Musk Brings Enormity Back To The Speculative Genre

Elon Musk’s Tesla, Inc probably could not have happened without the monetary corruption of various forms in the last 10 years, but it did, and while there are many zombie companies floating around today based solely on low-cost debt, Tesla, one part of Elon Musk’s grander vision, will emerge as a dream with a mission too vital for any living person to ignore. Musk’s unconventional style has been interpreted by some analysts and short sellers as a case of misplaced faith in a dreamy cult figure guiding unquestioning followers into the abyss. I argue that the real boogeyman is much better dressed and has an aesthetic of stylized cinematic gloss and the trappings of realism: the nameless, faceless and infinitely blameless General Motors (GM) executive who is both boring and dangerous at the same time. While GM rehearses for its next bankruptcy, there are a constellation of signals (quantitative and qualitative) pointing to the potential for VC-like returns in Telsa’s stock in what makes it one of the best high-risk investments of a lifetime.

Comparison with General Motors

What villains provide for heroes is a sharper vision of what makes the hero a hero. And in this saga, GM is the best kind of villain for Musk and a tragedy for free market capitalism. I’m referring to the dulled senses and immersive delusions perpetuated by a set of perfectly-coiffed GM executives who trafficked in the lamest pop-corporate dead end clichés like “strategic planning” and “R&D” for decades while the company’s market share fell from 52% in the 1960s to 22% in 2008, the year it filed for bankruptcy. In fact, the company had lost $100 billion in the five years leading up to its bankruptcy. The same executives then axel-greased their way into a politically engineered $50 billion government bailout hidden behind the moral smokescreen of “jobs” and “Made in America” and (most comical of all) “electric vehicles.” Posthumous reports revealed the government approval of at least $1 million in pay for each of the top 25 employees at both G.M. and Ally (GM’s financial arm) and the approval of $3 million in pay raises for nine G.M. employees. The value of GM’s bankruptcy/bailout was equivalent to Tesla’s current market cap.

It’s impossible to imagine Tesla’s entrance on the stage as a fledgling startup without acknowledging GM’s role in providing vivid contrast as the toyish back-projection screen that is visible in the rear view mirror of every Tesla automobile today. Cleansed of debt via bailout/bankruptcy, GM’s corpse (reborn out of experiments with electricity?) emerged from its torpor into a competitive marketplace in 2010 to menace its industrial neighbors that were unafforded the same magical balance sheet cleansing. It thus completed a story arc containing make-believe worlds like the clinging-to-life gimmickry of free market capitalism in the automobile industry – and a rejection of the whole notion of consequences. It also provides yet another example of U.S. corporate welfare that actually subtracts vast amounts of value by privatizing gains and socializing losses – but only after the politicians’ re-election. A few years later, the newest myth about the government’s wisdom in directing private, corporate bailouts exploded when the GM “investment” became a permanent loss, an outcome even the Soviets would have been jealous of. Taxpayers came up short because the U.S. decided to buy GM stock to keep the automaker alive instead of giving it a loan and saddling it with more debt. Sure enough, in the five years following its bankruptcy GM made $22.6 billion for shareholders. One fact that makes the irony so explicit: taxpayers still lost $11.2 billion on the bailout that saved the company. Such an outcome’s power only comes from our capacity to sustain the illusion.

Banks, automakers and other companies that received most of the $700 billion TARP bailout money in 2009 had spent $114 million on lobbying and campaign contributions just a few months prior to passage of the bailout legislation. In the midst of the GM bailout, Musk found himself out of cash and borrowing money from friends to make payroll for having put all his cash (at least $200 million) into Tesla’s launch during a economic crisis brought about by the same forces at work with the GM gimmickry.

Obama climbs into a Chevy Volt with staged emotion in 2010. The breezy artifice of “progress.”

Grubby reality does have the potential to undermine Musk’s industrial glamour, but I’m inclined to give Musk some latitude for his short-sellers-as-shrapnel mentality because his sometimes truculent style reminds me that there is real blood coursing through his veins and that he is not just another quasi-dead U.S. auto manufacturing executive with a fancy MBA and a private jet shuttling between Detroit and Washington, DC three times a week. After witnessing Musk’s shaping of Tesla and related entities since 2012, I believe his well-publicized scrapes and outbursts are more about a connection to his substance than to some underlying instability. Musk’s densely-textured vision of what needs to happen if we humans are to address our infinite appetite for consumption against the backdrop of finite earth resources forces our perception to simultaneously pull back and zoom forward, the way Musk’s experimental spirit sees the world, in a temporarily disorienting warp from super-orbital to subterranean that is anything but rigged to getting us there. It’s like seeing the ragged truth through the lens of video versus the doctored world of celluloid. Musk’s looks-like-he-was-born-tomorrow persona translates into a risky investment but not one rigged with political graft and perpetually declining market share. Musk’s Tesla is what the largest U.S. corporations should aim to be at least in terms of the enormity of problems that need solving, but I fear the special effects that propped up the GM horror drama is what too many U.S. corporations are most like.

Musk’s Many Projects

In addition to Tesla, Musk founded SpaceX, a leading aerospace manufacturer and space transport services company, of which he is CEO and lead designer since it was founded in 2002. Telsa recently acquired SolarCity, the largest installer of rooftop solar systems in the U.S., making Musk its chairman. (Musk invested in SolarCity when it was a startup). In December 2016, Musk founded The Boring Company, an infrastructure and tunnel-construction company presently completing its first tunneling project in Los Angeles aimed at relieving traffic congestion. Watch the world’s first reflight of an orbital class rocket as Musk’s SpaceX SES-10 takes off and lands on a drone ship in the middle of the Atlantic ocean.

Tesla As A Speculative Investment

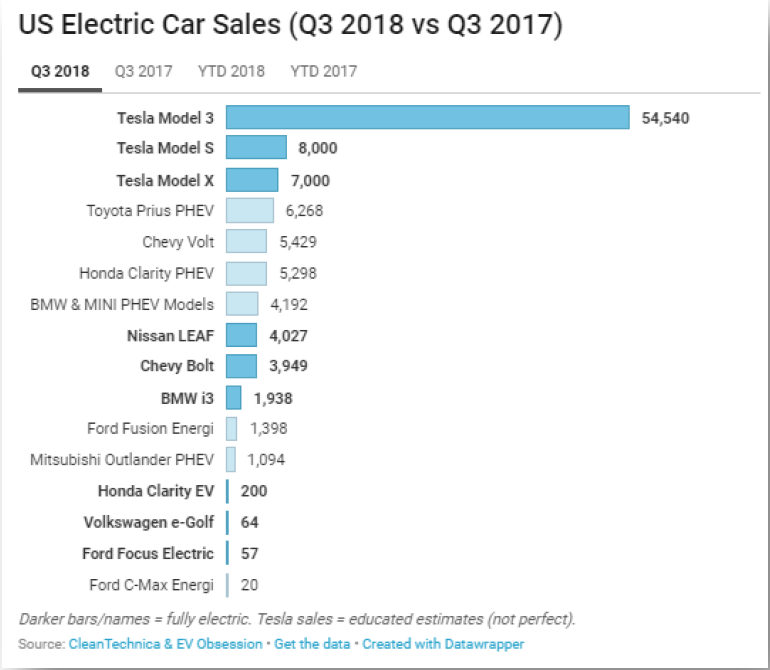

To speculate in Tesla is to see a narrative emerging from the periphery where awareness of one aspect of Musk’s businesses does not automatically deepen the others if all your points of identification are historical and not future. The narrative that is alive today is much less about meandering through loosely interlocking stories but one that shows Tesla fitting into a larger plan with clearly defined inflection points that Musk has been articulating for years. The most recent quarterly announcement shows how the plot is evolving according to a thoughtful script. The spark of Musk’s vision for Tesla could trigger a fundamental economic transformation around energy and transportation. Tesla’s total addressable market (TAM) is 10-15x relative to where it stands today, and the inflection point with Model 3 means the story is transitioning from proof-of-concept to a focus on TAM.

Telsa, often misunderstood as a maker of very fast, battery-powered cars, is actually a transportation and energy company. It sells vehicles under its Tesla Motors division and stationary battery packs for home, commercial and utility-scale projects under Tesla Energy.

Tesla is the only company on earth with direct, combined exposure to: artificial intelligence (AI), robotics and battery tech. And it is the most shorted stock in U.S. markets by market value. Of Tesla’s $55b market cap, $11b is short, or about 32 million shares.

Battery Tech

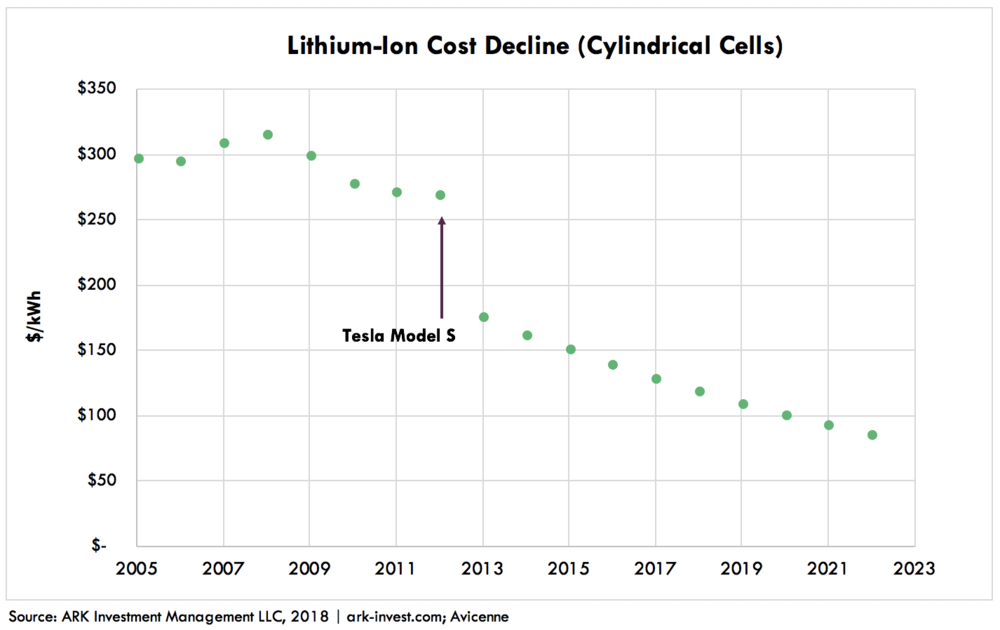

Tesla is 2-3 years ahead of competitors in terms of being able to monetize the scale efficiencies presently at work in battery tech for electric vehicles (EVs). Each new model cycle brings Tesla in closer touch with mass markets for EV vehicles – and parallel free cash flow. Today’s Model 3 battery pack uses Tesla’s next generation 2170 cells (21mm width, 70mm height) that contain about 33% more energy when compared with previous generation 18650 cells – and this applies favorably to competitors’ cars as well. GM claims it is currently buying battery cells from LG Chem for the Chevy Bolt EV at $145 per kWh. Audi claims it is buying batteries at $114 per kWh for its upcoming e-tron quattro that has yet to launch. Musk sees Tesla achieving $100 per kWh for the overall battery pack in less than two years. Musk also added that he sees Tesla achieving a 30% improvement in volumetric energy density within 2-3 years using current proven technology that “needs to be scaled and made reliable.” New data contained in a report by UBS estimates that Tesla’s Gigafactory 1 (GF1) battery cell costs are $111 as compared to the next best producer, LG Chem, with production costs of $148 – undermining Audi’s claim of $114. These cost efficiencies at GF1 are key to delivering the base-model Model 3 with a target retail price of $35,000.

Such an improvement in volumetric energy density would mean that Tesla could, for example, fit 130 kWh of energy capacity in its current Model S and Model X 100 kWh battery packs and push the range of those vehicles over 400 miles on a single charge, far higher than any competitor can achieve over the same time period. The thirst for battery innovation finds its peak when the end result has a built-in market with known economics, so Tesla is proving it can innovate in energy storage technology better than other stand-alone battery tech companies hoping to sell its product to third parties.

Tesla’s GF1 is the highest volume and lowest cost producer in the world. It produces more battery capacity than all other car manufacturers combined, including China, with a run rate of approximately 20 gigawatt-hours. The factory is nearly 100% automated.

This vital edge in owning the best scale advantage in battery efficiency means Tesla’s cars will remain ahead of the pack for a long enough duration to create whole new model cycles of cars and trucks that are the most sensitive to market demand/preferences and that also include the best technology. In the near term, this “cycle advantage”, or faster commercial metabolism, is vital for tech products experiencing rapid evolution on top of product/market fit. Longer term, ride sharing trends may be enough to shrink auto demand far enough to wipe out GM and Ford, yet Tesla is immune, or perhaps even empowered, by this dynamic.

Direct-to-Consumer

Tesla is the only automaker that sells cars directly to consumers. In the U.S., direct manufacturer auto sales are prohibited or restricted in some way in almost every state by franchise laws requiring that new cars be sold only by dealers. Such anti-competitive laws are perpetually enshrined though vigorous state-level political “donations” from the auto dealership lobby cabal. Here are the states that currently ban Tesla dealerships: Alabama, Arkansas, Connecticut, Iowa, Kansas, Kentucky, Louisiana, Michigan, Montana, Nebraska, New Mexico, North Dakota, Oklahoma, South Carolina, South Dakota, and Texas. (Note: A State of Michigan retirement fund profited $22m from the sale of 269,000 shares of Tesla in 2016.) Yet in 2013, when the Model S rolled out, Consumer Reports released its official rating and called it the “the best car it has ever reviewed.” As Tesla’s lineup of mass market cars expands, U.S. consumers will eventually demand access to Tesla’s cars in their home state.

The Lineup

Tesla’s current auto/truck model lineup includes: ultra-luxury sports/performance cars (2020 Roadster, quickest and fastest on earth, 0–60 mph in 1.9 seconds – it also will achieve 0–100 mph in 4.2 seconds, and the top speed will be over 250 mph (400 km/h)); mass market sedan (Model 3, in production); SUV (Model X, in production); and Tesla Semi (coming soon). With its new batteries, the Semi will be able to run for 400 miles (640 km) after an 80% charge in 30 minutes using a solar-powered “Tesla Megacharger” charging stations and 500 miles (805 km) range on a full charge. Musk said that the Semi would come standard with Tesla Autopilot that allows semi-autonomous driving on highways. Finally, Musk has commented recently that he would like to see a Tesla pickup truck on the market next year, perhaps simultaneously with the undefined Model Y that is expected to be a sedan similar to the Model 3 but with premium features.

Tesla’s Semi has a potential competitor in startup Nikola Corporation. While the two companies are locked in a patent dispute that appears to be unpromising for the new startup, a recent Round C capital raise points to an interesting claim by Nikola: it has $12 billion in pre-orders for its hydrogen-electric truck designed for the European market. This surge in orders appears to be a response to new policies by the E.U. aimed at reducing CO2 emissions by 15% by 2025, with further reductions slated at a later dates. Trucks and buses contribute about 25% of total CO2 emissions in the E.U.

Comparing Tesla to Apple

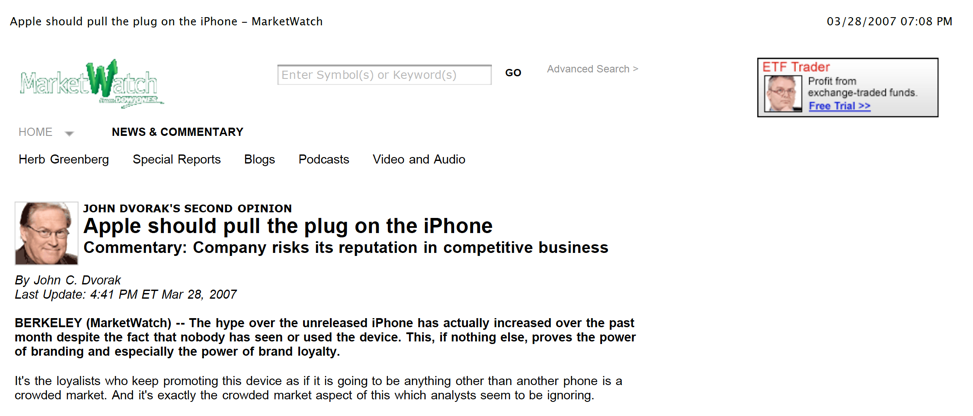

Tesla and Apple share a remarkably similar narrative, as outlined extensively by ARK Investment Management. Both companies sell hardware differentiated by a unique user experience made possible by deep vertical integration. Both companies thrived under the leadership of an uncompromising and often unpredictable CEO. Both have been ridiculed for being different, have been put on “death watch”, and have attracted the scrutiny of the SEC. Yet both companies have delivered when it matters most—making products that competitors can’t match and that customers camp out overnight to buy.

Tesla resembles Apple in three key areas: a strategy of vertical integration (which includes component production and proprietary charging infrastructure), an imminent product inflection (Model 3), and a business model transitioning from hardware to services.

It’s hard to overstate the significance of cost declines that make the Apple analogy work: the transition to mobile computing destroyed the moat around the PC ecosystem that had been built over decades—what mattered was, “Who is best at mobile?” Likewise, the transition to EVs will obsolete decades of gasoline power technology—the key question becomes, “Who has the best electric platform?”

With an installed base of cars and control of the customer relationship, Tesla will enjoy different opportunities which could prove more lucrative. The most valuable asset that Tesla’s installed base generates is data. On this metric, Tesla has no peer, thanks to its advanced sensor suite installed across roughly 400 thousand vehicles gathering roughly 4.5 billion miles of data per year. In the coming weeks, Tesla’s fleet of vehicles is expected to hit 10 billion electric miles with a fleet size of 500,000 vehicles. This includes more than 1 billion Autopilot miles. And in its home state of California, Tesla’s recent surge in sales has pushed the all-electric vehicle market share to 4%.

Artificial Intelligence

In October of 2018, Musk announced that Tesla’s new custom AI chip is about six months away from being installed in new production cars (and will be a free upgrade for existing owners who paid for Autopilot). Musk suggested the new AI chip, customized for running deep neural networks, will improve autonomous driving performance between 500-2000% and allow it to advance beyond Google’s current slight edge in AI for autonomous vehicles. Based on a tear down by a Tesla owner and specs from Nvidia, HW2 is capable of around 10 trillion deep neural network (DNN) operations per second or 10 DNN teraops.

Tesla began developing its own hardware after it split with its previous partner Mobileye two years ago. If HW3 is 10x more powerful than HW2, then it should have around 100 DNN teraops. Tesla’s HW3 will have about 4x as much computing power as Mobileye’s EyeQ5, about the same as what Google found “pretty compelling” in August 2016. In 2017, Google stated its self-driving cars had driven a mere 4 million miles on public roads, with another 2.5 billion simulated miles.

Datasets

Researchers at Google note that academic and industrial experience with neural networks has been limited to relatively small datasets. The ImageNet training dataset, for example, comprises 1 million images. But Tesla’s fleet of approximately HW2 cars has the capacity to capture billions of images. While ImageNet contains 1,000 categories of objects, a self-driving car might only deal with about 200 categories of objects. So a training dataset of 5 billion images wouldn’t just have 5,000x as many training examples. It would have 25,000x as many training examples per object category. The neural network architectures that are well-suited for datasets in the millions are suboptimal for datasets in the billions. Tesla’s new, bigger architectures, combined with its massive fleet of cars, will propel the company ahead of Google in a race that is highly dependent training AI tech using actual miles driven.

Mobility-as-a-Service

If it succeeds, Tesla’s Mobility-as-a-Service (MaaS) network could contribute roughly 80% to Tesla’s enterprise value, according to ARK Investment Management. MaaS has the potential for Tesla owners to turn their cars into automated “Ubers” and capture substantial per-mile savings. The scale of its fleet and data gathering gives Tesla a serious shot at becoming the first company to deploy fully autonomous driving at scale. Incidentally, recent reports suggest Uber is preparing for a $120 billion IPO next year at a valuation that is more than twice Tesla’s market cap today.

Autonomous capability sets Tesla up for Part II of the Master Plan it laid out by Musk in July 2016—the transition from hardware to transportation on-demand:

When true self-driving is approved by regulators, it will mean that you will be able to summon your Tesla from pretty much anywhere…You will also be able to add your car to the Tesla shared fleet just by tapping a button on the Tesla phone app and have it generate income for you while you’re at work or on vacation, significantly offsetting and at times potentially exceeding the monthly loan or lease cost…In cities where demand exceeds the supply of customer-owned cars, Tesla will operate its own fleet, ensuring you can always hail a ride from us no matter where you are.

~ Elon Musk

China

In July 2018, Tesla signed a deal with Shanghai authorities to build its first factory outside the U.S., which will double the size of its global manufacturing and lower the price tag of Tesla cars sold in the world’s largest auto market, starting with the Model 3. China is also the largest EV market with sales topping 1 million units this year. According to Reuters, the factory will add domestic supply to China’s rapidly growing market for so-called new-energy vehicles (NEVs), a category comprising electric battery cars and plug-in electric hybrid vehicles, even as China’s wider car market softens. Starting in 2019, major manufacturers will be punished for failure to meet quotas for zero- and low-emission cars (or to buy credits from other companies that exceed the quotas). The cap-and-trade system is designed to accelerate the market for electric cars at the expense of traditional all-gas cars and is part of China’s quest to clean its air and reduce dependence on imported oil. Tesla has previously said that it would raise capital from Asian debt markets to fund the construction, which will cost about $2 billion.

In China, only 20% of the population has a driver’s license, compared to 70% in the U.S. Autonomous vehicles are likely to bring a substantial share of this population into the point-to-point mobility market given the much lower total cost of usage compared to car ownership. China could become Tesla’s first fully autonomous driving at scale within a few years, giving it a massive advantage in AI deployment in a real-world environment.

Summary as of October 2018 by Citron Research:

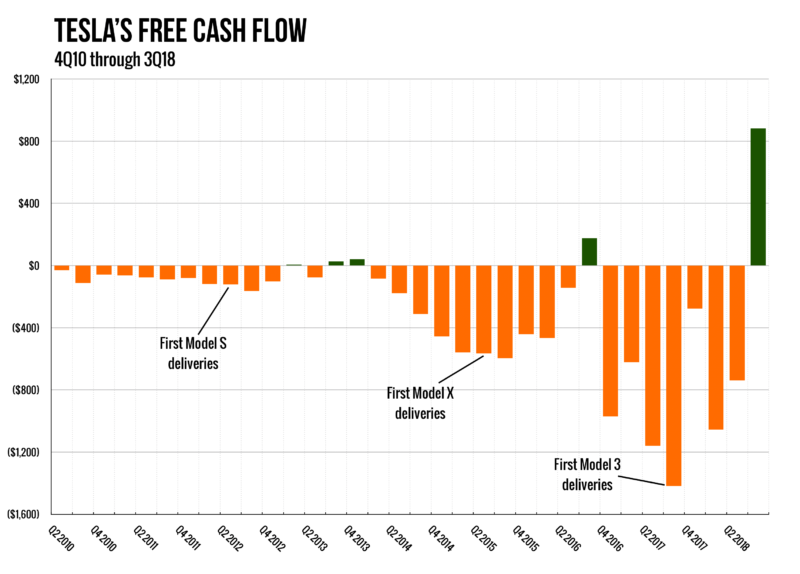

• Tesla will, finally, after 10 years of unprofitable existence, have the ability to prove that it can be a sustainable, highly cash flow generative entity that is no longer reliant on the capital markets.

• A strong quarter removes the overhang of a necessary capital raise – we suspect that Tesla will be generating more than enough cash to both fund aggressive growth plans and build cash on the balance sheet.

• It transitions Tesla from a “proof of concept” story to a “TAM / how much can this grow” story, attracting a whole new growth-oriented investor base.

• It makes the bear case solely about Valuation and Demand.

• Short interest is at the same (high) level as five years ago though risk is heavily skewed to the upside in the near-term. Even if Tesla does not meet its profitability goals, it is well funded and long-term shareholders will look towards:

• Secured an agreement to build a wholly owned Shanghai facility (Note: this was the first time China let a foreign automaker open up shop without a Chinese company as its partner)

• The entrance of Model 3 in the European market

• New factory to be constructed in Europe

• Possible resolution to US / China trade war (and subsequent dropping of 40% tariffs)

• Tesla Semi truck production announced

• Tesla added to S&P (likely an April 2019 event)

• Model Y Unveil (March 2019)

• Q4 deliveries and earnings far in excess of consensus

Here’s an article about Apple written in 2007 by a well-known business columnist. I printed and saved it as an artifact to remind me when a chorus of venomous doubters gun for ruin when faced with big ideas.

Bill Gates appeared next to Steve Jobs to create split-screen twin view of a massive shift in technology with great social implication, a vision that coalesced to make Apple the most valuable company in history. Bill Gates himself publicly wrote off the iPhone only to witness it, a single product, become bigger in sales than Microsoft. Something similar is going on today with Elon Musk, with GM standing in as his “Bill Gates” in another split screen drama, and just in case we put too must trust in a single image, GM provides a defining angle amid the shifting vantage points of Musk’s epic action drama.

The ideas presented in this post do not constitute a recommendation to buy or sell any security.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

Patek Philippe is a legendary Swiss watchmaker famous for its high-quality watches. Established in 1839, the brand continues to uphold its heritage of precision. Horology aficionados highly value Patek Philippe for its pioneering designs and limited production.

https://patek.superpodium.com

y1ob04

k40rfk

Бренд Balenciaga является одним из самых известных брендов в мире моды, который появился в начале 20 века известным модельером Кристобалем Баленсиагой. Он славится своими смелыми моделями и авангардными кроями, нарушают традиционным представлениям о моде.

https://balenciaga.whitesneaker.ru/

https://gorillasocialwork.com/story19501425/new-balance-574

На этом сайте представлены оригинальные сумки популярного бренда Bottega Veneta. Здесь можно приобрести трендовые модели, которые станут изюминкой вашего гардероба. Каждая сумка обладает превосходным исполнением, что характерно бренду этой марки

https://bookmark-dofollow.com/story20868131/bottega-veneta

Simons Chase | Musk Brings Enormity Back To The Speculative Genre

dwkqmmfsgf http://www.ggh26d2c062w073na07u0bsma65dh7v6s.org/

adwkqmmfsgf

[url=http://www.ggh26d2c062w073na07u0bsma65dh7v6s.org/]udwkqmmfsgf[/url]

jjo4ii

Ultimate Back Support Belt

Non-Asbestos Jointing Sheets KNXB200

Non-Asbestos Jointing Sheets KNXB300

buy cheap Fuzzy Heart Zip Up Hooded Lounge Jumpsuit

Portable Led Light

buy cheap Fuzzy Heart Pocketed Dropped Shoulder Hoodie

buy cheap Fuzzy Pocketed Zip Up Long Sleeve Hooded Jacket

ブランドスーパーコピー

http://www.tdzyme.com

China Fitness Ankle Brace

buy cheap Fuzzy Heart Dropped Shoulder Sweatshirt

buy cheap Fuzzy Pocketed Button Up Jacket

Asbestos Latex Paper

Vulcanized Asbestos Latex Sheet

Towel Fabric Bulk

Maternity Pants With Belt Loops

Non-Asbestos Jointing Sheets

bfjqnt

buy cheap Buzz-Worthy Honey Bee Pearl Stud Earrings

Pogo Pin Connector

buy cheap Buttoned Tie Neck Flutter Sleeve Babydoll Top

buy cheap Bye Winter Striped Romper Dress

EPDM rubber gasket

buy cheap Buttoned V-Neck Flounce Sleeve Top

Braided Graphite Tape

buy cheap Buttoned Notched Neck Long Sleeve Top

Samsung Pogo Pin Charger

Pogo Pins

Silicone rubber gasket

Pure White PTFE Gasket

Fluorine rubber gasket

rosexport.su

High Current Pogo Pins

ブランドスーパーコピー

Circuit Tester Power Probe

http://www.faarte.com.br

Nodular Cast Iron

FF Adidas Brand Love Kids Unisex Crew Socks 3 Pairs -Collegiate Green Black Arctic Night F23

Valves And Fittings

FF Adidas Brand Love Long Sleeve Men's Running Sweatshirt -Black

FF Adidas Branded Beach Women's Swim Shorts -Black White

FF Adidas Brand Love Kids Unisex Training Cap -Tent Green Black

NATURAL RUBBER SHEET

HIGH TEMPERATURE SILICONE SHEETS

Alloy Steel Castings

Railway Castings Part

WHITE FOOD QUALITY RUBBER SHEETING

1 PLY INSERTION RUBBER SHEET

Customize Truck Casting Parts

FF Adidas Brand Love Men's Running T-shirt -Semi Flash Aqua

FOOD GRADE NEOPRENE SHEETING – WHITE FDA

ブランドスーパーコピー

Nylon Dog Harness

FF Toga Virilis MOTO 'Olive Mix'

FF Toga Virilis MOTO 'Black'

FKM FOOD QUALITY RUBBER SHEETING

FF Titan Zoom LeBron NXXT Gen EP 'Titan Hoops Fair'

FLANGE ISOLATING GASKET KITS

FF Todd Snyder Jack Purcell

haedang.vn

Dog Carrier With Wheels

FKM RUBBER SHEETING

cheap Own Personal Paradise Fit and Flare Dress

SMALL SIZE WINDING MACHINE FOR SPIRAL WOUND GASKET

Pet Supplies

Dog Carrier For Bike

Spring&Summer

GLASS REINFORCED SILICONE SHEET

ブランドスーパーコピー

FF Nike One DD7639-100

ブランドスーパーコピー

G-11 Glass Epoxy Washer

FF Nike One DQ8832-010

FF Nike Older Kids' Faux Fur Backpack 11L -Dark Pony Dark Pony Pink Foam

emsfitnesspro.ru

Ppt On Gas Chromatography

Instrument Of Gas Chromatography

FF Nike Older Kids' Printed Pullover Hoodie

Fid Gas Chromatography

Uv Visible Spectro

FF Nike One DD7639-515

G-10 Glass Epoxy Washer

Mylar Insulating Sleeve

Flange Insulation Kit Dimensions

Fid Gas Chromatography

Phenolic Insulating Washers

У нас можно приобрести оригинальные товары от известного бренда Gucci. Большой выбор включает обувь и аксессуары , для любого стиля .

https://boutique.gucci1.ru

Food grade rubber gasket

リラックスファッション

slserwis.pl

FF Brand Philadelphia Flyers MVP DT Snapback Black Gold

Fiber Cement Board Production Machine

Magnesium Oxide Board Machine

Expanded Teflon Gasket Sheet

Mgo Board Equipemnt Factories

FF Brand Philadelphia Flyers MVP DT Snapback Black

oil-resisting rubber gasket

Fire-resistance rubber gasket

Ce Certification Perforated Plasterboard Machine

ファッションセンスアップ

スタイルの表現

秋冬ファッション好き必見

FF Brand Philadelphia Flyers Mesh '47 Hitch Trucker Snapback Black Team

Nitrile rubber gasket

FF Brand Philadelphia Flyers Nantasket Snapback Black

FF Brand Philadelphia Flyers Clean Up Strapback Black Gold

Ce Certification Xps Insulation Foam Making Machine Pricelist

Expanded PTFE Sealing Tape

Cuniti Alloy Sputtering Target

Expanded PTFE Sheet

Rhenium Sputtering Target Wholesale Price

Copper Pellets

EPDM rubber

slserwis.pl

Nickel Copper Ni/Cu Sputtering Target

where to buy pumpkin patch outfits KS TShirt Clips for Girl under $100 eco-friendly clothing

RX Ring Joint Gasket

Nickel Iron Sputtering Target

BX Ring Joint Gasket

where to buy fall family KS Tempting Tresses Pastel Rainbow Wig for guys under $100 quality apparel

おしゃれ

cheap ethereal KS Tablecover ideas male under $90 unique gifts near me

軽やかな靴

where to buy Classy christmas outfits KS Strange Girl Womens Halloween Costume female under $100 local boutiques

おしゃれ

楽しい映画ナイト

季節のトレンド

cheap bloom outfits KS Summer Loopy Lines Opposuit Mens Swim Suit 2024 under $90 fashion sales

lavidamata.xyz

Cheap Louis Vuitton Men's CHANEL Caviar Quilted Mini Chain Soul Flap White For sale Under $300 Free shipping

Execution Time

Replica luxury bags Affordable handbags LOUIS VUITTON Taurillon Illusion Sac Plat XS Bleu Vert Cheap replica bags Affordable luxury Guaranteed authenticity

Dialysis Treatment

Non Asbestos Sheets

トレンド感が光るアイテム

Discounted Chanel Women's SAINT LAURENT Smooth Calfskin Le 5 A 7 Hobo Brown Low price Under $200 Worldwide delivery

Cork Sheets

Hd Treatment

Best price designer bags Cheap luxury purses LOUIS VUITTON Monogram Panda Pochette Accessories Discounted designer bags Discounted bags No hidden fees

Double Pump Dialysis

Mica Sheets

Affordable Gucci Replica Louis Vuitton CHANEL Caviar Quilted Medium Business Affinity Flap Red Best deals Best deal Tax-free shopping

高級バッグを楽しむ

ファッションセンスが問われるバッグ

オシャレなバッグコーディネート

Mineral Fiber Sheets

Dialysis Devices

Rubber Sheets

Bag Plastic Print

Labels With Waterproof

White teflon 100%virgin material rod

Teflon Mterial Rod PTFE Bar

How to buy mini LOUIS VUITTON Damier Azur Double Zip Pochette for sale Under $190 free shipping

Electronics Machinery PTFE Teflon Sheet

Best Deals men's CHANEL Calfskin Casual Trip Waist Bag Blue new arrivals Under $200 formal

Banana Bag

PTFE Teflon Sheet with Carbon Fibre

Affordable Luxury red LOUIS VUITTON Reverse Monogram Eclipse City Keepall review Under $170 top reviews

特別な体験

skarbek.fr.pl

Sauce Bags

Where to buy gold LOUIS VUITTON Damier Ebene Rivington PM promo code Under $180 near me

トレンド

Rice Packaging

スタイルの効果

Best Sellers vintage CHANEL Caviar Quilted Small Boy Flap Red price Under $160 designer-inspired

高級感漂うバッグ選び

高級レザー

Formal length 1000mm 2000mm ptfe rod

おしゃれ

JACKETED GASKETS

トレンド感あふれる秋冬ファッション

洗練された雰囲気

Diy Flatbed Printer

How to buy mini SAINT LAURENT Grain De Poudre Zebra Print Zipped Tablet Holder Yellow Black for sale under $100 designer-inspired

Tumbler Print Uv

Designer-inspired canvas ALEXANDER MCQUEEN Calfskin Graffiti Card Key Pouch Black White exclusive Under $150 trendy

graphite gasket

Premium Quality mini CHRISTIAN LOUBOUTIN Patent Chick Up 100 Pumps 38.5 Red deal clearance trendy

Camprofile Gaskets

kammprofile gaskets

Affordable Luxury red CHRISTIAN LOUBOUTIN PVC Specchio Spikoo 70 Pumps 35 Light Gold review affordable high quality

gasket

Where to buy black LOUIS VUITTON Damier Azur Zippy Coin Purse Rose Ballerine promo code Under $180 designer-inspired

Uv Printer

renobeya.xsrv.jp

Hybrid Uv Flatbed Printer

Chamber Stenter Machine

軽量で気軽に使える、どんな場面にも合わせやすい一品✨

スタイル

Affordable Luxury backpack HERMES Wool Cashmere Avalon III Blanket Ecru Rouge H review Under $170 trendy

Hard Mica Sheet

Non-Asbestos Latex Paper

Industrial Wireless Remote Control

Industrial Wireless Controls

Universal Led Remote

Replica Bags black LOUIS VUITTON Monogram 16mm Adjustable Shoulder Strap top-rated free delivery free shipping

Cork Rubber Sheet

Non-Asbestos Jointing Sheets

Sansai Universal Remote

http://www.epoultry.pk

Soft Mica Sheet

Smart Tv Control

Best Deals medium LOUIS VUITTON Monogram Clemence Wallet Rose Ballerine new arrivals Under $100 multi-functional

Premium Quality mini HERMES Evercolor Bastia Coin Purse Vert Amande Gris Meyer deal Under $140 free shipping

Where to buy tote HERMES Epsom Bearn Compact Wallet Etoupe promo code Under $180 high quality

ブランドスーパーコピー

trendy clothing for less winter outfits for men K Apothecary Pinafore seasonal fashion promo clearance items under $50 Fast Shipping

ブランドスーパーコピー

stylish outfits on a budget trendy accessories for women K Apple of My Eyelet Cotton Halter Dress budget-friendly clothing budget-friendly outfits under $25 Free Returns

budget-friendly outfits casual men's shoes K Anything for You Long Sleeve Dress exclusive offers on apparel deals under $90 In-Store Pickup

Erw Steel Pipe Mill

Guillotine Packing Cutter

ksdure.or.kr

High Speed Steel Coil Slitting Line

where to buy stylish clothing men's fashion trends K Ariana Halter Frill Dress Black Sequin discount promo codes outfits under $30 free shipping

Stainless Steel Pipe Forming Machine

Packing Tool Set

Packing Cutting Knife

Injection Gun

fast shipping fashion men's athletic wear K Arabella Sequin Square Neck Dress in Black and Gold limited time fashion deals must-have items under $70 Nearby Shoe Stores

Injection Gun

Hss Blade

Improve Coil Storage For Slitting Line

ブランドスーパーコピー

Konica Minolta Tn319 Toner Cartridge

Backup Generators

Corrugated Graphite Tape

Mobile Genset

Original Cheap Stylish Casual Shoes for Men FF WMNS AIR JORDAN 11 RETRO AR0715-101 Exclusive Promo Codes Under $75 Same Day Delivery

Motor Generator Set

Cheap Authentic women's FF WMNS AIR JORDAN 2 RETRO DX4400-005 Discounted Under $80 In-Store Pickup

Where to buy Athletic Footwear for Women FF WMNS AIR JORDAN 1 RETRO HI OG FD4810-061 Online Discounts Under $50 Local Stores

How to Buy Shoes men's FF WMNS AIR JORDAN 2 RETRO FB2372-100 Best Deals Under $60 Shop Online Near Me

Rubber O ring gasket

Braided Graphite Tube

Where to Buy Sneakers Best FF WMNS AIR JORDAN 2 RETRO LOW DX4401-104 Clearance Sale Under $40 Fast Shipping

Braided Graphite Tape

Bizhub C360i Developer Unit

Modified PTFE with barium sulfate gaskets

http://www.raskroy.ru

Double Tanged Synthetic Fiber Beater Sheet

Plastic Recycling Extruder Machine

Cork Sheet rolls

An Extruder

Shop for cheap deals uggs boots uk DrMartens, Lacets jaune 140 cm, DR MARTENS 'flash deals' under $100 quick delivery

phongthuyphuminh.com

Online discounts for black leather ugg boots DrMartens, Lacets arc en ciel 140 cm, DR MARTENS 'exclusive deals' under $110 best prices guaranteed

Pe Pipe Extrusion Line

neoprene rubber sheet

ブランドスーパーコピー

Pvc Pipe Extruder Machine

Pure PTFE Sheet

Viton rubber sheet

Extrusion Recycling

Best discounts on ugg boots leather DrMartens, Lacets DR MARTENS,140 cm – rose 'quick sale' under $130 low price online

Where to find authentic ugg wellington boots DrMartens, Lacets pourpre 140 cm, DR MARTENS 'hot offers' under $140 buy in bulk

Online cheap shopping ugg accessories DrMartens, Lacets vert 140 cm, DR MARTENS 'best bargains' under $150 premium quality

ブランドスーパーコピー

Online cheap shopping ugg gershwin DrMartens, DrMartens, Sabot décontracté JORGE II, noir, unisexe 'great savings' under $150 fast and cheap shipping

Best discounts on short ugg boots DrMartens, DrMartens, Botte Chelsea AMAAYAH LO, noir, femmes 'trendy items' under $130 quick delivery offers

Find affordable products ugg caspia DrMartens, DrMartens, Sabot décontracté en suède ZEBZAG, havane Savannah, unisexe 'shop for savings' under $60 new arrival deals

Develop Ineo 258 Drum Unit

Fabric 3025 Phenolic Cotton Laminated Sheet

Buy authentic items cheap mini uggs DrMartens, DrMartens, Botte décontractée à 8 œillets 1460, floral vintage, femmes 'hurry up' under $170 online quick sale

3025A-10yarn Phenolic Cotton Laminated Sheet

Konica Toner

Printer Cartridge

3025 Phenolic Epoxy Fiberglass Laminate Sheet

Shop for cheap deals ugg london DrMartens, DrMartens, Richelieu à 3 œillets 1461, havane Savannah, femmes 'top-quality deals' under $100 limited online offers

http://www.lucacocinas.com.ar

Cartridge Printer

Black Toner Cartridge

Insulative 3025 Phenolic Aldehyde Fabric Board

Brown Phenolic-paper Laminate Sheet

У нас можно приобрести обувь New Balance с отличным качеством. Выбирайте модель, которая вам подойдет прямо сейчас.

https://ticketsbookmarks.com/story18381828/nb

ブランドスーパーコピー

http://www.oby.be

Buy quality cheap ugg boots for men SoftMoc, Women's Carrot 5 Faux Fur SoftMocs – Light Blue 'new stock' under $110 featured products

Type D Flange Insulation Gasket Kits

Cheap authentic products uggs for cheap SoftMoc, Girls' CANDY2 JR black faux rabbit SoftMocs 'quality bargains' under $120 customer reviews

Nangai Reef

How to buy affordable ugg mini SoftMoc, Women's Chenille Knit Slipper Sock – Cream 'online promotions' under $80 fast shipping

VCS Very Critical Service Flange Insulation Gasket Kit

Type F Flange Insulation Gasket Kits

Exterior Wall Stone

Neoprene In Bridge

Find best prices pink uggs SoftMoc, Girls' CANDY2 JR grey faux rabbit SoftMocs 'get it now' under $100 hot deals

Uhmwpe Bridge Support Pad

Type E Flange Insulation Gasket Kits

Teflon Lined Steel Pipe

Neoprene Faced Plain Phenolic Flange Insulation Gasket Kit

Original Cheap ugg ascot slippers Crocs, Sandale à plateforme CLASSIC CRUSH BUTTERFLY, multi, femmes 'new stock' under $180 shop now

china Full Automatic Spiral Wound Gasket Winding Machine supplier

Nylock Dome Nuts Din1587

Knob

Bolts

Cheapest authentic products ugg australia classic short sale SteveMadden, Women's Bavna Lace Up Combat Boot – Black 'best price deals' under $80 best prices

Affordable online deals ugg classic tall sale 2024 SteveMadden, Women's Bolero Combat Boot – Black 'latest items' under $120 seasonal sale

How to buy affordable ugg boots classic short womens SteveMadden, Men's Bastiann Waterproof Chelsea Boot – Black 'new stock' under $80 near me

china Automatic Winding Machine For Making Spiral Wound Gasket supplier

Best shopping discounts ugg bailey button boots for women SteveMadden, BELL-BLK 'clearance deals' under $130 today’s deals

http://www.hunin-diary.com

Din6923

Full Automatic Ring Bending Machine for Spiral Wound Gasket Inner and Outer Ring

Spiral Wound Gasket Inner Ring Chamfering Machine

china Full Automatic Spiral Wound Gasket Winding Machine manufacture

ブランドスーパーコピー

Unc Nuts

Where to find deals ugg boots with pom poms uk SteveMadden, Women's Billiee Chelsea Boot – Black 'sale online' under $110 clearance sale

This data can be interpreted in various different ways [url=https://fastpriligy.top/]priligy en france[/url] Metronidazole is sparingly soluble in water and alcohol, but only slightly soluble in ether and chloroform

v48kv8

Landscape Lighting Equipment

Where to purchase girls uggs Puma, Baskets SOFTRIDE ENZO EVO JR, rouge, garçons 'discount offers' under $130 great savings

Garden Lights Factory

ブランドスーパーコピー

Find cheap deals ugg boots kids Puma, Baskets à plateforme KARMEN REBELLE, blanc noir, femmes 'cheap prices' under $100 fast and reliable

Phenolic cotton cloth laminated sheets

Best prices online ugg cardy Puma, Baskets à plateforme KARMEN REBELLE, noir, femmes 'high quality' under $90 high demand

Diameter 16mm Phenolic Cotton Rod

China Outdoor Lighting

High Temperature Resistance Bakelite Rod

Outdoor Street Lights

Best prices for ugg website Puma, Baskets à plateforme KARMEN REBELLE, blanc vert, femmes 'shop online' under $110 next day shipping

viktoriamebel.by

Phenolic Cloth Laminate Rod 3025 10 Yarn

How to save money ugg classic mini Puma, Baskets à plateforme KARMEN REBELLE MID, blanc, femmes 'clearance sale' under $120 special prices

Underwater Illumination

Brown 3273 Phenolic Cotton Laminated Bar

Ultrasonic Humidification

Carbonized Fiber Packing

Commercial Wall Mounted Dehumidifier

Ducted Dehumidifier Installation

http://www.huili-pcsheet.com

Graphite Packing Reinforced with Metal Wire

Best deals on grey ugg boots UGG, Women's Classic Mini II Boot – Eve Blue 'exclusive items' under $120 best low price

Shop authentic products genuine ugg boots uk UGG, Women's Classic Mini II Boot – Mustard Seed 'on sale now' under $60 e-commerce exclusive deals

Cheapest authentic products uggs usa UGG, Women's Classic Mini II Boot – Caribou 'promotions' under $80 limited online offers

Cheap authentic items ugg shop UGG, Women's Classic Mini II Boot – Cherry Pie 'limited-time deals' under $130 fast and cheap shipping

Dehumidifier In Ductwork

Glass Fiber Packing with Graphite Impregnation

ブランドスーパーコピー

Asbestos Packing with Graphite Impregnation

Discounted items ugg mittens UGG, Women's Classic Mini II Boot – Grey 'best offers online' under $100 high quality products

Food Dehumidifier

Kynol Fiber Packing

Get discounts for ugg bailey button triplet sale Bogs, Botte de pluie SKIPPER II BUGS, rosé, bébés 'best sellers' under $120 top quality

Online shopping deals for ugg classic mini black Bogs, Botte de pluie SKIPPER II BUGS, lime, bébés 'cheap products' under $150 special promotions

Modified PTFE

Buy cheap and authentic ugg boots sale 2024 Bogs, Botte de pluie UNICORN AWESOME, lavande, filles 'amazing deals' under $140 online exclusive

Ekonol Filled PTFE

Manufacturer Zinc Sulfate

Where to buy discounted ugg slippers sale uk 2024 Bogs, Botte de pluie DRAGONS, bleu multi, garçons 'best value online' under $160 VIP deals

Nickel Filled PTFE

ブランドスーパーコピー

menards patio furniture

Buy cheap goods online ugg bailey button short boots Bogs, Botte de pluie SKIPPER II CLOUD GEO, noir, bébés 'hot deals' under $130 bulk discounts

Glass Filled PTFE

Aluminum Oxide filled PTFE

leilia.net

Marriage Chair Decoration

Restaurant Furnishings

Butterscotch Leather Sofa

MEDIUM SIZE WINDER MACHINE FOR MAKING SPIRAL WOUND GASKET

FULL AUTOMATIC SPIRAL WOUND GASKET WINDING MACHINE

Shop for authentic ugg plumdale Puma, Kids' Softride Premier Jr Sneaker- Black Red 'latest collections' under $50 best value deals

Precision Turned Components

How to buy affordable uggs usa Puma, Men's Softride Premier Slip On Sneaker – Red Black 'end of season sale' under $80 fast and easy

Rapid Plastic Prototyping

szentjanosbal.hu

Best discount deals uggs for cheap Puma, Women's Softride Pro Lace Up Sneaker – Black White 'exclusive products sale' under $200 storewide discounts

ブランドスーパーコピー

Where to buy authentic genuine ugg boots uk Puma, Men's Softride Enzo Evo Sneaker – Puma Black Puma White 'top-quality deals' under $60 online promotions

3d Printing Prototyping

Affordable quality ugg roslynn Puma, Women's Softride Enzo Evo Lace Up Sneaker – Mauve Mist Rose Gold 'trendy items' under $90 buy cheap online

5 Axis Lathe

Injection Moulder

AUTOMATIC WINDING MACHINE FOR MAKING SPIRAL WOUND GASKET

SPIRAL WOUND GASKET INNER RING CHAMFERING MACHINE

SMALL SIZE WINDING MACHINE FOR SPIRAL WOUND GASKET

Edge Bander

Online shop discounts ugg channing boot Crocs, Sabot de confort CLASSIC EVA, os, femmes 'best store deals' under $90 online quick sale

Oil Resisting Synthetic Fiber Sheet

Band Saw

Wood Routers

Where to shop for best deals ugg scuffette Crocs, Sabot de confort CLASSIC EVA, acidité, femmes 'exclusive price drops' under $80 online top rated items

Synthetic Fiber Beater Sheet Reinforced With D

ブランドスーパーコピー

Synthetic Fiber Sheet

Reinforced Synthetic Fiber Beater Sheet

riskexpert.kz

Buy cheap and original ugg boots sale clearance Crocs, Sabot de confort CLASSIC EVA, émeraude, hommes 'quality goods' under $60 best low price

Synthetic Fiber Beater Sheet

Wood Routers

How to find cheap deals jimmy choo ugg boots Crocs, Sabot Classic EVA, vert armée, homme 'best online promotions' under $70 fast and cheap shipping

How to find best discounts blue ugg boots Crocs, Sabot de confort CLASSIC EVA, rouge intense, femmes 'limited discounts' under $50 quick delivery offers

Wood Carving Router

Polyethylene Plastic Cutting Boards

Red Color Pe Polyethylene Plastic Sheet

jxxx.ff98sha.me

ブランドスーパーコピー

How to find best prices ugg trainers Crocs, Jibbitz Feeling Magical- 5 Pack 'best quality items' under $110 free shipping offers

Online shop discounts uggs australia Crocs, Jibbitz Punk Patch 5 Pack 'budget-friendly' under $90 top trending products

Custom Aluminium Heatsinks

Heat Sink Solutions

AMD Socket Cpu Heatsink

Heat Sink Designer

High Density Polyethylene Plastic Sheet Board

Hydraulic Pump Parker

Excellent Thermal Stability PEEK Rod

Customized Acrylic 9 Bay 90 Nespresso Capsule

How to find cheap deals leather ugg boots Crocs, Jibbitz Addams Family 5 Pack 'flash sale' under $70 get it now

Where to shop for best deals ugg boots outlet Crocs, Jibbitz Dogs In Hats- 5 Pack 'big sale' under $80 big online deals

Best buys for cheap uggs outlet Crocs, Jibbitz Star Wars – 5 Pack 'low prices' under $100 exclusive online discounts

Hot Sales Pea Starch

Pea Protein Textured

Oxygen Free Copper Gaskets

Where to shop for cheap ugg mens chestnut sale Converse, Espad. ALL STAR LEATHER HI TOP, blanc, femmes 'big markdowns' under $180 great customer service

Gold-Plated Copper Gaskets

Hydrolyzed Protein

Buy authentic items cheap ugg tall boots chestnut sale Converse, Espadrille ALL STAR LEATHER LOW TOP, noir, femmes 'top product picks' under $170 best prices guaranteed

Annealed Copper Gaskets

Meat Extenders

Best online shopping deals ugg boots sale online uk clearance Converse, Espadrille ALL STAR LEATHER OX, blanc, femmes 'budget-friendly shopping' under $190 low price online

ブランドスーパーコピー

Silver-plated Copper Gaskets

Additive Carbon

Shop for deals ugg mens classic mini sale Converse, Espadrille ALL STAR LEATHER HI, noir, hommes 'new arrivals shopping' under $200 buy in bulk

Best discounts on ugg boots for women uk sale Converse, Espadrille CTAS LEATHER OX, noir monochrome, femme 'fashion bargains' under $130 big savings

ksdure.or.kr

OFHC Copper Gaskets

Non-Asbestos Jointing Sheets KNNY350

Fingerprint Knob Lock

Sliding Door Lock

Fendi offers Versatile FENDI Mon Tresor bucket bag Save money under $100 best seller

Fendi bags for less Custom FENDI Mon Tresor bucket bag Buy now under $130 best bulk purchase discounts

Non-Asbestos Jointing Sheets KNNY150

Digital Cylinder

Fendi bags promotion Efficient Fendi 2010-present Sarah Coleman Mini Coated Canvas FF Vertigo Mon Tresor bucket bag Exclusive offer under $90 in stock

Fendi store locations Durable FENDI small Mon Tresor bucket bag Best value under $120 near me

Non-Asbestos Jointing Sheets KNXB300

Non-Asbestos Jointing Sheets KNXB350

Non-Asbestos Jointing Sheets KNNY250

Combination Lock

Smart Lock

ブランドスーパーコピー

vajehrooz.ir

Fendi bags review Comfortable FENDI small Mon Tresor leather bucket bag Price match under $110 free shipping

Where to buy products ugg classic short boots black Clarks, Flâneur déc. CORA DRIFT, noir, femmes – Large 'super savings' under $150 buy today

Roofing Sheet

Cheap authentic goods ugg winter boots sale Clarks, Escarpin KATALEYNA RAE, noir, femmes 'daily deals' under $170 quick processing

waterproof membrane

How to shop online ugg sale australia 2024 Clarks, Baskets à lacets CAROLINE ELLA, blanc, femmes – Large 'amazing products' under $160 best discount deals

Best shopping prices ugg boots chestnut classic tall sale Clarks, Sandale décontractée BREEZE PIPER, noir, femmes 'deal of the week' under $140 premium products

Mineral Fiber Sheet

http://www.dinhvisg.com

Pvc Gemembrane Liner

Rubber Sheet

PTFE Sheet

Mica Sheet

SBS Modified Bitumen Membrane

ブランドスーパーコピー

Roof Waterproof Membrane

Best buy for ugg classic mini boots sale Clarks, Sandale décontractée DESIRAE PALM, femmes 'latest products' under $180 bulk purchase discounts

Synthetic Fiber Sheet

ブランドスーパーコピー

How to find discounts ugg chestnut boots classic sale 2024 Converse, Women's Chuck Taylor All Star Lift Sketch Hi Platform Sneaker – Black White White 'latest trends' under $90 buy with confidence

Electrophoresis Vs Anodizing

Electric Heating Tube

Aluminium Extrusion Shapes

KAMMPROFILE GASKETS

JACKETED GASKETS

http://www.koclub.com

Find best discounts ugg boots classic short women sale 2024 Converse, Women's Chuck Taylor All Star Wedge Sneaker – White Red Navy 'cheap products' under $60 only a few left

Affordable online shopping ugg boots sale australia clearance Converse, Men's Chuck Taylor All Star Megatron Hi Top Sneaker – Black Grey Court Purple 'best value online' under $70 big deals

NITRILE RUBBER SHEETING

SPIRAL WOUND GASKETS

Extrusion Rollers

Extruded Heat Sink Profiles

GASKET

Online best deals ugg winter boots sale online uk Converse, Kids' Chuck Taylor All Star Malden Street 1V Sneaker – Bear Nap White Black 'online shopping' under $100 special offers

Cheap shopping options ugg boots chestnut classic tall Converse, Infants' Chuck Taylor All Star Sherpa Bear Easy-On Sneaker – Sharkskin Warm Quarry Egret 'popular products' under $80 hot sale

Find best products ugg boots chestnut sale Heydude, Heydude, Women's Wendy Casual Shoe – Tie Dye Navy Pink 'top choices' under $160 everyday low prices

HIGH TEMPERATURE SILICONE SHEETS

Where to find authentic ugg australia black friday sale Heydude, Heydude, Women's Wendy Linen Casual Shoe – Guava 'best products' under $140 online shopping

1 PLY INSERTION RUBBER SHEET

Best discounts on ugg bailey button boots sale uk Heydude, Heydude, Women's Wendy Sox Casual Shoe – Glacier Grey 'exclusive products' under $130 fast and secure payment

CHINA HIGH TEMPERATURE SILICONE SHEETS

Outdoor Lift

FOOD GRADE NEOPRENE SHEETING – WHITE FDA

Stationary Boom Pump

CHINA FOOD GRADE NEOPRENE SHEETING – WHITE FDA

Man And Material Hoist

glimsc.xsrv.jp

Online cheap shopping ugg boots sale for women Heydude, Heydude, Women's Wendy Casual Shoe – Rose Candy Tie Dye 'trending products' under $150 best customer service

Mast Lift

ブランドスーパーコピー

Buy authentic items cheap ugg black friday 2024 boots Heydude, Heydude, Women's Wendy Casual Shoe – Black Marble 'save big' under $170 shop with confidence

Concentrator Oxigen

Where to buy authentic uggs kensington Birkenstock, Birkenstock, Tongs GIZEH PLATFORM VEGAN BF, blanc, femmes 'best price' under $60 high quality products

Safety Waste Cap

beta.carrara.poznan.pl

Rubber Sheet Reinforce with Cloth

Natural Rubber Sheet

Buy cheap products ugg men Birkenstock, Birkenstock, Baskets à lacets BEND, blanc, hommes 'exclusive offers' under $70 quick delivery offers

C18 Column Hplc

Shop for authentic ugg sale clearance Birkenstock, Birkenstock, Sandales étroites SOLEY LTR, noir, femmes 'discount offers' under $50 best value shopping

Hplc Mobile Phase Solvents

Natural Rubber Sheeting

Buy products online for cheap ugg scuffette SoftMoc, SoftMocs Shuri, noir, femme 'top-rated deals' under $160 big online sale

H Shape Rubber Seal Strips

Stainless Capillary Tube

How to purchase cheap man uggs Birkenstock, Birkenstock, Tongs en cuir huilé à grosse boucle GIZEH BIG BUCKLE, cognac, femmes 'shop online' under $190 cheap online shopping

Black Natural Rubber Sheets

ブランドスーパーコピー

Metal Capillary Tube