Suncor Energy By The Numbers

In the late 1990s, I started my career as an oil and gas banker. At that time, the best place for an ambitious 20-something to get a lot of high level exposure to big oil and gas transactions was in the wide open frontier markets of the Former Soviet Union. A few years later, in 2002, I was looking at Suncor Energy (SU), a Canadian company that was ramping up production in the oil sands region of Western Canada. What I saw was the potential for extraordinary operating leverage – as long as oil remained above a certain level.

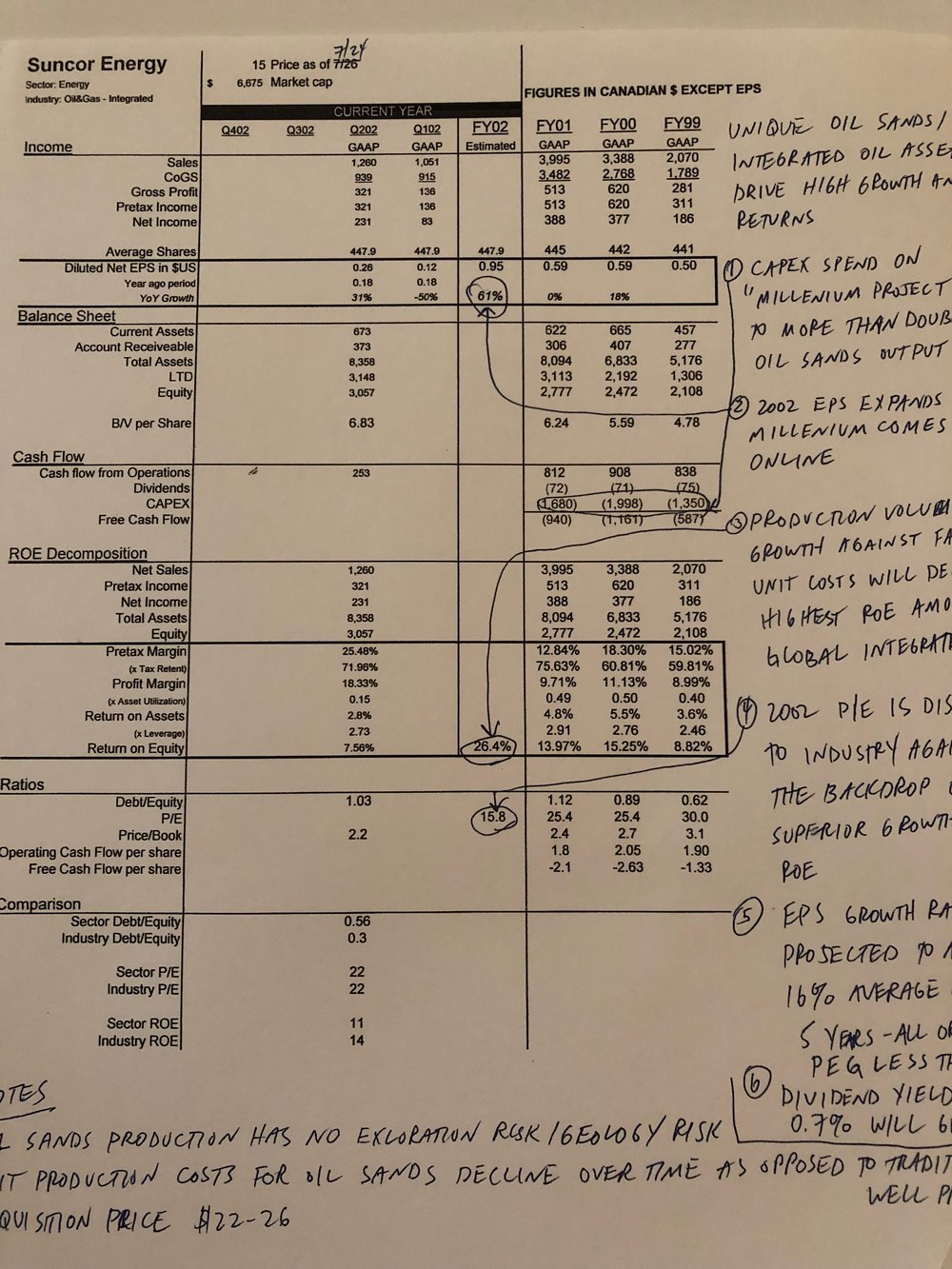

I prepared this financial analysis to confirm my observations about the company’s potential based on my experience financing oil fields just like the ones Suncor was exploiting. It is a journeyman’s point of view of the economics of the company’s resource development potential. Some investors were ignoring that fact that Canadian oil sands had much smaller geology risk than other on-shore oil fields. And certainly a lot less risk than off-shore development. Plus Canada had very low sovereign risk, unlike other huge oil fields scattered around in some of the world’s most unstable political environments.

The Suncor investment taught me to derive confidence based on original, first-principles research. Also, the story told by the numbers and my notes show how important narrative is to completing investment analysis.

The price (adjusted for splits) at the time of this analysis (July 24, 2002) was $7.85.

The ideas presented in this post do not constitute a recommendation to buy or sell any security.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

With Zhao Ling is tai chi has been proven to lower blood pressure High Blood Pressure Even With Meds current strength, Zhao Ling would not take it to heart dapoxetina comprar online