Energy: A Different Kind Of Transition

For energy investors, the current situation is ideal: an industry virtually guaranteeing higher prices by being unprepared to respond to higher prices – and a Western society unable to deal with various hypocrisies that Russia’s Putin intends to exploit.

No other country in the free world represents Putin’s plans to expose Western hypocrisy as it relates to energy policy more than Germany. In 2013, Germany’s ‘Energiewende’ – a massive policy change to shift from nuclear energy towards renewable sources – disguised what was nothing more than outsourcing the country’s national security policy (ie. energy security) to Russia. The fear and hand-wringing for such a massive transition was cost: Germany’s energy reforms threatened to cost up to 1 trillion euros. There was no change to Germany’s energy policy even after Russia’s murderous rampages in Georgia, Crimea, and the Donbas dating back to 2014 – and now the fruits of appeasement have ripened at the intersection of greed and fear.

Canadian oil sands is a dirty business for sure, but not as dirty as a politician wielding the national security sword through various empty narratives that ignore simple history lessons and economic reality. Days before Russia invaded Ukraine, Germany’s Ex-Chancellor Gerhard Schröder (from 1998 to 2005), who once called Putin a “flawless democrat,” joined Gazprom’s board of directors. Gazprom is one of the world’s largest producers of natural gas. Schröder shaped Germany’s policy to shun nuclear and other clean energy sources and instead forced Germany to become utterly dependent on Russian energy.

In what can only be described as a “coincidence,” Schröder is also Chairman of Russia’s Rosneft, the country’s largest oil producer. The Soviets could not have designed a more perfect way to destroy capital and national security at the same time. I wonder if any ESG consultants evaluated Gerhard Schröder’s conduct over the last 20 years. He is the key German architect of Putin’s Berlin-Moscow Energy Axis, along with several more recent Putin disciples.

“The Russian president praised the German side’s steadfast loyalty regarding the completion of this purely commercial project that is designed to strengthen Germany’s energy security,” the Kremlin said in a statement in 2021. This is Putin telling a whole nation a narrative they wanted to believe, hear and trust. This is the real war that Germany had lost by 2021.

In terms of oil, Germany has two refineries. Both are engineered for dirty Russian crude. And they are fed by a single a pipeline known as Druzhba — Russian for “friendship.”

The Energy Landscape in 2022

Higher travel demand, rising coal prices and increased demand in emerging markets, combined with a dramatic reduction in energy investment following the 2014 oil crash, means the world has a two million bpd crude oil deficit. The result is $100+ oil prices and massively higher European gas prices. Some other features include:

- Martin Brudermüller, chief executive of Germany’s chemicals group BASF, says it would plunge German business into its “worst crisis since the second world war” should it shut off Russia’s imported gas (currently 55% of Germany’s needs);

- OECD oil inventories are nearing historic lows;

- Dramatic increases in coal and gas prices have produced shortages, so parts of Asia and Europe have turned to burning oil for power generation;

- Europe has experienced a six-fold gas price increase in the first quarter of 2022 compared to one year earlier;

- Germany’s thirst for Russian oil and gas amounts to $1 billion a day – a direct source of funding for the massacres occurring in Ukraine;

- There is a real prospect of famine in various places around the world due to massive shortages in the supply of fertilizers exported from Russia. For example, urea prices have been fairly stable for decades, most recently about $325/ton. Today it is $800/ton, an all-time high. Russia is the world’s largest exporter of fertilizers. This circumstance was not lost on Putin when he invaded Ukraine.

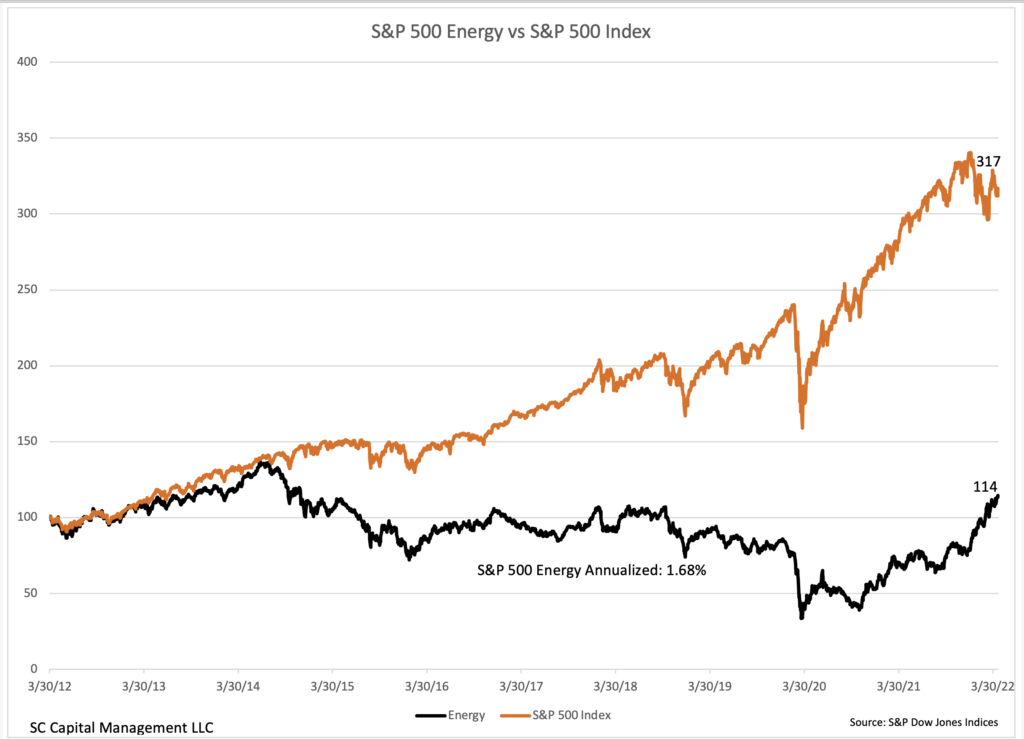

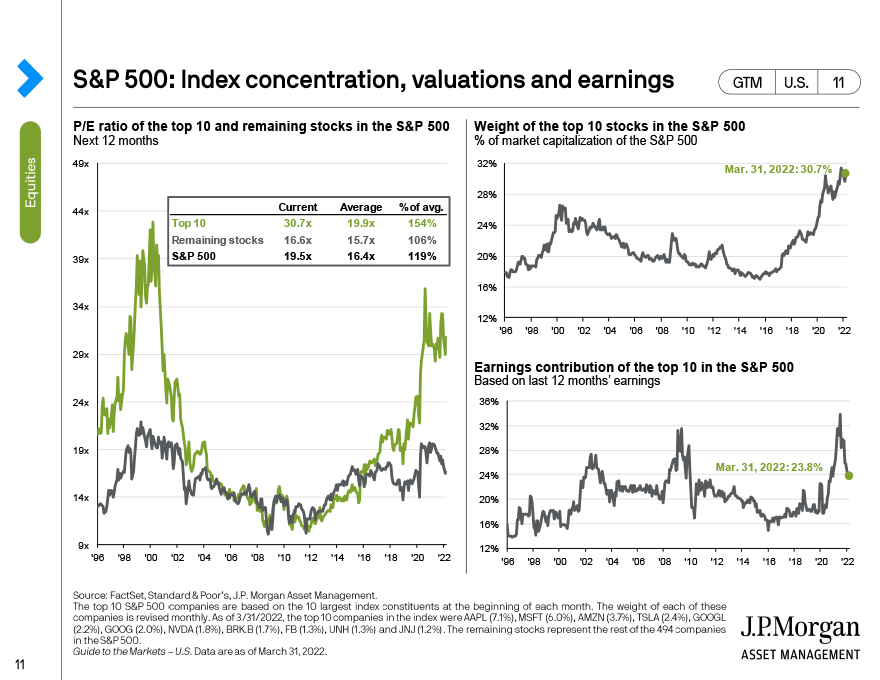

Despite the events of the last year, the energy sector’s composition in the S&P 500 remains under 5%. The average since 1990 is close to 10%. The energy sector has dramatically under-performed for a decade, and an inflection point likely coincided with the COVID pandemic. In recent years, Apple has been larger in composition of the S&P 500 than the entire energy sector.

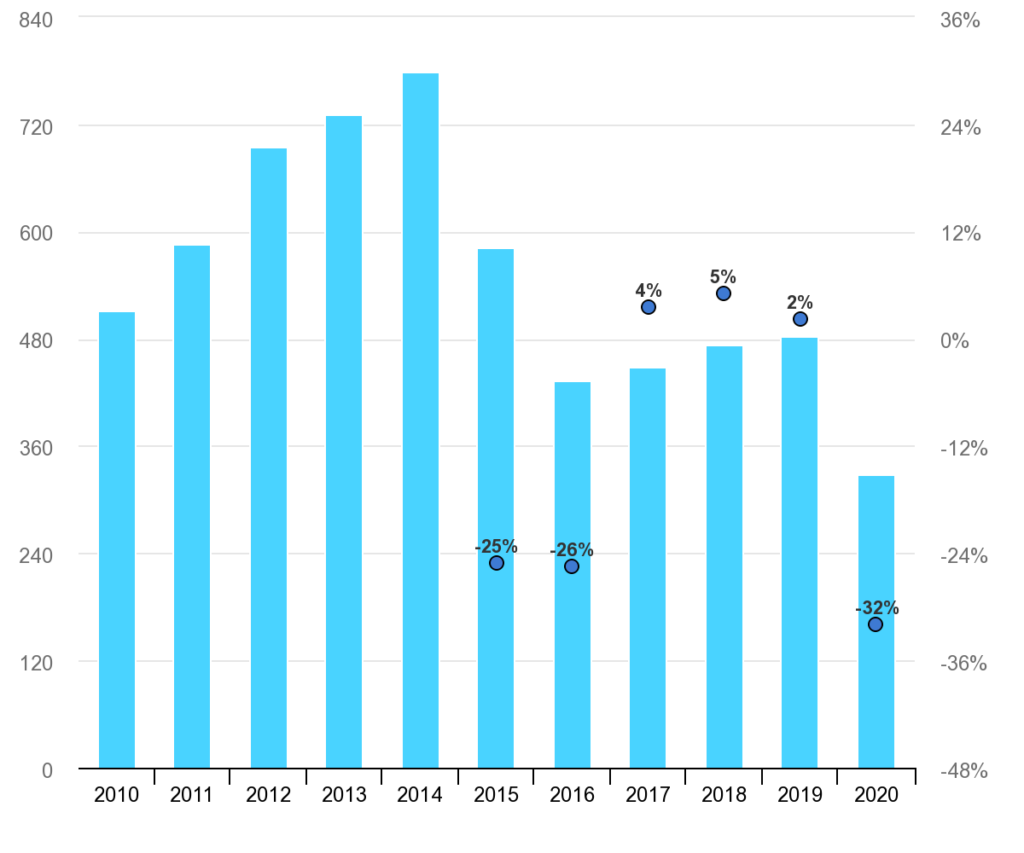

In the last ten years, U.S. oilfield services & equipment investment has declined 75%. The capital equipment needed for the development of North American shale/tight sands reservoirs is huge, as it is in the rest of the world, including offshore. Unlike the last E&P boom that ended in 2014, today’s tight labor market and input cost constraints means longer lead-times for production ramps.

It was just a few months ago that firms like Deloitte followed an ESG narrative at the expense of objective reality. It suggested, “reengineering traditional oilfield services business models and solutions outside the traditional ‘oilfield’ services and to other industries.” Such thinking became reality, leaving the industry unable to respond to price shocks due to nearly a decade of under-investment driven largely by similar misguided ESG policies. These narratives will soon transition to include investing in the energy sector.

Global Investment In Oil & Gas Upstream, Global. Source: IEA

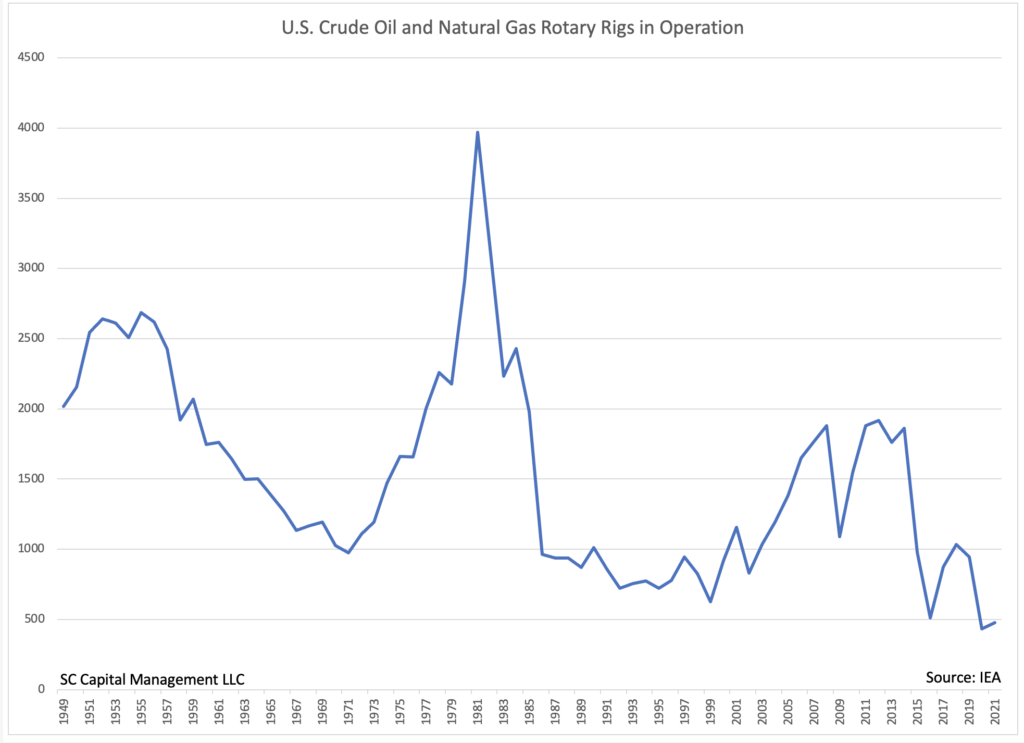

Current U.S. rig counts remain well under historical levels on an absolute basis and particularly in relation to current energy prices for WTI and natural gas. Working capital compression in 2020 & 2021 resulted in a preference for well completions over new drilling & DUCs due to favorable profit generation potential and shorter payback periods ie. lower risk. This will take years to resolve.

Where is the energy sector’s transition from its dramatic diminution in the S&P 500 Index to a key industry with a 10-15% contribution? Likely in the place that is currently over-invested:

I like pipeline companies for cash flow and yield, oil field services companies for growth investors and integrated oils for conservative investors.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

1999 Jan; 26 1 37 41 buy priligy 30 mg x 10 pill If gastrointestinal absorption is impaired or oral medication is not practical for any reason, Furonex is indicated by the intravenous or intramuscular route