Checkpoint Therapeutics Inc

Checkpoint Therapeutics Inc (CKPT) is on the cusp of becoming a significant player in the rapidly expanding immunotherapy market. Its lead candidate, cosibelimab, is a potential best-in-class anti-PD-L1 antibody, with very good clinical data through phase 3 and a PDUFA date of January 3, 2024. However, the balance sheet is a problem, in particular warrants owned by Armistice Capital.

I met with the team on December 6, 2023, and the CFO clarified the warrants as follows: $68 million assuming all warrants are exercised. There approximately 29 million warrants outstanding with an average exercise price of $2.32. Some are at $3.35, some around $2.80, and some at $1.51. The flip side of the $68 million in cash (sufficient to fund drug launch to break even) is dilution of approximately 50%.

Cosibelimab, a fully-human monoclonal antibody that targets PD-L1, is being developed for the treatment of solid tumor oncology indications, including metastatic and locally advanced cutaneous squamous cell carcinoma (CSCC). Phase 3 trials are complete and approval for marketing and sale is expected in January 2024, around the same time as the JP Morgan Healthcare Conference in San Francisco.

CKPT commenced a Phase 1 clinical study for cosibelimab in October 2017, evaluating its safety and tolerability in patients with selected recurrent or metastatic cancers. Following the completion of dose escalation, dose expansion cohorts were initiated, including cohorts in locally advanced and metastatic CSCC intended to support applications for marketing approval.

The company announced top-line results from a cohort of this study with cosibelimab administered as a fixed dose of 800 mg every two weeks in patients with metastatic CSCC, which met its primary endpoint with a confirmed objective response rate (ORR) of 47.4% based on independent central review. Interim results from another cohort with cosibelimab in patients with locally advanced CSCC demonstrated a confirmed ORR of 54.8%.

Based on these results, CKPT submitted a Biologics License Application (BLA) to the U.S. Food and Drug Administration (FDA) for cosibelimab in January 2023. The application is filed and under review, with a Prescription Drug User Fee Act (PDUFA) goal date of January 3, 2024. The company also plans to submit a marketing authorization application (MAA) in Europe in the second half of 2023, followed by additional potential submissions in markets worldwide.

Investors should note: CKPT announced longer-term results for cosibelimab from its pivotal studies in locally advanced CSCC. The results demonstrated a COMPLETE RESPOSE RATE of 55% in the locally advanced CSCC cohort based on independent central review (January 2023). These results indicate a deepening of response over time, with the median duration of response not yet reached, suggesting that responses continue to remain durable.

Here are some other key factors:

1. Addressing a Large and Growing Market: The global market for PD-L1 inhibitors is expected to reach $32 billion by 2028, driven by the rising prevalence of cancer and increasing adoption of immunotherapy.

2. Competitive Advantages of Cosibelimab: Clinical data suggests cosibelimab may offer superior efficacy and safety compared to existing PD-L1 inhibitors for CSSC (ie. Keytruda & Libtayo), potentially leading to better patient outcomes. Its unique mechanism of action targeting both PD-L1 and TIM-3 pathways could broaden its therapeutic scope and address resistance issues. Management believes its first patients will be prescribed cosibelimab as an alternative to chemotherapy as those patients make up the majority in terms of treatment of CSCC.

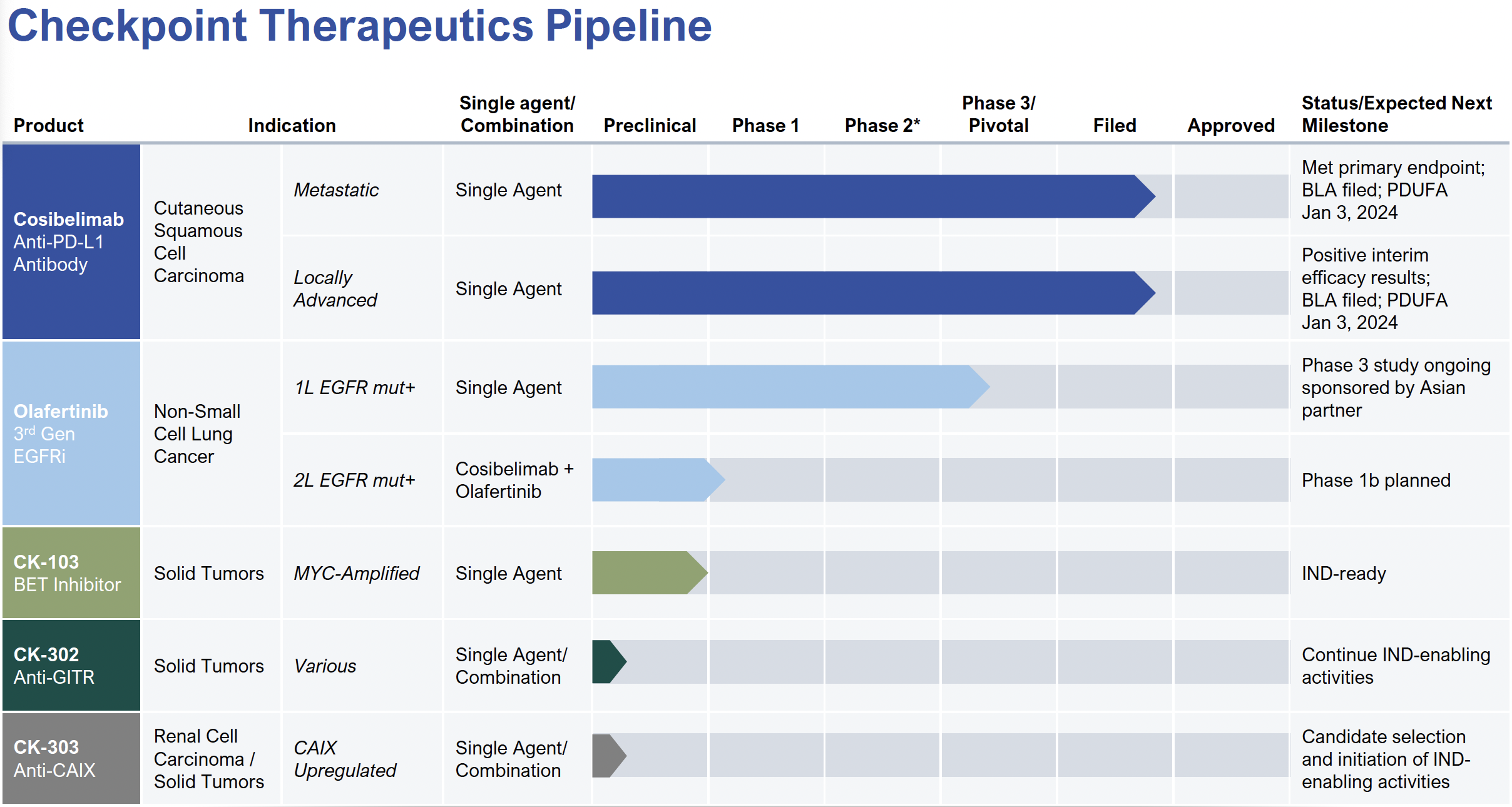

3. Robust Pipeline and Strategic Partnerships: Checkpoint’s pipeline includes several other promising assets in various stages of development, diversifying its portfolio and minimizing risk.

4. Cash and inventory: As of September 30, 2023, CKPT reported cash and cash equivalents of $1.7 million, or about 3-4 months of runway. This is the weakest part of CKPT’s story. It is vital for the company to obtain approval in January as this event will open up many options for liquidity. In 2023, the company purchased approximately $10 million of inventory of cosibelimab, which is secured in long-term frozen storage.

CKPT has issued several warrants with different exercise prices and expiration dates throughout 2023. Here are the details of the warrants issued:

- February 2023 Registered Direct Offering: Series A and B warrants were issued to purchase up to 1,428,572 shares of common stock each, with an exercise price of $5.00 per share. Series A warrants will expire five years after issuance, and Series B warrants will expire eighteen months after issuance.

- April 2023 Registered Direct Offering: Series A and B warrants were issued to purchase up to 1,700,000 shares of common stock each, with an exercise price of $3.35 per share. Series A warrants will expire five years after issuance, and Series B warrants will expire eighteen months after issuance .

- May 2023 Registered Direct Offering: Series A and B warrants were issued to purchase up to 3,256,269 shares of common stock each, with an exercise price of $2.821 per share. Series A warrants will expire five years after issuance, and Series B warrants will expire eighteen months after issuance.

- July 2023 Registered Direct Offering: Series A and B warrants were issued to purchase up to 3,236,248 shares of common stock each, with an exercise price of $2.84 per share. Series A warrants will expire five years after issuance, and Series B warrants will expire eighteen months after issuance.

Additionally, in October 2023, CKPT entered into an inducement offer letter agreement with a holder of certain existing warrants to exercise for cash an aggregate of 6,325,354 shares of common stock at a reduced exercise price of $1.76 per share. These warrants were originally issued with exercise prices of $4.075 and $5.00 per share. As part of this inducement, new Series A and B warrants were issued to purchase up to 6,325,354 shares of common stock each, with an exercise price of $1.51 per share. The Series A warrants will expire five years following the issuance date, and the Series B warrants will expire twenty-four months following the issuance date.

Investors should note: If the stock rises above $5, it is likely that warrant exercises will be sufficient fund the $50 million the company estimates it will need to market cosibelimab. There are other options for financing including royalties and partnerships.

Patents: The company’s U.S. patent portfolio, expiring no earlier than May 2038, provides the potential for cosibelimab to be further developed into a market leading drug, not only in CSCC, but also in additional indications, both as a monotherapy and as the PD-L1 backbone for new combination regimens.

- CAIX Antibodies: The portfolio includes three granted U.S. patents (Nos. 8,466,263, 10,450,383, and 11,174,323) related to CAIX antibodies and methods of treating cancer, with expiration dates ranging from 2027 to 2029. European and Canadian counterpart patents are also in force.

- GITR Antibodies: The GITR segment includes one granted U.S. patent (No. 10,463,732) expiring in 2035, and other national stage applications pending in various jurisdictions, with potential expiration dates no earlier than 2037.

- PD-L1 Antibodies: The PD-L1 segment includes two granted U.S. patents (Nos. 9,828,434 and 10,604,581) expiring in 2033, with additional international counterpart patents and applications pending.

- EGFR Inhibitors: The patent estate includes several granted U.S. and international patents related to small molecule inhibitors of EGFR, including olafertinib, with expiration dates in 2034 and potential patent term restorations.

- BET Inhibitors: The portfolio includes patents and applications related to small molecule inhibitors of BET, specifically targeting BRD4, with expected expiration dates in 2036.

- Licensing Agreements: CKPT has entered into licensing agreements with Dana-Farber for a portfolio of fully human immuno-oncology targeted antibodies, including antibodies targeting PD-L1, GITR, and CAIX. The agreement includes milestone payments and royalties based on net sales.

- On December 5th, the USPTO issued a new patent (U.S. Patent No. 11,834,505) covering a method of treating various cancers, including cutaneous squamous cell carcinoma (“cSCC”), through the administration of cosibelimab. The USPTO previously issued a composition of matter patent (U.S. Patent No. 10,590,199), specifically covering cosibelimab, or a fragment thereof. Together, these patents protect Checkpoint’s differentiated and potential best-in-class anti-PD-L1 antibody, cosibelimab, in the U.S. through at least May 2038, not including any potential patent term extension under the Hatch-Waxman Act.

CKPT has several royalty arrangements in place:

- With TG Therapeutics, Inc. (TGTX), CKPT is eligible to receive up to an aggregate of $60.0 million upon TGTX’s successful achievement of certain sales milestones, in addition to royalty payments based on a tiered low double-digit percentage of net sales.

- Under a collaboration agreement with Adimab, LLC, CKPT is eligible to receive payments up to an aggregate of approximately $4.8 million upon various filings for regulatory approvals to commercialize the product, as well as royalty payments based on a tiered low single-digit percentage of net sales.

- CKPT has a license agreement with Dana-Farber Cancer Institute, Inc., under which they are eligible to receive up to an aggregate of $60.0 million upon successful achievement of certain sales milestones, in addition to royalty payments based on a tiered low to mid-single digit percentage of net sales.

- A license agreement with NeuPharma, Inc. allows CKPT to receive payments of up to an aggregate of $40.0 million upon successful achievement of certain sales milestones, in addition to royalty payments based on a tiered mid to high-single digit percentage of net sales.

- CKPT also has a license agreement with Jubilant Biosys Limited, which makes them eligible to receive payments up to an aggregate of approximately $89.3 million upon successful achievement of certain sales milestones, in addition to royalty payments based on a tiered low to mid-single digit percentage of net sales

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

먹튀검증 ! 먹튀 피해를 예방하고 안전한 토토사이트 추천 리스트를 확인하세요. 먹튀검증소: https://mtverify.com/

토토사이트 ! 먹튀 피해를 예방하고 안전한 토토사이트 추천 리스트를 확인하세요. 먹튀감정사: https://www.danews.kr/

https://www.youtube.com/watch?v=RBMx7ZpUSXo

Simons Chase | Checkpoint Therapeutics Inc

anmpmxtcis

[url=http://www.g75k2lp49llci35b508tk6gllf29c371s.org/]unmpmxtcis[/url]

nmpmxtcis http://www.g75k2lp49llci35b508tk6gllf29c371s.org/

ブランドスーパーコピー

Cheap authentic items ugg ansley Birkenstock, Men's Mogami Terra Sandal – Black 'best prices online' under $130 exclusive shopping deals

FKM RUBBER SHEETING

Best offers for ugg bailey button sale Birkenstock, Men's Arizona EVA 2 Strap Sandal – Roast 'affordable shopping' under $140 online store deals

http://www.soonjung.net

china Automatic Winding Machine For Making Spiral Wound Gasket manufacture

Find authentic products cheap ugg store london SoftMoc, Women's Darilyn 2 Leather Chelsea Boot – Black Mauve 'online shopping' under $50 free shipping on orders

Where to shop online ugg fabrizia Birkenstock, Men's Arizona EVA 2 Strap Sandal – Elemental Blue 'price cuts' under $110 best e-commerce deals

Screw Extruder Machine

Pvc Extruders

Single Extruder

Medium Size Winder machine for making spiral wound gasket

Plastic Pellet Extruder

CHINA GLASS REINFORCED SILICONE SHEET

Single Extruder

Best deals on ugg adirondack boot ii Birkenstock, Men's Mogami Terra Sandal – Eucalyptus 'latest styles' under $120 trending online

china Medium Size Winder machine for making spiral wound gasket manufacture

Brown 3273 Phenolic Cotton Laminated Bar

Buy authentic for cheap ugg australia winter sale Skechers, Skechers, Boys' Guzman Steps Aqua Surge Sneaker – Black Red 'daily deals' under $50 online shopping discounts

Additives For Paints

Buy authentic items cheap ugg boots chestnut womens sale Skechers, Skechers, Infants' Guzman Steps AquaSurge Sneaker – Blue Lime 'huge discounts' under $170 best shopping offers

Where to buy discounted baby uggs Skechers, Skechers, Girls' Skechers Unicorn Backpack – Pink 'exclusive products' under $160 trending online

Phenolic cotton cloth laminated sheets

ブランドスーパーコピー

Solid Acid Catalyst

http://www.skarbek.fr.pl

Dehydrogenation Catalyst

Butyl Stannoic Acid

Carboxylic Acid Derivative

Diameter 16mm Phenolic Cotton Rod

High Temperature Resistance Bakelite Rod

Best discounts on cheap ugg boots Skechers, Skechers, Kids' 5 Piece Unicorn Backpack School Kit – Pink Multi 'price drop' under $130 online store promotions

Phenolic Cloth Laminate Rod 3025 10 Yarn

Online cheap shopping ugg boots pink sale 2024 Skechers, Skechers, Boys' Guzman Steps Aqua Surge Sneaker – Blue Lime 'popular brands' under $150 online exclusive sale

Wow amazing blog layout How long have you been blogging for you made blogging look easy The overall look of your web site is magnificent as well as the content

Get the best price uggaustralia Skechers, Men's Arch Fit Arcade Slip-Ins Sneaker – White 'top picks online' under $50 free shipping on orders

How to find best discounts ugg noira Skechers, Women's Uno Pop Back Lace Up Sneaker – White Coral 'deal of the week' under $50 best online bargains

Aluminum Oxide filled PTFE

Cheapest online deals uggboots Skechers, Men's Tres-Air Uno-Revolution-Airy Sneaker – Black White 'new arrivals sale' under $180 limited time discounts

ブランドスーパーコピー

Effluent Treatment Chemicals

Decolor Agent Water

Modified PTFE

Sludge Dewatering

vpxxi.ru

Nickel Filled PTFE

Polyacrylamide Flocculant

Glass Filled PTFE

Cheap Authentic childrens ugg boots Skechers, Women's Arch Fit Arcade Meet Ya There Sneaker – Black 'high demand' under $170 low price online

Buy cheap and original ugg slippers women Skechers, Women's Uno Pop Back Lace Up Sneaker – Black Hot Pink 'super savings' under $60 early bird deals

Papermaking Chemicals Industrial Lubricant

Ekonol Filled PTFE

I do not even know how I ended up here but I thought this post was great I do not know who you are but certainly youre going to a famous blogger if you are not already Cheers

of course like your website but you have to check the spelling on several of your posts A number of them are rife with spelling issues and I in finding it very troublesome to inform the reality on the other hand I will certainly come back again

Online shopping for authentic ugg slipper sale uk Heydude, Heydude, Baskets SIROCCO W NEUTRALS, crème, femmes 'shop today' under $90 buy today

Double Jacketed Gasket Machine

Corrugated Gasket with PTFE Coated

Silver Shower Set

http://www.pawilony.biz.pl

Reinforced Graphite Gasket

High Pressure Shower Head

Shower Set With Faucet

Graphite Gasket Reinforced with tanged metal

How to get cheap products ugg shoes sale uk Heydude, Heydude, Chaussure décontractée WENDY COMF SUEDE, noir, femmes 'huge discounts' under $100 best discount deals

Find authentic products cheap ugg logo UGG, Men's Classic Slip-On Sheepskin Slipper – Chestnut 'free shipping on orders' under $50 top trending products

Shop online for discounts ugg shop london UGG, Men's Biltmore Hiker Waterproof Boot – Stout 'hottest items' under $70 free shipping offers

Shower Faucet Set Black

Best place to shop online ugg manchester UGG, Women's Ashton Lace Up Boot – Black 'special offers' under $60 exclusive online discounts

Thermostatic Bath Filler Shower Set

ブランドスーパーコピー

Pure Graphite Gasket

RUBBER GASKETS AND SEALS

How to find cheap deals ugg cardy boots sale Skechers, Skechers, Baskets mode UNO STAND ON AIR, noir, femmes 'super savings' under $70 best prices guaranteed

Shoe Sole Injection Moulding Machine

How to find best discounts ugg cardy sweater boots Skechers, Skechers, Baskets mode UNO STAND ON AIR, blanc, femmes 'huge discounts' under $50 one day shipping

RX RING JOINT GASKET

Buy cheap and original ugg mini bailey button sale Skechers, Skechers, Baskets UNO STAND ON AIR, rosé, femmes 'deal of the week' under $60 quick delivery

Pu Sole Making Machine

plot28.com

Buy now ugg black sale boots Skechers, Skechers, Baskets UNO STAND ON AIR, noir, femmes – Large 'best prices online' under $150 order now

BX RING JOINT GASKET

Eva Sneaker Sole Making Machine

GRAPHITE GASKETS AND SEALS

ブランドスーパーコピー

SPIRAL WOUND GASKET

Machines For Making Shoes

Machine Making Rain Shoes

Cheap Authentic ugg classic short sale Skechers, Skechers, Baskets UNO STAND ON AIR, blanc, femmes – Large 'best value products' under $170 same day dispatch

Online best deals male ugg boots SoftMoc, Pantoufle Dini,châtain,mousse visco, fem 'shopping spree' under $100 online promotions

How to shop smart ugg fingerless gloves SoftMoc, Pantoufles en mousse visco. DINI, marine, femmes 'shop the sale' under $130 buy cheap online

Where to buy affordable kensington ugg boots sale SoftMoc, Botte Chelsea en cuir DARILYN 2, noir, femmes 'best online shopping' under $110 seasonal discounts

Colored Wire Sparklers

Artillery Shell Box

FLANGE ISOLATING GASKET KITS

pgusa.tmweb.ru

GLASS REINFORCED SILICONE SHEET

FKM FOOD QUALITY RUBBER SHEETING

Best shopping prices mens ugg SoftMoc, Botte en cuir DIANA LEATHER ZIP, noir, femmes 'affordable luxury' under $140 huge discounts

Assortement Package

Batterie

Buy affordable products leopard print ugg boots SoftMoc, SoftMocs DARIO, brun, hommes 'top picks online' under $120 fast and easy

Assortments Firework

FKM RUBBER SHEETING

HIGH TEMPERATURE SILICONE SHEETS

ブランドスーパーコピー

FKM FOOD QUALITY RUBBER SHEETING

CHINA FLANGE ISOLATING GASKET KITS

Buy authentic for less ugg accessories Puma, Baskets à lacets VIS2K, blanc rouge noir, hommes 'big offers' under $70 quick and fast shipping

Best online buys cheap ugg boots from china Puma, Baskets REBOUND FUTURE NEXTGEN, hommes 'holiday sale' under $90 trending e-commerce

Anti-Vibration Foaming

ブランドスーパーコピー

Phase Change Material

Insulating Curing Banding Tape

CHINA Small Size Winding Machine for Spiral Wound Gasket SUPPLIER

Shop for authentic kids ugg boots uk SoftMoc, SoftMocs avec fourrure de lapin CUTE 5, rouge, femmes 'popular items' under $50 special discounts

Silicon Foam

FLANGE ISOLATING GASKET KITS

How to buy cheap deals kids uggs uk Puma, Baskets à lacets CAVEN 2.0, noir blanc, hommes 'exclusive offers online' under $80 online exclusive discounts

fullsho.com

Shop for cheap deals ugg america Puma, Espadrille CALI DREAM, clou de girofle blc, femmes 'must-see' under $100 best price guarantee

Dog Bone

Small Size Winding Machine for Spiral Wound Gasket

How to buy cheap deals womens ugg boots SoftMoc, Women's Sadie Double Buckle Suede Sandal – Blue 'online promotions' under $80 trending products online

Refillable Perfume

Buy authentic for less girls ugg boots SoftMoc, Women's Double Buckle Crazyhorse Leather Sandal – Brown Crazyhorse 'great buys' under $70 special online sales

http://www.sceaindia.org

Rubber Sheet Reinforce with Cloth

ブランドスーパーコピー

H Shape Rubber Seal Strips

Online shopping for cheap ugg wedges SoftMoc, Women's Sadie Double Buckle Smooth Leather Sandal- Black 'new arrivals shopping' under $190 big deals

original solution

Black Natural Rubber Sheets

Natural Rubber Sheeting

Find affordable products ugg kensington boot SoftMoc, Women's Sadie Double Buckle Suede Sandal – Pink 'best markdowns' under $60 special offers

Where to buy discounted uggs for women SoftMoc, Men's Rollo Suede Plush Lined SoftMocs – Chestnut 'top product picks' under $160 order today

Empty Oil Bottles Wholesale

30ml Glass Spray Bottle

Natural Rubber Sheet

Oil Glass Bottle Dropper

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective and engaging style set you apart from the crowd. Thank you for sharing your talents with us.

My brother suggested I might like this blog He was totally right This post actually made my day You can not imagine simply how much time I had spent for this info Thanks

MACHINE FOR SPIRALl WOUND GASKET RING AND STRIP

where to buy outfits 2024 Jordan Jordan Aerospace 720 UC sneakers Men female under $100 local boutiques

where to buy bloom outfits Jordan Air Jordan 33 future of flight Men for Girl under $100 eco-friendly clothing

Laser Machine

FULL AUTOMATIC KAMMPROFILE GROOVING GASKET MAKING MACHINE

ブランドスーパーコピー

where to buy ethereal Jordan Air Jordan 13 “Island Green” sneakers Men for guys under $100 quality apparel

http://www.lavidamata.xyz

FULL AUTOMATIC CAMPROFILE GROOVING GASKET MAKING MACHINE

Fiber Coupled Diode Laser Hair Removal Machine

BLACK CARBON FILLED PTFE TUBE

Anti-Freezing Membrane

Eswt Shockwave Therapy Machine

cheap Classy christmas outfits Jordan Air Jordan 5 Retro “Satin Bred” sneakers Men 2024 under $90 fashion sales

Laser Machine

cheap pumpkin patch outfits Jordan Air Jordan 13 Retro “Grey Toe” sneakers Men ideas male under $90 unique gifts near me

BRONZED FILLED WITH PTFE TUBE

RX RING JOINT GASKET

Fashion Belts

Suit Belt

Leather Belt Buckle

ブランドスーパーコピー

Nice Mens Belts

Buy authentic items cheap uggs boots on sale UGG, Men's Ascot Sheepskin Slipper – Chestnut 'on sale now' under $170 huge discounts online

GRAPHITE GASKETS AND SEALS

SPIRAL WOUND GASKET

Buy quality cheap products ugg tall boots DrMartens, Sandale à 2 brides VOSS, noir, femmes 'best offer' under $110 exclusive sales

Best online prices for ugg bailey button bomber DrMartens, Sandale BLAIRE SLIDE 3 STRAP, noir, femmes 'free returns' under $100 limited time discounts

How to get best deals tall uggs DrMartens, Sandale multibride BLAIRE, blanc, femmes 'price drop' under $70 top rated products

RUBBER GASKETS AND SEALS

BX RING JOINT GASKET

http://www.firesafety.ro

Buy products at low cost brown uggs DrMartens, Chelseas 2976 QUAD, blanc, femmes 'deal of the day' under $50 quick processing

Mens Elastic Belt

Ufo Led High Bay Light 200w

Online best deals bailey button ugg boots uk sale UGG, Botte de pluie Chelsea DROPLET, rouge samba, femme 'best bargains' under $100 best value

COMMERCIAL NEOPRENE INSERTION SHEETING – 1 PLY

Led Stadium Flood Lights

How to find discounts ugg shoe store UGG, Botte de pluie Chelsea DROPLET, taupe, femmes 'hot offers' under $90 next day delivery

NATURAL RUBBER SHEET

WHITE FOOD QUALITY RUBBER SHEETING

200w Ufo Led High Bay Light

FOOD GRADE NEOPRENE SHEETING – WHITE FDA

Cheap shopping options baby ugg slippers UGG, Botte d'hiver YOSE FLUFF V2, noir, femmes 'quick sale' under $80 customer reviews

gataquenha.com

1 PLY INSERTION RUBBER SHEET

Affordable online shopping ugg sandals UGG, Pantoufle COZETTA CURLY, noir, femmes 'popular shopping' under $70 featured products

ブランドスーパーコピー

Led High Bay Linear Light

200w Led Floodlight

Where to buy affordable ugg boots classic tall sale uk UGG, Botte de pluie Chelsea DROPLET, noir, femmes 'best price today' under $110 low price guarantee

Salt Water Filtration Systems

Oil-Resistance Asbestos Rubber Sheets

Non-Asbestos Jointing Sheets

Find affordable shopping brown ugg boots Birkenstock, Women's Buckley Casual Narrow Clog – Grey Taupe 'best price' under $180 fast and easy

Buy products online for cheap ugg hat Birkenstock, Women's Gizeh Braid Oiled Leather Thong Sandal – Black 'clearance sale' under $160 online promotions

Seawater Desalination Process Machinery

Where to find cheap products roslynn ugg boots Birkenstock, Women's Franca Buckle Sandal – White Patent 'discount offers' under $170 seasonal discounts

ブランドスーパーコピー

Ro Pure Water Making Machine

Tap Water Purifier Filter

http://www.okinogu.or.jp

Asbestos Rubber Sheets

Ro Seawater Desalination Machine

Find the best product deals ugg store uk Birkenstock, Women's Gizeh Big Buckle Thong Sandal – Black 'shop online' under $150 best value deals

Asbestos Rubber Sheet with wire net strengthening

Get the best online deals knitted ugg boots Birkenstock, Women's Franca Soft Footbed Buckle Sandal – Dove Grey 'exclusive offers' under $190 buy cheap online

Acid-Resistance Rubber Sheets