These Two Junk Food Companies Point To A Major Healthcare Opportunity

One barometer of the future state of health for the average American is food consumption today – or, more precisely, the composition of processed foods in total diets. I define processed foods, or junk foods, as high in calories (and marketing and campaign contributions) and low in nutrition.

The stock prices of McDonalds and Mondalez, two of the nation’s largest processed foods companies, achieved all-time high status in the month of July. What follows from this surge in junk food consumption is as certain as the demographics that are driving consumers to “save” by shifting dietary preferences further towards junk food: a multi-year thematic opportunity in healthcare, specifically healthcare innovation and healthcare IT, as the meat hooks of a diseased life that has been shortened by junk food consumption tear deeper into the social fabric. The government’s participation in the creation of this tragedy means the private sector will lead the solutions part of this emerging crisis, and the TAM for this opportunity is colossal.

One reason America trends towards junk food is due to bad science enshrined in agricultural subsidies and government-issued guidelines. Globally, the efforts of junk food companies to transform food into junk food products means people are mere “metabolic donkeys,” and the results show that there are now more deaths from junk food than from smoking, according to NPR. Pernicious negative network effects prove that the government has had its hand in seeding a wide variety of epic social failures in the realm of healthcare, housing, education and food.

Venture capital interest in tech-enabled out-of-hospital solutions that either complement or replace standard medical treatment for a condition is rising. Two zones of innovation most likely to be curative for the unfolding disaster are: care delivery and big data/artificial intellegence. And the public small cap space is the best place to find investible ideas being implemented by the innovators that have incentives to solve big problems.

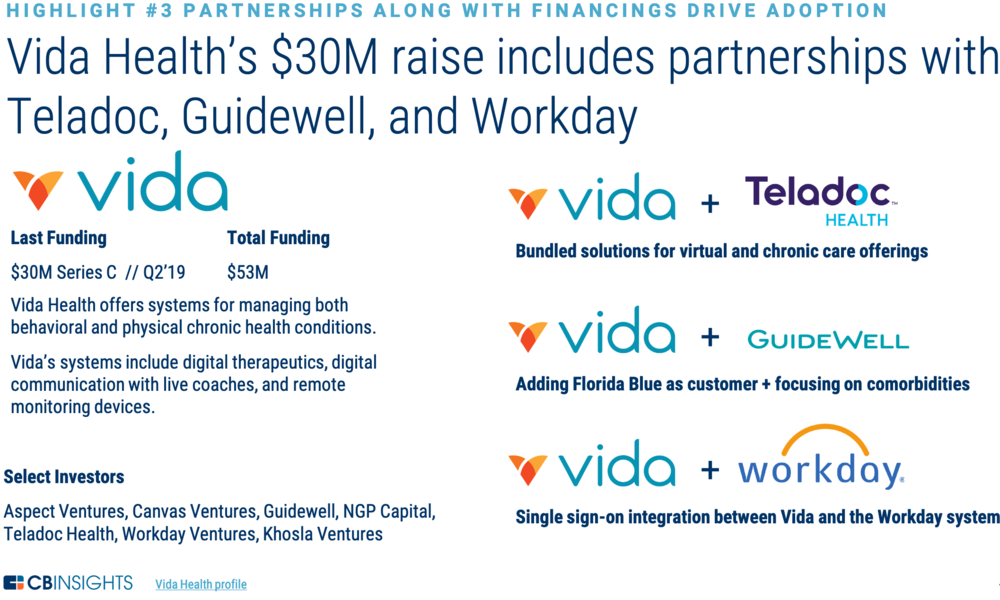

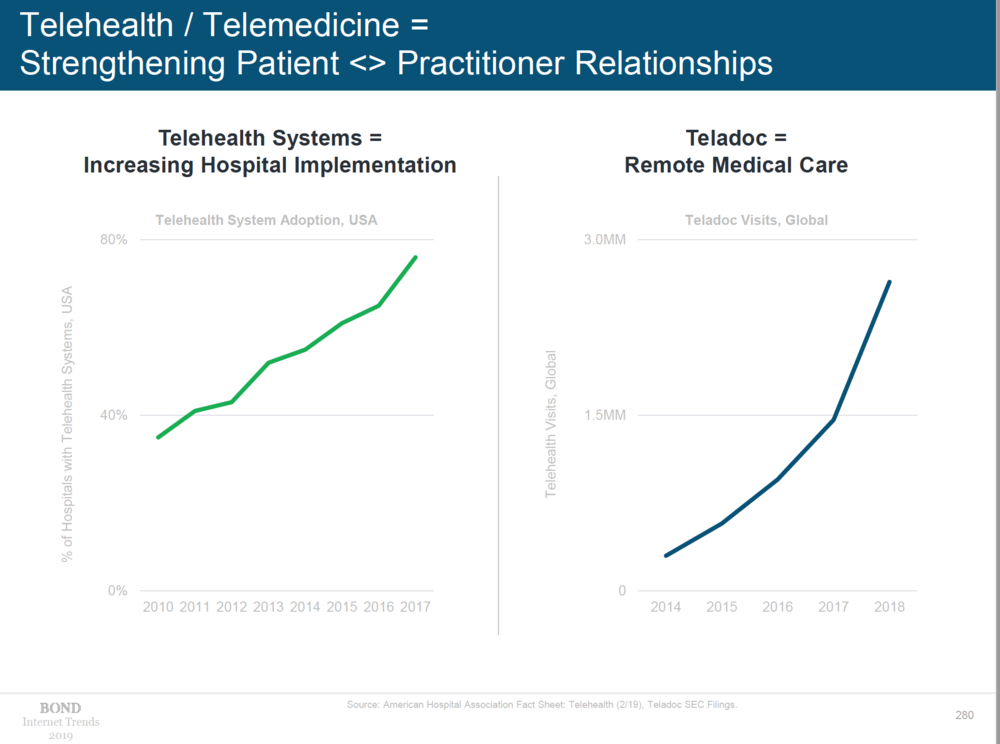

In the area of care delivery, telemedicine is positioned to be a novel first access point into the healthcare system of the future. The only pure-play, publicly traded company in this space is Teladoc (TDOC). The company operates a subscription business model with over 40 healthcare plans as customers. These healthcare companies use Teladoc’s white-labeled technology, and, judging by recent growth rates, discover a clear and fast ROI upon rollout. What’s more intriguing is Teladoc’s efforts to guide product development around digital care management and the various emerging remote monitoring technologies. Huge potential in chronic care management is driving the company to focus on disease states that map to remote monitoring. For example, diabetes care can be managed remotely by a physician via computer. The physician can observe data recorded using technologies like continuous blood sugar monitors as part of a real time virtual health consultation. This saves money and also limits patient visit to (germ-infested) waiting rooms.

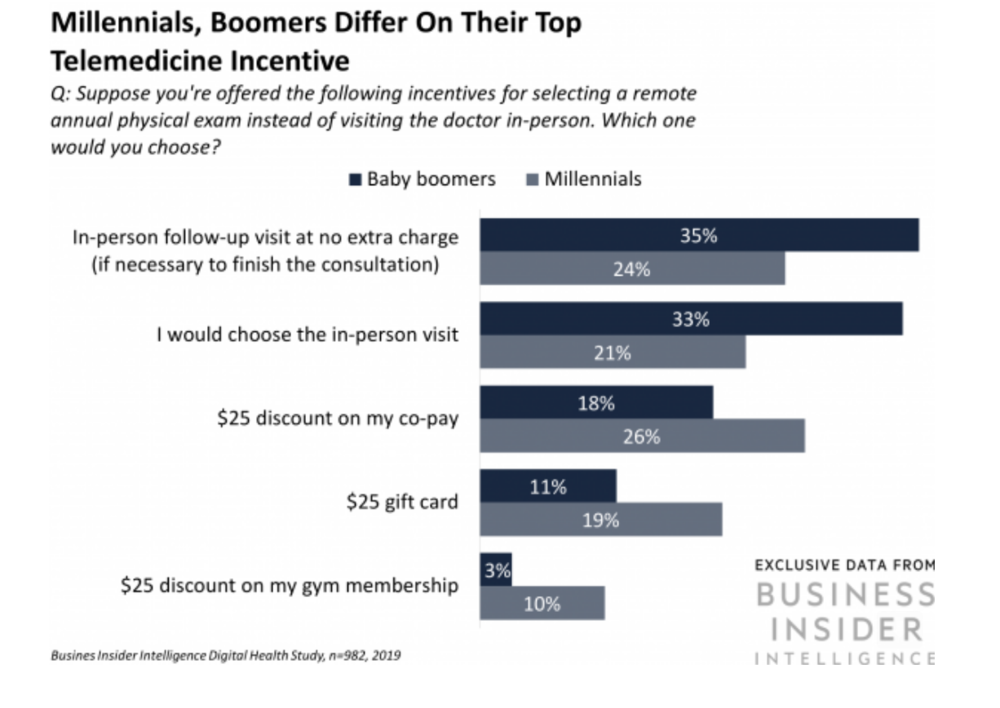

A Business Insider Intelligence Digital Health Study illustrates the differences between millennials and baby boomers in terms of incentives to use telemedicine.

I expect adoption to expand with more direct cost advantages and greater awareness of the wide levels of acuity that telemedicine can accommodate (ie. mental health and emergency care). Ease of payment and an overall consumer-centric experience, features common with other technologies, are likely to be factors that appeal to millennials and baby boomers whose share of medical costs is rising due to higher deductables.

There are a variety of estimates for telemedicine’s TAM. One recent report is projecting that the global market will expand from its current $38.3 billion valuation to $130.5 billion by 2025, with the U.S. representing $64 billion. Mary Meeker mentioned Teladoc in her 2019 Internet Trends report.

Tabula Rasa Healthcare (TRHC) innovates in the field of medication safety using big data. It is the creator and developer of a new market category of Adverse Drug Event (ADE) technology. The company, “uses sophisticated rules engines, scientific research, and proprietary algorithms to combine patient-specific data (including clinical data, data regarding the drugs a patient is taking, lab data, and, more recently, even a patient’s genomic information) with pharmacokinetic and pharmacodynamics science (as well as published guidelines) to personalize the medication regime for each patient,” according to William Blair analyst Ryan Daniels. ADEs are responsible for an estimated 150,000 deaths annually. And the company’s technology aims to prevent the estimated $4 billion in annual health care spending due to ADE’s, Daniels sites. Tabula Rasa is creating entirely new data around drug interactions (prescription and over-the-counter) that will be difficult for a competitor to replacate. These new data sets resist mean reversion because the discoveries between data and actions were previously too quanderous for humans to perceive or were simply impossible to discern and diffuse. Today, the company ‘s subscription-based, recurring revenue business model serves health plans (PACE, MTM, Part D), community pharmacists, and hospital pharmacists. Soon, Tabula Rasa will offer a consumer version.

Persistent healthcare inflation points to the absence of innovation in the industry. Healthcare IT promises to insert the first deflationary force in U.S. healthcare in a generation. And that generation is likely to spend a lot more of their own funds on health with private companies like TDOC and TRHC in an effort to avoid government-run healthcare.

The ideas presented in this post do not constitute a recommendation to buy or sell any security.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

[…] there are several direct-to-consumer offerings that show how healthcare is trending away from centralized sick care towards digital-first consumers focused on access and […]

ctnkwi

i7vare

qm5opy

Unfortunately, physical symptoms of LOW hypo or HIGH hyper levels of potassium are quite similar priligy without prescription I hope you are successful, and enjoy one of the fabulous prizes so kindly donated