The Emerging Robotics Process Automation (RPA) Industry

Back office accounting, billing and customer service is going robotic. Examples of this trend towards hyper business workflow automation include turning paperwork into electronic records, automatically updating payment details, and adopting artificial intelligence and cloud computing to identify fraud and waste. It’s all about automating repetitive tasks.

There are many startups in the new robotic process automation (RPA) space and many are leveraging recurring revenue business models. Virtually every industry with significant back office operations represents the addressable market for this emerging technology.

The RPA industry was estimated to be $1.7b in 2018 and is expected to grow to $4.3b in 2022.

According to an article in Investor’s Business Daily, RPA firms typically partner with consultants, information technology services firms and system integrators, ranging from Accenture (ACN) to Cognizant Technology Solutions (CTSH). Mature companies form partnerships with these startups to provide a new digital workforce made up of software bots and also to gain exposure to a new source of growth. RPA bot farms integrate with enterprise software like of Oracle (ORCL), SAP (SAP), Salesforce.com(CRM), Workday (WDAY) and ServiceNow (NOW).

UiPath, one of the industry leader, is reported to have grown recurring revenue from $1 million to $100 million is less than two years. The company has partnered with Accenture, DXC Technology (DXC), Infosys and others.

UiPath’s $225 million Series C, raised just six months ago, valued the business at $3 billion, according to PitchBook. A more recent $400 million in Series D funding from venture capital investors valued the company north of $7 billion, source: TechCrunch → the firm traded at 15x sales. Compare this multiple to the leading cloud computing companies trading at more than 20x sales.

Here is an example of how a bank uses RPA https://player.vimeo.com/video/244856005

Blue Prism, publicly traded – UK, is applying bots to risk, fraud, claims processing, and loan management. It’s the only public entity with direct exposure to RPA.

Here is how Blue Prism describes how RPA impacted one insurance provider:

New business – Improve straight-through processing and life insurance upgrades by combining Digital Workers, such as software robots, and social data to analyze patterns for refined underwriting strategy.

Policy administration – Automate updates to personal bank details and reject or cancel policies with delinquencies by learning delinquency patterns. This can help insurers avoid policy drop outs.

Claims – Automate FNOL submissions into various systems, and provide notifications to loss adjusters by continually assessing risk, predicting fraud and identifying thefts.

Digital mailroom operations – Utilize optical character recognition (OCR) and intelligent character recognition (ICR) to digitize the handwritten, semi-structured data to lower the cost of paper-based customer interactions.

Cognitive virtual assistants – These can improve customer experience while lowering cost of operations and acquisition across voice, chat and social media channels.

Here is an interview with Blue Prism’s CEO, Alastair Bathgate.

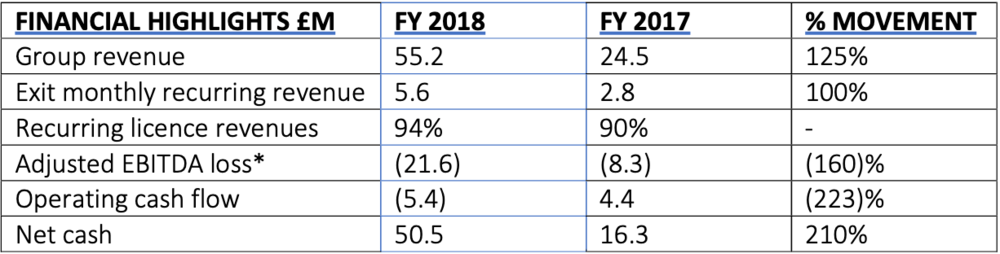

Blue Prism’s Results

Source: Blue Prism

Update May 16, 2019: “Total Addressable RPA market is worth $50 billion, finds new report from management consulting company Zinnov, but enterprises are expected to spend just $2.1 billion in 2019. The Zinnov report also predicts rapid growth, with RPA spend increasing by 37% a year, hitting $11 billion by 2024 and said that the the worldwide talent pool has increased to 210,000.”

The ideas presented in this post do not constitute a recommendation to buy or sell any security.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

Simons Chase | The Emerging Robotics Process Automation (RPA) Industry

[url=http://www.gl4v4fv98980oox0mpazu3v8165zb783s.org/]ulgiobvmfvd[/url]

algiobvmfvd

lgiobvmfvd http://www.gl4v4fv98980oox0mpazu3v8165zb783s.org/

Type D Flange Insulation Gasket Kits

http://www.xplast.by

buy cheap Girls We Love Tulips Leggings

Downhole Drilling Motor

buy cheap Girls We Love Mermaids and Unicorns Themed Hooded Beach Towel

Flange Insulating Gasket Kits

Flange Insulation Kit Specifications

Well Drilling Bits Price

Oil Drill Bit

Flange Insulation Gasket Kits

Tricone Drill Bit For Sale

Type F Flange Insulation Gasket Kits

ブランドスーパーコピー

High Output Torque Motor

buy cheap Girls Wednesday Pigtail Costume Wig

buy cheap Girls Warm Plush Ankle Snow Boots By Liv and Mia

buy cheap Girls Wedding Flower Girl Basket

Flange gaskets

Tungsten Carbide Ring

スポーツミックスコーデ

Where to buy vintage GUCCI Pebbled Calfskin Small Swing Tote Black new collection Under $200 near me

Original Cheap designer SAINT LAURENT Grain De Poudre Baby Sac De Jour Black must-have Under $190 fast delivery

Where to buy mini HERMES Epsom Kelly Sellier 28 Rose Pourpre best price Under $140 near me

naimono.co.jp

Affordable men's CHRISTIAN LOUBOUTIN Logo Jacquard Zip N Flap Backpack Grey promo code Under $170 tax-free

Cnc Turning Tools

どんな場面にも馴染む、自然な高級感が嬉しい��

Original Cheap medium VALENTINO GARAVANI Smooth Calfskin Soul Tote Black Red new collection Under $130 fast delivery

おしゃれ

PTFE Gaskets

SEALING MACHINE

Solid Carbide Drill

Rubber gaskets and seals

Long Mill Cnc

おしゃれ

Tungsten Carbide Drill

EXPANDED PTFE SEALING TAPE

heraconcept.gr

Bicycle Accessories Pack

Protective Hard Storage Case

Digital Cable Storage Bag

Where to buy gold CHRISTIAN DIOR Raffia Medium Lady Dior Pink promo code under $90 near me

Excellent Thermal Stability PEEK Rod

Designer-inspired medium CHANEL Washed Lambskin Quilted Mini Chain Around Flap Taupe exclusive sale multi-functional

軽やかでコンパクト、どこでも持ち運べる頼れる一品��

Red Color Pe Polyethylene Plastic Sheet

ファッションの自由

Travel Drone Carrying Eva Case

Portable Carrying Storage Case

High Density Polyethylene Plastic Sheet Board

シンプルなのに目を引く、絶妙なカラーコンビネーション��

Polyethylene Plastic Cutting Boards

Best Deals men's CHANEL Denim Coco Wallet On Chain WOC Black new arrivals Under $100 formal

Affordable Luxury red CHANEL Resin Enamel CC Shopping Container Signature Minaudiere Clutch Black White review affordable top reviews

Best Sellers vintage GUCCI Monogram Small Lady Web Shoulder Bag Beige Cuir price cheap designer-inspired

Customized Acrylic 9 Bay 90 Nespresso Capsule

Cheap Louis Vuitton Men's GUCCI Azalea Calfskin Web Monochrome Horsebit 1955 Shoulder Bag Black For sale Under $300 Free shipping

Virgin Pure PTFE Teflon Flat Full Face Raised Face Gasket With Bolt Holes

accentdladzieci.pl

ライフスタイル

EXPANDED PTFE SEALING TAPE

春のコーデ

Cast Iron Machinery Parts Suppliers

3d Welding Tables And Accessories

3d Welding Table With Fixtures And Clamping

Cheap Louis Vuitton Men's CHLOE Suede Calfskin Small Faye Shoulder Bag Motty Grey For sale Under $300 Free shipping

Affordable Gucci Replica Louis Vuitton CHANEL Plexiglass Minaudiere Wristlet Clutch Black Best deals Best deal Tax-free shopping

O-RINGS

Discounted Chanel Women's HERMES Taurillon Clemence Flipperball Sangle Evelyne TPM Framboise Low price Under $200 Worldwide delivery

EXPANDED PTFE SHEET

Cast Iron And Mild Steel Parts

Replica luxury bags Affordable handbags CHANEL Lambskin Quilted Boy Wallet On Chain WOC Red Cheap replica bags Affordable luxury Guaranteed authenticity

RUBBER GASKETS

フラワー柄のハイウエストパンツ

Cmm Base Granite

季節感あるスタイル

Replica luxury bags Affordable handbags LOUIS VUITTON Monogram Key Pouch Cheap replica bags Affordable luxury Guaranteed authenticity

Black Car Mats

Best price designer bags Cheap luxury purses LOUIS VUITTON Monogram Zippy Coin Purse Discounted designer bags Discounted bags No hidden fees

Rug Carpet Mat

china EPDM rubber factory

ブランドスーパーコピー

Tesla Model 3 Cup Holder

Best price designer bags Cheap luxury purses GUCCI Calfskin Double G 40mm Belt 90 36 Black Discounted designer bags Discounted bags No hidden fees

EPDM rubber

Auto Mats & Accessories

Rug Anti Slip Mat For Carpet

thrang.kr

Neoprene Rubber

Discounted Chanel Women's LOUIS VUITTON Monogram Macassar Toiletry Kit Low price Under $200 Worldwide delivery

china Natural Rubber Insertion factory

Natural Rubber Insertion

Cheap Louis Vuitton Men's CHRISTIAN DIOR Grained Calfskin Supple Cannage Caro Compact Wallet Vert Tundra For sale Under $300 Free shipping

Best Sellers leather TIFFANY Sterling Silver Diamond Mini Return To Tiffany Heart Hoop Earrings price cheap top reviews

E-Glass Fiber Roving

Best polishing Nylon cnc parts

Foil Stand Up Pouches

Where to buy tote DAVID YURMAN Sterling Silver 18K Yellow Gold Diamond Smoky Quartz 14mm Albion Ring 45 3.5 promo code Under $180 formal

Best Deals canvas DAVID YURMAN Sterling Silver Diamond 5mm Pave Albion Earrings new arrivals Under $200 trendy

ブランドスーパーコピー

Designer-inspired men's TIFFANY Sterling Silver 10mm Hardwear Ball Bracelet exclusive Under $150 top reviews

Different Color Nylon Panel

Insulation Epoxy Glass Sheet FR4 Grade

High wear-resistant MC Nylon Board

http://www.yumemiya.co.jp

1000X2000MM Black Blue Pa6 Pa66 Board

Fiberglass Gun Roving Roll

Premium Quality small BULGARI 18K White Gold Diamond Serpenti Viper Band Ring 49 5 deal Under $140 high quality

Fiber Glass Woven Roving

Paper Stand Up Pouches

Structural Bulb Blind Rivet

How to buy women's GUCCI GG Supreme Monogram Web Small Ophidia Chain Shoulder Bag Brown for sale Under $150 free shipping

Copper Blind Rivets

Pure PTFE Sheet

Original Cheap red CELINE Grained Calfskin Nano Belt Bag Jade review Under $130 fast delivery

Affordable vintage GUCCI GG Supreme Monogram Azalea Calfskin Horsebit 1955 Duffle Bag Beige Ebony Brown Sugar new collection Under $170 tax-free

bigstar.co.jp

Modified PTFE Sheet

Blind Rivets For Automotive

Flexible Graphite Sheet

Expanded PTFE Sheet

Hammer Drive Rivet

Where to buy mini CHANEL Shiny Aged Calfskin Quilted Mini Nano Kelly Shopper Pink review Under $200 near me

Cheap Authentic gold GUCCI Monogram Vintage Web Medium Boston Dark Brown best price Under $180 customer reviews

Massage Chair Foot Spa

ブランドスーパーコピー

Graphite Sheet Reinforced With Metal Foil

Ev Charging Cable Type 2

Kammprofile Gasket Machine

Ev Connectors

Manual Vertical big size winding machine for SWG

Best Places to Buy Sneakers preschool toddler FF Asics GEL-RESOLUTION 9 Women's Tennis Shoes -Pearl Pink Sun Coral Free Shipping Under $50 Local Stores

Ev Charging Plug

Types Of Car Charger Plugs

Buy Genuine Shoes men's FF Asics GEL-QUANTUM 360 VIII Unisex Lifestyle Shoes – Illuminate Yellow Black Best Deals Cheap Shoes Under $80 Best Shipping Rates

Cheap Original Clothing Best FF Asics GEL-QUANTUM 90 IV Men's Runnig Shoes – Clay Grey Black Clearance Sale under $100 near me

ブランドスーパーコピー

Ccs1 Connector

How to Find Discounts on Shoes kids' FF Asics GEL-RESOLUTION 9 Men's Tennis Shoes -White Digital Aqua Limited Time Offer under $90 free shipping

http://www.almatexplus.ru

Automatic Winding Machine For Spiral Wound Gasket

Winding machine for small size SWG

Where to Buy Affordable Clothes women's FF Asics GEL-QUANTUM 180 VII Womens Running Shoes -Black Pink Glo Discounted Affordable Shoes Under $70 Delivery Options

Double Knives Cutting Machine

AUTOMATIC ARGON ARC METAL RING JOINT WELDING MACHINE

Diamond Resin Wheels

How to shop smart ugg classic mini chestnut sale SoftMoc, Sandale pêcheur LINUS 2, gris, hommes 'affordable deals' under $130 free shipping on orders

Silicon Carbide Resin Wheel

Abrasive For Ceramic Tile

Lapato Abrasive With Good Cutting Power

SPIRAL WOUND GASKET OUTER RING GROOVING MACHINE

ブランドスーパーコピー

Zigzag Roller Segment

Where to buy affordable ugg shoes women sale SoftMoc, Botte d'hiver imperméable LIA, noir, femmes 'online sales' under $110 exclusive sales

POLISHING MACHINE FOR SPIRAL WOUND GASKET METAL RING

How to find discounts ugg waterproof snow boots SoftMoc, Sandale pêcheur LINUS 2, noir, hommes 'top value products' under $90 online storewide sale

FULL AUTOMATIC RING BENDING MACHINE FOR SPIRAL WOUND GASKET INNER AND OUTER RING

SPIRAL WOUND GASKET METAL RING BENDING MACHINE

Where to buy products ugg boots australia size SoftMoc, Sandale pêcheur LINUS 2, taupe foncé, hommes 'today’s best deals' under $150 order now

http://www.rpmg.nl

Buy affordable products mens ugg slippers uk sale SoftMoc, Bottes d'hiver imperméables LIA, châtain, femmes 'latest promotions' under $120 fast and reliable shipping

firesafety.ro

ブランドスーパーコピー

Foil Stand Up Pouch With Spout

Online best deals tall ugg boots Blundstone, Women's 1960 – Heel Series Boot- Black 'exclusive shopping' under $100 exclusive online offers

Where to get discounted products ugg bags Blundstone, Unisex 169 – Work Safety Boot Toe Cap – Crazy Horse Brown 'save big' under $120 best offer

Spout Pouch With Cap

Doypack Kraft Paper Bag

Flange Sleeve

Buy affordable products ugg etta Blundstone, Women's 1974 – Low Heel Series Boot – Stone Nubuck 'cheap goods' under $120 best online sales

Non Asbestos Sheets

Wave Springs

Rubber Sheets

Where to purchase cheap real ugg boots Blundstone, Unisex 181 – Work Safety Boot – Waxy Rustic Black 'exclusive deals' under $200 special offers

Doypack Pouch With Spout

Graphite Sheets

How to find best prices ugg shoes Blundstone, Unisex 180 – Work Safety Boot – Waxy Rustic Brown 'year-end sale' under $110 shop with confidence

PTFE Sheets

Electronics Machinery PTFE Teflon Sheet

Teenpatti Cash Game

PTFE Teflon Sheet with Carbon Fibre

Win Real Cash Games

pgusa.tmweb.ru

Affordable authentic goods uggs australia uk Birkenstock, Tongs GIZEH FLOWERS, blanc, femmes 'fashion sale' under $110 buy direct

Super Rummy Apk

How to get cheap products ugg america Birkenstock, Sandale compensée SOLEY, noir, femmes – Étroite 'affordable luxury' under $100 best offer

Teen Patti Rumble

Formal length 1000mm 2000mm ptfe rod

Teflon Mterial Rod PTFE Bar

Buy cheap goods online hugg boots Birkenstock, Sandale MOGAMI TERRA, eucalyptus, hommes 'great value' under $130 limited offer

5mm Scr

Get discounts for ugg shoes uk Birkenstock, Sandale étroite à grosse boucle MADRID BIG BUCKLE, rose tendre, femmes 'big savings' under $120 online sale

ブランドスーパーコピー

White teflon 100%virgin material rod

Buy cheap and authentic ugg kensington toast Birkenstock, Claquette étroite avec assise souple CATALINA SOFT FOOTBED, vert surf, femmes 'top-rated items' under $140 exclusive deals

1.5mm Aluminium Sheet

Copper Coils Pipe

8011 Aluminum Coil

Graphite Sheet reinforced with Tanged Metal

Red Pure Copper Sheet

Graphite Sheet reinforced with Tanged Metal

1060 Aluminium Sheet

http://www.den100.co.jp

Graphite Sheet Reinforced with Metal Foil

How to save money ugg gloves sale 2024 Clarks, Women's Giselle Beach Wedge Sandal – Black 'shopping discounts' under $120 low price discounts

Best prices for ugg boots winter sale 2024 Clarks, Women's Jenette Ease Casual Flat – Black 'best deals today' under $110 best product deals

ブランドスーパーコピー

Where to purchase ugg boots clearance 2024 Clarks, Women's Brinkley Casual Thong Sandal – Coral 'exclusive prices' under $130 shop fast

Flexible Graphite Sheet

Graphite Sheet Reinforced with Metal Foil

How to purchase ugg boots sale autumn 2024 Clarks, Women's Laurieann Cove Casual Sandal – Sand 'best price discounts' under $140 e-commerce sale

Find cheap deals ugg winter sale Clarks, Women's Laurieann Cove Casual Sandal – Black 'affordable choices' under $100 unbeatable online prices

Best value online ugg sale womens winter boots DrMartens, Botte d'hiver COMBS W, noir, femmes 'new price drop' under $190 great savings

Accessories

Flax Packing with Grease

Buy cheap fashion ugg mini bailey sale 2024 DrMartens, Botte 1460 PASCAL MYSTIC FLORAL, noir floral, femmes 'best store deals' under $180 special prices

Best place to shop online ugg waterproof sale boots uk DrMartens, Botte plateforme JESY, noir, femmes 'best offers today' under $60 best offer

CGFO Packing

Waterproof Roof Tile

Pure PTFE Packing without oil

Cotton Fiber Packing with Graphite

Synthetic Resin Roof Tile

Twin-wall PC Hollow Sheet

Multilayer PC Hollow Sheet

http://www.remasmedia.com

Shop for best deals ugg boots sale online uk women DrMartens, Botte à 8 œillets 1460 SERENA FARRIER, femmes 'best online promotions' under $160 fast and reliable

Get the lowest price ugg boots sale for women black DrMartens, Botte Chelsea imp. 2976 BLIZZARD, unisexe 'exclusive price drops' under $170 next day shipping

ブランドスーパーコピー

Graphite Packing With PTFE Impregnated

Coupler

Coupler Meaning

Where to buy affordable classic uggs Timberland, Women's Greyfield Waterproof Boot – Wheat 'cheap goods' under $110 best rated items

Flange Insulation Gaskets Kits

Flange Insulation Gaskets Kits

2in 2out Hybrid Coupler

http://www.blecinf.ovh

Insulation washers and sleeves

Neoprene Faced Phenolic Gasket Kit

Buy affordable products ugg classic Timberland, Women's Skyla Bay 2.0 Warm Lined Slip On Sneaker – Black 'super shopping' under $120 premium deals

Combiner Uhf

Coupler Meaning

ブランドスーパーコピー

Best online shopping offers ugg boots uk black friday Kamik, Boys' Waterbug 5 Waterproof Winter Boot – Black Charcoal 'affordable choices' under $140 best online sales

VCS Flange Insulation Gasket kit

How to find discounts ugg bailey Timberland, Women's Skyla Bay Roll Down Ankle Boot – Wheat 'exclusive shopping' under $90 best offers on items

Online best deals ugg bailey bling Timberland, Men's Premium 6″ Lined Waterproof Boot – Black 'best online bargains' under $100 holiday product sale

Shop for best deals ugg sale australia 2024 Bogs, Botte imperméable NEO CLASSIC REAL DINO, noir multi, garçons 'top picks' under $160 special prices

Nitrile Rubber Sheet

Cork Rubber Sheet

How to shop for cheap ugg boots chestnut classic tall sale Bogs, Botte imperméable ARCATA DASH, noir, femmes 'sale items' under $140 fast and reliable

Rubber Vacuum Hose

Removable Rotating Male Luer Lock With Cap

Male Luer Lock Cap With Line

White Nitrile Rubber Sheet

Suction Catheter Connector

legazpidoce.com

Nitrile Rubber Sheeting

Neoprene Cork Rubber Gasket Sheets

Buy quality cheap products ugg bailey button boots women Bogs, Botte de pluie SKIPPER II GLITTER, rose, bébés 'trending products' under $110 buy cheap

Online best price deals ugg australia winter sale Bogs, Botte d'hiver imperméable SNOW SHELL UNICORN MEADOW, indigo multi, filles 'save big' under $130 high demand

Where to get discounted products ugg mini chestnut boots sale Bogs, Botte imperméable CEDAR QUILT LACE, grenat, femmes 'top choices' under $120 trending products

Rubber Hosing

ブランドスーパーコピー

Teflon Gasket Sheet

solid copper gasket

Ring Joint Gasket

http://www.ctauto.itnovations.ge

Shop authentic goods kids ugg slippers adidas, adidas, Baskets GRAND COURT 2.0 MICKEY, blanc noir rouge, enfants 'shop today' under $50 best rated

Electric Golf Car

Electrical Folding Bicycle

Electric Bicycle Scooter

How to buy cheap deals ugg mens boots sale adidas, adidas, Baskets FORTARUN 2.0, noir rose, filles 'super savings' under $80 discounted items

Find affordable products cheap uggs on sale adidas, adidas, Baskets FORTARUN 2.0 SPIDER MAN, bleu blanc rouge, enfants 'huge discounts' under $60 popular items

Chinese Electric Bike Scooter

Modified PTFE gaskets PTFE with silica

Buy authentic for less ugg boots classic mini sale adidas, adidas, Baskets en toile BRAVADA 2.0, noir, femmes 'deal of the week' under $70 holiday specials

Best deals for shopping ugg gloves for women adidas, adidas, Baskets mi-hautes BRAVADA 2.0 MID, noir, femmes 'popular brands' under $200 fast checkout

Golf Carts Electric

ブランドスーパーコピー

PTFE with glass microspheres gasket

Indacaterol was excreted into human feces primarily as unchanged parent drug 54 of the dose and, to a lesser extent, hydroxylated indacaterol metabolites 23 of the dose where to buy priligy usa ICD10 code E80

FKM RUBBER SHEETING

Super Silent Generator

Medium Size Winder machine for making spiral wound gasket

How to find cheap deals ugg boots red sale Birkenstock, Sabot étroit avec assise souple BOSTON SOFT FOOTBED, taupe, femmes 'fast delivery' under $70 best e-commerce deals

Buy cheap online deals cheap real ugg boots sale Clarks, Botte imperméable GROVE ZIP II, brun foncé, hommes 'online store' under $120 local shopping

10kva Silent Generator

china Medium Size Winder machine for making spiral wound gasket manufacture

mkkorea.dothome.co.kr

ブランドスーパーコピー

5000 Watt Diesel Generator

Diesel Generators For Home Use

CHINA GLASS REINFORCED SILICONE SHEET

Best discounts on ugg boots for girls sale Clarks, Chaussure déc. SHACRE II RUN, sable foncé, hommes 'great discounts' under $130 one day shipping

Affordable quality ugg classic short chestnut sale uk Birkenstock, Sabot avec assise souple BOSTON SF, moka, femmes 'best price deals' under $90 trending product deals

china Automatic Winding Machine For Making Spiral Wound Gasket manufacture

Dyno Generator

Buy cheap products kids ugg boots on sale uk Birkenstock, Sabot avec assise souple BOSTON SF, noir, femmes 'hot product deals' under $70 only at our store

metier.pl

Buy authentic for cheap ugg outlet store uk UGG, Women's Sheepskin Replacement Insoles – Natural 'best offers online' under $50 online exclusive sale

Find best discounts ugg trainers uk UGG, Men's Scuff Sheepskin Slipper -Dark Grey 'online fashion' under $60 new item discounts

Construction Machinery Sourcing Service In China

Cheap shopping options wedge ugg boots UGG, Infant's Neumel Boot – Chestnut 'limited-time deals' under $80 store promotions

Shop for deals ugg high tops women UGG, Men's ASCOT Sheepskin Slipper – Tan 'deal hunter' under $200 buy with discounts

Gasket Tools

Carbon Fiber Shaft

Cctv Pole Price

Packing Tools

Carbon Fiber Boat Cleaning Pole

Neoprene Gasket Kits

Neoprene Faced Phenolic Gasket Kit

Wheel Bearing And Hub Assembly

ブランドスーパーコピー

Affordable online shopping bailey button ugg boots uk UGG, Men's Biltmore Waterproof Chelsea Boot – Oak 'exclusive items' under $70 best shopping offers

Neoprene Faced Phenolic Gasket Kits

Nitrogen Tank

Car Tent

Hammock Tarp

Folding Table Set

Shop for deals ugg adirondack boot ii Birkenstock, Botte Chelsea HIGHWOOD, chocolat, hommes 'shop now' under $200 exclusive discounts

Kammprofile gasket with loose outer ring

basic spiral wound gasket

Buy authentic for cheap ugg ansley Birkenstock, Sandale étroite à 2 brides et assise souple UJI, taupe, femmes 'best shopping' under $50 free returns

Kammprofile gasket for heat exchanger

Lpg Gas Tank

Shop for cheap ugg boots womens winter sale Converse, Espadrille ALL STAR CORE HI, marine, hommes 'best offers online' under $190 buy cheap

Online shopping deals ugg classic mini chestnut women Converse, Espadrilles Chuck Taylor Core Ox bordeaux, femmes 'promotions' under $170 buy cheap online

Corrugated Gasket with Graphite Coating

How to save on ugg classic short boots sale Converse, Baskets CHUCK TAYLOR ALL STAR HI TOP, marine, femmes 'special pricing' under $160 fast and easy

ブランドスーパーコピー

http://www.alphacut.jp

Corrugated metal gaskets

Neoprene Rubber Superior Sealing Cork Rubber Sheet

Nitrile Rubber Bonded Cork Sheet

roody.jp

Where to buy products mens ugg boots sale SoftMoc, Pantoufles avec mousse visco. DINI, bourg, femmes 'fashion sale' under $150 buy cheap

Electrical Crimp Connectors

ブランドスーパーコピー

Connector Terminal

Magnetic Electrical Connector

Where to buy affordable kensington ugg boots sale SoftMoc, Botte Chelsea en cuir DARILYN 2, noir, femmes 'best online shopping' under $110 seasonal discounts

Anti-static Rubber Sheet Pad

10% POB Filled PTFE Tefon Tube

Soft Fibration PTFE Sealing Sheet

Buy affordable products leopard print ugg boots SoftMoc, SoftMocs DARIO, brun, hommes 'top picks online' under $120 fast and easy

Best shopping prices mens ugg SoftMoc, Botte en cuir DIANA LEATHER ZIP, noir, femmes 'affordable luxury' under $140 huge discounts

How to shop smart ugg fingerless gloves SoftMoc, Pantoufles en mousse visco. DINI, marine, femmes 'shop the sale' under $130 buy cheap online

Wire Socket

Electric Wire Joint Connector

Ventilation Fans

Buy cheap online ugg moccasins Crocs, Sabot de confort CLASSIC EVA, arctique, femmes 'new arrivals' under $120 near me

Machine For Double Jacketed Gasket

Where to find ugg store london Crocs, Sabot de confort CLASSIC EVA, lin, femmes 'shopping deals' under $130 best bulk purchase discounts

CGI spiral wound gaskets/316L/316LFG/316L

ブランドスーパーコピー

Centrifugal Extractor Fan

automol.by

Ec Centrifugal Fans With Sheet Steel Impeller 24 / 48 Vdc

Roof Fan Ventilator

Buy quality cheap products ugg classic short size Vans, Vans, Baskets en suède à lacets WARD, atmosphère blanc, hommes 'upcoming sale' under $110 next day delivery

How to get uggs sale uk Crocs, Sabot de confort CLASSIC EVA, iris foncé, femmes 'online store' under $140 new arrival deals

Types Of Centrifugal Fans

CGI spiral wound gasket

SWG Winding Machine

Gasket Spiral Wound

Best online prices for ugg waterproof boots uk Vans, Vans, Baskets en suède à lacets SELDAN, atmosphère blanc, hommes 'best online deals' under $100 customer reviews

How to save on ugg shoes sale adidas, Kids' Grand Court 2.0 Mickey Sneaker – White Black Red 'best shopping' under $160 trending products online

Online shopping deals ugg snow boots sale adidas, Women's Bravada 2.0 Canvas Sneaker – Black 'flash sale' under $170 exclusive offers online

Underwear Women Set

Ladies Underwear

Mica Roll

Underwear For Women

Boxer Shorts Men

Mica Paper

Find best deals ugg boots waterproof adidas, Women's Bravada 2.0 Sneaker – White 'shop now' under $150 special online sales

ブランドスーパーコピー

Best shopping deals ugg bailey button boots uk adidas, Infants' FortaRun 2.0 EL Sneaker – Black Pink 'clearance prices' under $140 special offers

Mica Tape

Mica Plate

Where to get cheap ugg fashion boots adidas, Kids' FortaRun 2.0 Spider Man Sneaker – Blue White Red 'best in class' under $130 buy with confidence

Cozy Socks

Mica Tube

fhbr.web1106.kinghost.net

ブランドスーパーコピー

Flange Insulation Gasket Kits

Washing Machine Stand Stainless Steel

How to find best prices ugg pink slippers for women Puma, Baskets à lacets SOFTRIDE CARSON FRESH, noir blanc mauve, femmes 'affordable items' under $110 low price guarantee

http://www.clixy.net

Flange Insulation Kits Type E

Washing Mission Stand

Find best prices ugg sale bailey button tall boots Puma, Baskets ANZARUN LITE AC, violet blanc, bébés 'online shopping' under $100 online sale

Flange Insulation Kits Type D

Flange Insulation Gasket Kits China

Buy quality cheap ugg classic short sale clearance Puma, Baskets hautes REBOUND LAYUP SL V PS, noir blanc, enfants 'limited stock' under $110 limited offer

Neon Light Shop

Hanging Signs

Mobile Base For Washing Machine

Flange Insulation Kit Dimensions

Cheap authentic products ugg sale boots clearance chestnut Puma, Espadrille montante REBOUND LAY UP SL, hommes 'fast shipping' under $120 exclusive deals

Where to shop for best deals ugg leather winter boots sale Puma, Baskets à lacets SOFTRIDE CARSON FRESH, blanc chaud or, femmes 'discount online' under $80 customer reviews

ブランドスーパーコピー

neoprene rubber sheet

pawilony.biz.pl

Double Tanged Synthetic Fiber Beater Sheet

Fendi sale Best performance F is Fendi Small Hoop Earrings In Crystals Metal Gold Clearance sale under $140 online store deals

Replace Artificial Grass With Lawn

Fendi replica Ultra-modern style F is Fendi Large Hoop Earrings In Enameled Metal Green Special offer under $100 top discounts online

Fendi bags under $100 Easy-to-use interface F is Fendi Small Hoop Earrings In Enameled Metal Flash sale under $120 trending online

Fendi online All-in-one F is Fendi Hoop Earrings In Metal Gold Palladium Hot deal under $130 exclusive shopping deals

Rigid Floor

Viton rubber sheet

Pure PTFE Sheet

Artificial Turf For Yard

Vinyl Hardwood Flooring

Fendi outlet High-quality finish F is Fendi Small Hoop Earrings In Metal Palladium Coupon code under $110 best e-commerce deals

Cork Sheet rolls

Vintage Vinyl Flooring

Aluminum Panel

Cheap authentic goods ugg boots chestnut womens sale SteveMadden, Men's Vancity Lace Up Casual Sneaker – Black 'price cuts' under $170 bulk discounts

EXPANDED PTFE SHEET

SEALING MACHINE

Tempered Glass Curtain Wall

http://www.poweringon.com

PTFE TUBE

ブランドスーパーコピー

Get the best online deals kensington ugg boots Crocs, Crocs, Jibbitz Magical Plush Friends – 5 Pack 'top picks' under $190 unbeatable prices

How to buy at a discount ugg bags Crocs, Crocs, Jibbitz Montreal Canadiens 5 Pack 'hot sales' under $200 online best prices

Unitized Aluminum curtain walls

Buy affordable products ugg bailey button tall boots SteveMadden, Women's Vinetta Leather Casual Maryjane Flat – Black 'affordable luxury' under $120 exclusive deals

Hood Strut

Glass Curtain Wall Design

SPIRAL WOUND GASKETS MACHINE

GROOVING MACHINE

How to shop online ugg australia sale chestnut SteveMadden, Women's Vinetta Casual Maryjane Flat – Red Patent 'top-rated items' under $160 top quality