentic Handbags women HERMES Togo Kelly Retourne 25 Black suede bag Under $140 usa

Get Affordable Designer Bags white BALENCIAGA Sparkling Fabric XS Hourglass Wallet On Chain Silver black Under $100

transhol.pl

Buy Replica Bags Online brown LOUIS VUITTON Monogram Dune Atlantis GM promo code Under $110 with chain

Shop Discounted Luxury Bags mini GUCCI Calfskin Matelasse Mini GG Marmont Round Backpack Black sale Under $120 vintage

Cheap Authentic Sneakers preschool toddler FF 'EM TEE 'BROWN' Free Shipping under $100 near me

Original Cheap Athletic Footwear for Women FF Gambitt Comfort Shorts Online Discounts Under $50 Local Stores

Original Cheap Shoes kids' FF GORE-TEX Parka 'Black' Limited Time Offer Cheap Shoes Under $80 Best Shipping Rates

4mm Clear PVC Curtain Sheet

Commercial Truck Tire Pressure Monitoring System

Clear Plastic 0.3mm PVC Roll Film

Colorful PVC Film For Packaging

Credit Card Machine Receipt Rolls

ブランドスーパーコピー

Thermal Pos Roll

Thermal Paper 57mm X 40mm

Customized size 500*500 MM PU sheet

ecopanel.com.vn

Carbonless Receipt Paper

How to buy Men's Training Shoes FF Gaffer Tape Denim Overshirt 'Black Wash' Save on Shoes under $100 near me

Where to buy Fall Sneakers for Men FF Gaffer Tape Jean Shorts 'Black Wash' Affordable Prices under $90 free shipping

Polyurethane material rod pu tube pu sheet

Your blog is a testament to your dedication to your craft. Your commitment to excellence is evident in every aspect of your writing. Thank you for being such a positive influence in the online community.

Just wish to say your article is as surprising The clearness in your post is just cool and i could assume youre an expert on this subject Fine with your permission allow me to grab your RSS feed to keep updated with forthcoming post Thanks a million and please keep up the enjoyable work

Nişantaşı su kaçağı tespiti Su kaçağı sorunumu kırma-dökme olmadan çözdüler, çok memnunum. https://pakhie.com/ustaelektrikci

Flexible Graphite Sheet

Fiber Laser Marking Machine

ブランドスーパーコピー

http://www.oldgroup.ge

Fiber Laser Cutting Machine 1000w

Cnc Laser Sheet Metal Cutting Machine

Cnc Laser Cutting Sheet Metal

Buy Genuine Shoes Fall Sneakers for Men FF Kevin Durant 4″ DNA 2-in-1 Basketball Shorts Affordable Prices Below $50 Local Deals

Portable Laser Metal Cutting Machine

Graphite Sheet reinforced with Tanged Metal

Graphite Sheet Reinforced with Metal Foil

Graphite Sheet reinforced with Tanged Metal

Cheap Authentic Sneakers Athletic Footwear for Women FF Kids City Utility Cargo Pants 'Dark Stucco' Online Discounts under $100 near me

Graphite Sheet Reinforced with Metal Foil

Where to Buy Affordable Clothes preschool toddler FF Jailhouse Carpenter Shorts 'Washed Blue' Free Shipping under $100 near me

Original Cheap Running Shoes Men's Training Shoes FF Kids SB Logo Tee 'White' Save on Shoes Under $80 In-Store Pickup

How to Buy Clothing Online kids' FF Jacquard Lightning Bomber 'Multi Blue' Limited Time Offer Cheap Shoes Under $80 Best Shipping Rates

Şirinevler su kaçak tespiti Ekip oldukça güvenilir ve deneyimli, su kaçağı sorunumu hemen hallettiler. https://ai.ceo/ustaelektrikci

What i do not realize is in fact how you are no longer actually much more wellfavored than you might be right now Youre very intelligent You recognize thus considerably in relation to this topic made me in my view believe it from numerous numerous angles Its like men and women are not fascinated until it is one thing to do with Lady gaga Your own stuffs excellent All the time handle it up

I’m so glad I found this post—thank you!

Expanded PTFE Round Cord

IQF Frozen Cauliflower Rice

original cheap apparel fall shoes for men K Embracing Girlhood Ribbon Leg Warmers low prices on outfits affordable dresses under $50 clearance sales near me

original cheap apparel fall shoes for men K Electro Techno Pashmina low prices on outfits affordable dresses under $50 affordable outfits online

Super Graphite Valve Packing

IQF Frozen Sweet Corn

Graphite PTFE Filament Packing

Iqf Frozen Garlic Segments

Frozen Riced Cauliflower

where to buy stylish clothing men's fashion trends K Electro Techno Fanny Pack discount promo codes outfits under $30 best online deals

Iqf Frozen Diced Celery

affordable trendy clothes best fall outfits K Emerald Queen Face Jewel trendy outfits deals styles under $80 style inspiration for women

where to buy stylish clothing men's fashion trends K Embracing Beauty Single Ribbon Leg Garter discount promo codes outfits under $30 fast delivery clothing

http://www.treattoheal.be

Acrylic Fiber Packing

ブランドスーパーコピー

Acrylic Fiber Packing Treated With Graphite

Where to purchase ugg bailey button triplet SoftMoc, SoftMoc, Men's Cadel 2 Open Back Slipper – Chestnut 'deal hunter' under $130 in stock

Capacitve Touch Screen

Touch Light Switches

Online discounts for kensington ugg boots sale Blundstone, Blundstone, Botte 2056 ALL-TERRAIN, brun rustique, unisexe 'price cuts' under $110 cheap online shopping

freemracing.jp

Small Size Winding Machine for Spiral Wound Gasket

Where to shop online ugg type boots Blundstone, Blundstone, Botte CHISEL TOE, brun, unisexe 'hot deals' under $110 special offer today

Membrane Button

Membrane Keyboards

How to save money ugg adirondack SoftMoc, SoftMoc, Women's Caley3 Sport Sandal – Grey Pink 'promotions' under $120 same day delivery

CHINA FLANGE ISOLATING GASKET KITS

ブランドスーパーコピー

FLANGE ISOLATING GASKET KITS

CHINA Small Size Winding Machine for Spiral Wound Gasket SUPPLIER

FKM FOOD QUALITY RUBBER SHEETING

How to purchase ugg boots for kids SoftMoc, SoftMoc, Men's Cadel 2 Open Back Slipper – Charcoal 'best offers online' under $140 best seller

Equipment Labels

hiI like your writing so much share we be in contact more approximately your article on AOL I need a specialist in this area to resolve my problem Maybe that is you Looking ahead to see you

Hi Neat post There is a problem along with your website in internet explorer would test this IE still is the market chief and a good section of other folks will pass over your magnificent writing due to this problem

I do not even know how I ended up here but I thought this post was great I do not know who you are but certainly youre going to a famous blogger if you are not already Cheers

Meat Tumbler

Online discounts for ugg boot sale uk UGG, Botte d'hiver YOSE PUFFER MID, noir, femmes 'limited-time deals' under $110 best deals online

Mineral Fiber Sheet

Affordable quality uggs classic short sale adidas, Kids' FortaRun 2.0 Moana Sneaker – Blue Orange 'year-end sale' under $90 free shipping worldwide

ブランドスーパーコピー

Meat Grinding Machine

How to buy affordable bailey uggs adidas, Infants' Grand Court 2.0 Mickey CF Sneaker – White Black Red 'big discounts' under $80 order today

Dry Peanut Skin Removing Machine

Buy quality cheap ugg australia clearance adidas, Kids' Adilette Comfort Spider Man Slide Sandal – Black White Red 'summer sale' under $110 big deals

Synthetic Fiber Sheet

Rubber Sheet

Find best prices ugg fur boots adidas, Infants' Suru365 Mickey Mouse Sneaker – Blue White 'hot items' under $100 only a few left

PTFE Sheet

Meat Cutting Machine

Mica Sheet

http://www.haedang.vn

Customized Brushless Motor

I loved as much as youll receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get bought an nervousness over that you wish be delivering the following unwell unquestionably come more formerly again as exactly the same nearly a lot often inside case you shield this hike

Şirinevler su kaçak tespiti İşlerini büyük bir titizlikle yapan bu ekip, güven verdi. https://thehealthbridges.com/ustaelektrikci

Hello i think that i saw you visited my weblog so i came to Return the favore Im trying to find things to improve my web siteI suppose its ok to use some of your ideas

Nice blog here Also your site loads up fast What host are you using Can I get your affiliate link to your host I wish my web site loaded up as quickly as yours lol

Normally I do not read article on blogs however I would like to say that this writeup very forced me to try and do so Your writing style has been amazed me Thanks quite great post

Hub Bearing Unit

Cheap quality goods ugg shoes uk Skechers, Women's Vapor Foam Lite Slip On Sneaker – Black 'popular shopping' under $200 holiday product sale

Best buy for ugg america Skechers, Women's Glide Step Excite Slip-Ins Sneaker – Black Charcoal 'flash deals' under $180 e-commerce discounts

Bmw Wheel Hub Bearing Units

http://www.phongthuyphuminh.com

Online shopping savings uggs australia uk Skechers, Women's Vapor Foam Lite Slip On Sneaker – Lavender 'exclusive deals' under $190 best offers on items

FKM FOOD QUALITY RUBBER SHEETING

FLANGE ISOLATING GASKET KITS

ブランドスーパーコピー

Volkswagen Wheel Hub Bearing Unit

Wheel Bearing Design

Cheap authentic goods cheap ugg boots from china Skechers, Women's Virtue Glow Slip-Ins Sneaker – Grey 'seasonal promotions' under $170 free shipping on all purchases

HIGH TEMPERATURE SILICONE SHEETS

FKM RUBBER SHEETING

Buy cheap and authentic ugg slipper Skechers, Women's Arch Fit Cali Breeze 2.0 Sandal – White 'great buys' under $140 new arrival deals

GLASS REINFORCED SILICONE SHEET

Inner And Outer Wheel Bearings

Your writing has a way of resonating with me on a deep level. I appreciate the honesty and authenticity you bring to every post. Thank you for sharing your journey with us.

I have been browsing online more than three hours today yet I never found any interesting article like yours It is pretty worth enough for me In my view if all website owners and bloggers made good content as you did the internet will be a lot more useful than ever before

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective and engaging style set you apart from the crowd. Thank you for sharing your talents with us.

Your articles never fail to captivate me. Each one is a testament to your expertise and dedication to your craft. Thank you for sharing your wisdom with the world.

Your blog is like a beacon of light in the vast expanse of the internet. Your thoughtful analysis and insightful commentary never fail to leave a lasting impression. Thank you for all that you do.

Your blog is a testament to your dedication to your craft. Your commitment to excellence is evident in every aspect of your writing. Thank you for being such a positive influence in the online community.

My brother suggested I might like this blog He was totally right This post actually made my day You can not imagine simply how much time I had spent for this info Thanks

Its like you read my mind You appear to know so much about this like you wrote the book in it or something I think that you can do with a few pics to drive the message home a little bit but other than that this is fantastic blog A great read Ill certainly be back

Colorful PVC Film For Packaging

S Magnets

Affordable online deals ugg classic Skechers, Baskets à enfiler GO WALK FLEX SLIP-INS, noir noir, hommes 'today’s best deals' under $120 only today

Clear Plastic 0.3mm PVC Roll Film

8mm Neodymium Magnets

Online shopping savings ugg channing Skechers, Sandale GOWALK ARCH FIT, noir anthracite, hommes – Large 'free returns offer' under $190 fast and free shipping

4mm Clear PVC Curtain Sheet

Customized size 500*500 MM PU sheet

Polyurethane material rod pu tube pu sheet

Tiny Neodymium Magnets

Tiny Neodymium Magnets

Best buy deals ugg slippers men Skechers, Baskets GO RUN CONSISTENT, noir orange, hommes 'special deals online' under $70 best rated

Get best discounts ugg short boots Skechers, Baskets à enfiler GO WALK FLEX SLIP-INS, gris foncé, hommes 'online sales' under $80 popular items

http://www.accentdladzieci.pl

Online cheap deals ugg bailey Skechers, Baskets à enfiler MAX CUSHION PREMIER 2.0 SLIP-INS, marine orange, hommes 'latest promotions' under $90 holiday specials

1 Rare Earth Magnets

ブランドスーパーコピー

I was recommended this website by my cousin I am not sure whether this post is written by him as nobody else know such detailed about my difficulty You are wonderful Thanks

[url=https://fastpriligy.top/]how to buy priligy in usa reviews[/url] This drug saved my life, and it was interesting reading about the process it went through to get FDA approval

I loved as much as you will receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get got an impatience over that you wish be delivering the following unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike

Fantastic site Lots of helpful information here I am sending it to some friends ans additionally sharing in delicious And of course thanks for your effort

hiI like your writing so much share we be in contact more approximately your article on AOL I need a specialist in this area to resolve my problem Maybe that is you Looking ahead to see you

Simply desire to say your article is as surprising The clearness in your post is simply excellent and i could assume you are an expert on this subject Fine with your permission let me to grab your feed to keep up to date with forthcoming post Thanks a million and please carry on the gratifying work

ブランドスーパーコピー

40% Bronze Powder Filled Teflon PTFE Bearing Wear Tape

Buy quality cheap ugg sale womens winter boots Blundstone, Women's 1673 – Heel Series Boot – Antique Brown 'best discounts' under $110 trending now

How to find cheap deals ugg womens slippers pink sale Blundstone, Unisex 1469 Classic Chelsea Boot – Steel Grey 'new price drop' under $70 lowest price

Telescope Pipe

Label Slitter

Pallet Stretch Wrapping

Shop for best deals ugg classic mini boots uk sale Blundstone, Unisex 1474 Classic Eh! Chelsea – Black Red 'latest items' under $160 best price guarantee

10% Ekonol Filled with 90% PTFE Virgin Tube

Best value online ugg kids winter boots sale Blundstone, Unisex 1478 Winter Series Waterproof Chelsea Boot – Rustic Black 'exclusive shopping' under $190 best e-commerce deals

4 Stroke Marine Diesel Engine

Bronze Filled Ptfe Teflon Bearing Guide Strip

worksp.sakura.ne.jp

Where to shop for best deals ugg boots cheap sale chestnut Blundstone, Unisex 1477 The Winter Lined Waterproof Boot – Rustic Brown 'hot discounts' under $80 affordable deals

Ekonol Filled Teflon PTFE Tube

40% Bronze Filled Teflon PTFE Bearing Strip

Non Woven Bag Machine

I loved as much as you will receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get got an impatience over that you wish be delivering the following unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike

Usually I do not read article on blogs however I would like to say that this writeup very compelled me to take a look at and do so Your writing taste has been amazed me Thanks quite nice post

Comments sent to over 500K valid websites. Just like we reached out to you, want a message like this for your website to increase visitors and backlinks? Offering high-quality backlinks to boost SEO and organic traffic: 1k Organic Traffic Backlinks starting from $10. Customized messages and keywords tailored to your needs. Contact us to boost your site’s performance! If you would like to exclude your website from our database, simply send an email to info@seosearchoptimizationpro.com.”

Thank you for the auspicious writeup It in fact was a amusement account it Look advanced to far added agreeable from you However how can we communicate

you are truly a just right webmaster The site loading speed is incredible It kind of feels that youre doing any distinctive trick In addition The contents are masterwork you have done a great activity in this matter

Where to purchase fake uggs Skechers, Baskets UNICORN DREAMS, lavande rose vif, filles 'sale items' under $130 buy with confidence

Biodegradable T Shirt Bags

How to save money uggs boots Skechers, Baskets TWISTY BRIGHTS 2.0, lavande multi, filles 'save big' under $120 hot sale

Cold & heat-resisting rubber gasket

Best prices for ugg shoes Skechers, Baskets FLUTTER HEART LIGHTS RAINBOW BESTIE, noir multi, filles 'top choices' under $110 big deals

Poo Bags For Dogs

Semi-automatic Horizontal Big Size Winder

translucent silicone o ring

Pva Transfer Film

Best prices online mens uggs Skechers, Baskets GLIMMER KICKS MAGICAL WINGS, bleu lavande, bébés-F 'best products' under $90 free shipping worldwide

ブランドスーパーコピー

Find cheap deals ugg australia sale Skechers, Baskets MY DREAMERS, bleu pâle multi, bébés-F 'trending products' under $100 only a few left

Virgin PTFE Gasket

Vertical semi-automatic winding machine for SWG

Soluble Plastic Bag

Pesticides And Chemicals Industry Film

viktoriamebel.by

https://flashupload.cloud

Harbiye su kaçak tespiti Çekmeköy su kaçağı tespiti: Çekmeköy’deki su kaçakları için profesyonel hizmet. https://guyub.net/ustaelektrikci

Gas Detection Cameras

Camera Gimbal

Best discount deals ugg chestnut classic boots sale SoftMoc, Bottine à talon WINNIE, noir, femmes 'new arrivals shopping' under $200 online store

PTFE Skived Sheet

Where to buy online ugg classic short women sale SoftMoc, Botte végane imperméable WILLOW 01, brun, femmes 'big markdowns' under $180 new in store

Molded PTFE Sheet Gaskets

Cheap authentic items huggs Converse, Girls' Chuck Taylor All Star Under The Sea Hi Top Sneaker – Indigo Dew 'huge sale' under $130 best online bargains

Gas Detection Cameras

Shop for authentic ugg boots waterproof women SoftMoc, SoftMocs imperméables WINTER NISKA 2, noir noir, femmes 'exclusive bargains' under $50 easy returns

PTFE Modified Material

hope.net.vn

ブランドスーパーコピー

How to purchase cheap ugg pink slippers for women SoftMoc, Botte végane imperméable WILLOW 07, fauve, femmes 'budget-friendly shopping' under $190 secure payment

High End Thermography

Handheld Thermal Binoculars

Pure PTFE Sheet

Mica Sheet Paper

Soğanlık su kaçak tespiti Evimde su sızıntısı olduğunu bile fark etmemiştim, hızlıca buldular! https://astronomyfriends.com/ustaelektrikci

Your blog is a constant source of inspiration for me. Your passion for your subject matter is palpable, and it’s clear that you pour your heart and soul into every post. Keep up the incredible work!

Göztepe su kaçak tespiti Bakırköy’deki işyerimdeki su kaçağını bulmak kolay olmamıştı ama ekip çok profesyoneldi. https://chatasik.com/ustaelektrikci

Your blog is a treasure trove of valuable insights and thought-provoking commentary. Your dedication to your craft is evident in every word you write. Keep up the fantastic work!

Your blog is a testament to your passion for your subject matter. Your enthusiasm is infectious, and it’s clear that you put your heart and soul into every post. Keep up the fantastic work!

I wanted to take a moment to commend you on the outstanding quality of your blog. Your dedication to excellence is evident in every aspect of your writing. Truly impressive!

Wow superb blog layout How long have you been blogging for you make blogging look easy The overall look of your site is magnificent as well as the content

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective and engaging style set you apart from the crowd. Thank you for sharing your talents with us.

Your writing is a true testament to your expertise and dedication to your craft. I’m continually impressed by the depth of your knowledge and the clarity of your explanations. Keep up the phenomenal work!

Your blog has quickly become my go-to source for reliable information and thought-provoking commentary. I’m constantly recommending it to friends and colleagues. Keep up the excellent work!

Your blog is a true hidden gem on the internet. Your thoughtful analysis and in-depth commentary set you apart from the crowd. Keep up the excellent work!

Online shopping for cheap ugg classic short size Converse, Boys' ylor All Star Dinoverse Sneaker – Black Multi 'hurry up' under $190 free returns

Best deals for shopping ugg shearling boots Converse, Boys' Chuck Taylor All Star Gamer Hi Top Sneaker – White Black Citron 'on sale now' under $200 holiday sales

soscovid.univ-skikda.dz

How to buy cheap deals ugg tan boots Converse, Boys' El Distrito 2.0 Sneakers – Black White 'best offers online' under $80 online store

Find affordable products ugg boots for sale cheap Converse, Boys' Chuck Taylor All Star Glow Bug Hi Top Sneaker – Black Green 'promotions' under $60 new in store

Cork Sheet

Solar Battery 10kwh

Servo Motor With Integrated Controller

Variable Speed Drive Dc Motor

Mineral Fiber Rubber Sheet

Mineral Fiber Rubber Sheet Reinforced With Wire Mesh

ブランドスーパーコピー

Mineral Fiber Beater Sheet

Tefc

Buy quality for cheap ugg waterproof boots uk Converse, Boys' Chuck Taylor All Star Street Pirates Cove Sneaker – Black Multi 'hot offers this week' under $180 exclusive discounts

Vsd Motor Control

Acid Resistant Mineral Fiber Rubber Sheet

Your blog is a testament to your dedication to your craft. Your commitment to excellence is evident in every aspect of your writing. Thank you for being such a positive influence in the online community.

I loved as much as you will receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get got an impatience over that you wish be delivering the following unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike

Somebody essentially help to make significantly articles Id state This is the first time I frequented your web page and up to now I surprised with the research you made to make this actual post incredible Fantastic job

Your writing is a true testament to your expertise and dedication to your craft. I’m continually impressed by the depth of your knowledge and the clarity of your explanations. Keep up the phenomenal work!

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective and engaging style set you apart from the crowd. Thank you for sharing your talents with us.

Thanks I have just been looking for information about this subject for a long time and yours is the best Ive discovered till now However what in regards to the bottom line Are you certain in regards to the supply

Your blog is a treasure trove of valuable insights and thought-provoking commentary. Your dedication to your craft is evident in every word you write. Keep up the fantastic work!

Fluid Bed Dryer

How to save on ugg boots ankle uk Converse, Espadrille CHUCK TAYLOR ALL STAR GAMER, garçons 'budget-friendly shopping' under $160 buy with discounts

Expanded PTFE Sheet

ブランドスーパーコピー

Best online stores ugg boots kids black friday Converse, Espad. CHUCK TAYLOR ALL STAR DITSY FLORAL, filles 'exclusive bargains' under $180 new item discounts

Modified PTFE Sheet

Drying Production Line

Window Rubber Seal Strips

Flat Rubber Seal Strips

Laboratory Fluid Bed Dryer

Where to purchase cheap ugg shoes womens sale Converse, Baslets CHUCK TAYLOR ALL STAR AXEL CANVAS COLOR, indigo marine, garçons 'best markdowns' under $200 store promotions

Online shopping deals ugg gloves sale uk Converse, Espadrille ALL STAR JUNGLE JIVE, gris rose, filles 'new arrivals shopping' under $170 online exclusive sale

Display Shelves

Rubber Seal Strip

bluefilter.ps

Shop for cheap ugg classic mini bailey button sale Converse, Espadrille EL DISTRITO 2.0, noir noir, garçons 'discount clothing' under $190 best shopping offers

Disk Drying Machine

Best online stores ugg sale black friday 2024 Clarks, Men's Clarkslite Ave Wide Slip On Dress Shoe -Tan 'exclusive price drops' under $180 affordable deals

Tufted Bathmat

Where to buy cheap ugg boots sale genuine Clarks, Women's Breeze Bali Slip On Sneaker – Dark Grey 'clearance shopping' under $60 holiday product sale

Shop for cheap ugg boots classic mini sale 2024 Clarks, Women's Breeze Bali Slip On Sneaker – Black 'best store deals' under $190 free shipping on all purchases

Mica for Thermal-Protection

Baby Mat

Floor Rugs

Where to purchase cheap ugg sale winter 2024 uk Clarks, Women's Glide Post Thong Sandal – Lime 'new price drop' under $200 e-commerce discounts

Mica Laminate & Mica Washer

Mica Heating Elements

Buy authentic products ugg sale best deals Clarks, Men's Clarkslite Ave Wide Slip On Dress Shoe – Black 'hot discounts' under $50 best offers on items

Outdoor Rugs 8×10

Mica Insulator

Rubber Gym Flooring

ブランドスーパーコピー

Mica Roll

sakushinsc.com

Haraççı su kaçak tespiti Dairemizde yaşanan su kaçağını bulmak için gelen ekip çok bilgiliydi. Her aşamayı detaylı açıkladılar. Nazan E. https://helobym.com/ustaelektrikci

This post is both informative and enjoyable!

Non-Asbestos Sheets

Affordable online shopping ugg winter boots uk sale Crocs, Jibbitz Pink And Gold – 5 Pack 'new price drop' under $70 seasonal discounts

Best online shopping deals ugg classic short sale clearance Crocs, Jibbitz Toy Story – 5 Pack 'quality goods' under $190 shop with confidence

Excavator Undercarriage

Mineral Fiber Sheets

Asbestos Sheets

Mica Sheets

Washer

Hitachi undercarriage parts EX1100

Buy authentic for cheap ugg sale chestnut mini boots Crocs, Jibbitz Taco Tuesday 5 Pack 'exclusive price drops' under $50 best value deals

Find best discounts ugg womens mini boots sale Crocs, Jibbitz Get Swole 5 Pack 'best store deals' under $60 online promotions

ブランドスーパーコピー

mkkorea.dothome.co.kr

Shop for deals ugg sale boots clearance chestnut Crocs, Jibbitz Girls Icon – 5 pack 'best online promotions' under $200 storewide discounts

D11 dozer track roller single flange OEM

Cork Sheets

Wain Roy Bucket Teeth

I just could not depart your web site prior to suggesting that I really loved the usual info an individual supply in your visitors Is gonna be back regularly to check up on new posts

Somebody essentially lend a hand to make significantly articles Id state That is the very first time I frequented your website page and up to now I surprised with the research you made to make this actual submit amazing Wonderful task

Paraformaldehyde For Sale

Fast-setting Underlayment

Where to buy Popular brand FENDI Baguette card case Best price under $110 best deals online

Get Fendi Functional FENDI FF-print wallet Limited offer under $70 secure payment

graphite PTFE filament packing

Betaine Indol Acid

Factory Hsca Expansive Mortar

Ramie packing with silicone rubber core

http://www.mbautospa.pl

Cheap Authentic Stylish appearance FENDI Baguette wallet Discounted under $90 easy returns

Ceramic Fiber packing with PTFE impregnation

Argamassa expansiva Max Crack

ブランドスーパーコピー

Discount Fendi Effortlessly stylish FENDI Continental wallet Affordable price under $50 special discounts

Acrylic Fiber Packing with Rubber Core

Glass Fiber Packing

Fendi deals Latest model FENDI FF Diamonds leather cardholder Price drop under $190 free returns

Fantastic site A lot of helpful info here Im sending it to some buddies ans additionally sharing in delicious And naturally thanks on your sweat

I just wanted to express my gratitude for the valuable insights you provide through your blog. Your expertise shines through in every word, and I’m grateful for the opportunity to learn from you.

biosweet.eco

O-RINGS

China Expanded PTFE Sealing Tape Nanufacture

China Expanded PTFE Sealing Tape Supplier

China Expanded PTFE Sheet Supplier

China Expanded PTFE Sheet Manufacture

Get the lowest price real uggs uk Birkenstock, Women's Arizona Soft Leather 2 Strap Sandal – Brown 'year-end sale' under $170 exclusive shopping deals

Best online prices for ugg slipper sale Birkenstock, Women's Arizona Soft Footbed Birko-Flo 2 Strap Sandal – Brown 'huge discounts' under $100 online exclusive discounts

Remote IED Wire Cutter

Best Eod Robot

Shop for best deals ugg australia store Birkenstock, Men's Arizona Birko-Flor 2 Strap Sandal – White 'big discounts' under $160 trending online

Where to get discounted products mens ugg boots uk Birkenstock, Women's Arizona Soft Footbed Oiled Leather 2 Strap Sandal – Habana 'super savings' under $120 best price guarantee

ブランドスーパーコピー

How to shop for cheap ugg wool gloves Birkenstock, Women's Arizona Birko-Flor 2-Strap Narrow Sandal – White 'daily deals' under $140 top discounts online

Electronic Listening Device

Portable Uav Jammer

Bomb Suppression Container

Somebody essentially lend a hand to make significantly posts I might state That is the very first time I frequented your web page and up to now I surprised with the research you made to create this particular put up amazing Excellent job

방콕변마: https://www.fullmoonbkk.com/

Sırapınar su kaçak tespiti Yeniköy su kaçağı tespiti: Yeniköy’de su kaçağını modern yöntemlerle tespit ediyoruz. https://tagshag.com/1731253092339592_5399

Mica for Thermal-Protection

Well Cementation Fluids For Cementation

transhol.pl

Best discount prices fake uggs for sale Crocs, Women's Classic EVA Comfort Clog – Green Ivy 'hot product deals' under $90 special discounts

Oil Well Cementing

Mica Roll

Shop authentic products ugg caspia Crocs, Women's Classic EVA Comfort Clog – Blue Calcite 'premium products' under $60 exclusive discounts

Drilling Fluid Additives Pam

Corrosion Inhibiting Compound

Buy products cheap ugg kids Crocs, Women's Classic EVA Comfort Clog – Atmosphere 'must-have items' under $70 free returns

ブランドスーパーコピー

Saf Dispersant

Mica Insulator

Discounted items ugg london Crocs, Women's Classic EVA Comfort Clog – Dark Iris 'top shopping deals' under $100 new in store

Cheapest authentic products ugg clearance Crocs, Women's Classic Graphics EVA Clog – Hemp Army Green 'super deals' under $80 holiday sales

Mica Heating Elements

Mica Laminate & Mica Washer

I have been surfing online more than 3 hours today yet I never found any interesting article like yours It is pretty worth enough for me In my opinion if all web owners and bloggers made good content as you did the web will be much more useful than ever before

ブランドスーパーコピー

EXPANDED PTFE SEALING TAPE

How to buy High-technology FENDI abstract-print silk blouse For sale under $200 special prices

Fendi offers Remarkable FENDI logo-tape zip-up sweatshirt Save money under $60 online bargains

Uv Paint Machine

Get Fendi Highly recommended FENDI fine-ribbed bodysuit Limited offer under $150 buy cheap

Door Frame Automatic Paint Spraying Machine

Dust Cleaning Equipment

FLANGE INSULATION GASKET KITS

Buy Fendi Leading performance FENDI Fendi Mirror intarsia-knit top On sale under $160 trending products

PTFE PRODUCTS

Paint Spray Machine

PTFE GASKET

oldgroup.ge

Chrome Spray Paint Machine

GRAPHITE GASKET

Original Cheap Premium selection FENDI logo-print cropped sweatshirt Promo code under $180 fast and reliable